GOLD OUTLOOK & ANALYSISWill gold’s low-risk attribute attract investors.Recent USD upside may be fading.Will the falling wedge pattern progress a

GOLD OUTLOOK & ANALYSIS

- Will gold’s low-risk attribute attract investors.

- Recent USD upside may be fading.

- Will the falling wedge pattern progress as expected?

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Gold prices have been negatively influenced by the recent uptick in risk aversion as tensions between Russia and Ukraine escalate, while the recent US ratings downgrade followed a similar trend. One would naturally expect the yellow metal to find some support as a traditional safe haven asset class but this is yet to develop. Looking back at the prior downgrade, gold managed to benefit and this could be a lagged consequence under current circumstances; however, gold could be in for an upside rally.

Recent US economic data have influenced expected future Fed interest rate probabilities which currently favors a pause before potential rate cuts beginning in early 2024. A weaker USD could lead to a stronger gold price but upcoming US fundamental economic data including US CPI later this week will contribute to the narrative.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

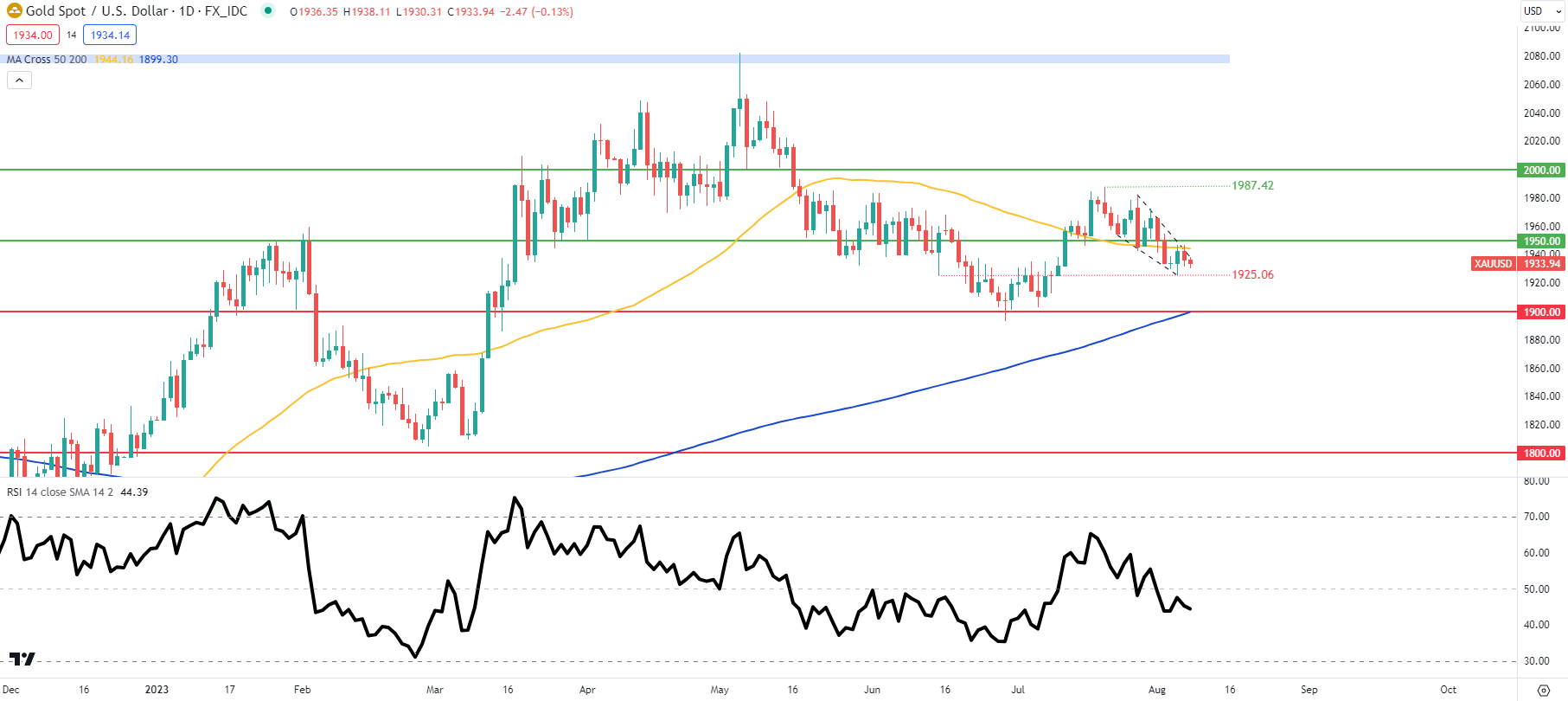

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

XAU/USD price action on the daily chart shows a developing falling wedge chart pattern (black) that is swiftly approaching the apex of the wedge. Generally, this chart pattern suggests a bullish breakout whereby a confirmation close above wedge resistance could spur an upside rally.

From a bearish perspective, a close below wedge support could invalidate the move and open up subsequent support zones.

Resistance levels:

- 1987.42

- 1950.00

- Wedge resistance/50-day moving average (yellow)

Support levels:

- Wedge support

- 1925.06

- 1900.00

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 75% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GOLD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com