Japanese Yen Talking PointsUSDJPY retraces the decline following the Federal Reserve interest rate decision as the Bank of Japan (BoJ) retains the Qu

Japanese Yen Talking Points

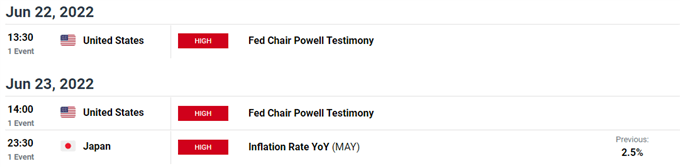

USDJPY retraces the decline following the Federal Reserve interest rate decision as the Bank of Japan (BoJ) retains the Quantitative and Qualitative Easing (QQE) program with Yield-Curve Control (YCC), and developments coming out of the US may influence the exchange rate over the coming days as Chairman Jerome Powell is scheduled to testify in front of Congress.

Fundamental Forecast for Japanese Yen: Bearish

USD/JPY is on the cusp of testing the yearly high (135.59) as the BoJ emphasizes that the central bank “will not hesitate to take additional easing measures if necessary,” and it seems as though Governor Haruhiko Kuroda and Co. will continue to utilize their non-standard tools in 2022 as officials expect “short- and long-term policy interest rates to remain at their present or lower levels.”

As a result, the diverging paths between the BoJ and Federal Open Market Committee (FOMC) may keep USD/JPY afloat as Fed officials project a steeper path for US interest rates, and fresh remarks from Chairman Powell may generate a bullish reaction in the Dollar should the central bank head endorse a restrictive policy in front of Congress.

In turn, USD/JPY may attempt to test the October 1998 high (136.89) as the FOMC plans to implement higher interest rates throughout 2022, but it remains to be seen if Chairman Powell will continue to rule out a 100bp rate hike as the central bank tries to prevent the US economy from facing a hard landing.

With that said, the semi-annual Fed testimony may prop up USD/JPY as the BoJ remains reluctant to shift gears, and expectations for higher US interest rates may fuel the rebound from the monthly low (131.49) as the FOMC steps up its effort to combat inflation.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com