KIWI DOLLAR TALKING POINTS AND ANALYSISExpected hike by RBNZ could help muster reprieve for Kiwi.Technical analysis points to overextended greenback.

KIWI DOLLAR TALKING POINTS AND ANALYSIS

- Expected hike by RBNZ could help muster reprieve for Kiwi.

- Technical analysis points to overextended greenback.

NEW ZEALAND DOLLAR FUNDAMENTAL BACKDROP

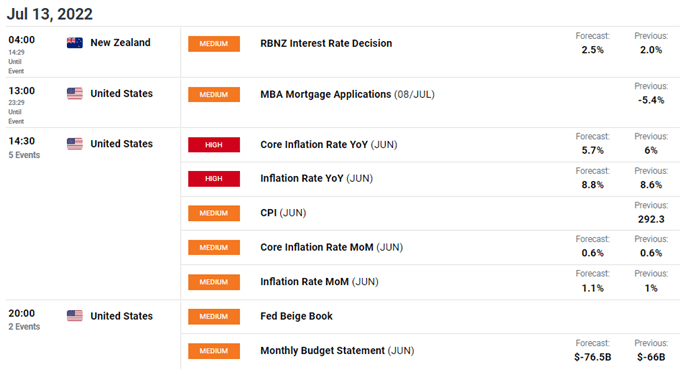

The New Zealand dollar currently faces a similar fate to global FX against the U.S. dollar as recessionary fears and safe-haven demand grip markets. Key economic data (see calendar below) may change fortunes for the rampaging greenback while the Reserve Bank of New Zealand (RBNZ) looks to hike rates tomorrow. Despite the fact that this is largely priced into the market, a poor read on U.S. inflation could trigger a short-term dollar selloff allowing for potential upside for the Kiwi.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

NZD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily NZD/USD price action shows bears testing the psychological 0.6100 support zone coinciding with Relative Strength Index (RSI) trendline support (green). Lower prices in conjunction with higher lows on the RSI suggest bullish divergence which traditionally implies impending upside (although timing can be ambiguous), and may bring the 0.6231 resistance zone into consideration. Should the 0.6100 and RSI support break, the upside call will be invalidated in favor of a push lower towards 0.6000.

Key resistance levels:

- 20-day EMA (purple)/0.6231

Key support levels:

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently LONG on AUD/USD, with 65% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positioning results in a short-term upside bias.

Contact and follow Warren on Twitter: @WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com