US Dollar, DXY INDEX, EUR/USD, USD/JPY, GBP/USD, USD/CAD - Talking PointsThe US Dollar has been on the back foot as the Fed reigns in rate hike timel

US Dollar, DXY INDEX, EUR/USD, USD/JPY, GBP/USD, USD/CAD – Talking Points

- The US Dollar has been on the back foot as the Fed reigns in rate hike timeline

- Central bank policies look to be driving underlying currency pairs against USD

- The DXY Index of the US Dollar could hold some clues. Will USD uptrend resume?

The US Dollar has been rallying ever since the middle of last year when inflation started to accelerate, and the market begun to anticipate the unwinding of stimulus from the Federal Reserve.

However, the Fed called the ‘eye popping’ inflation transitory at the time. Once they dropped that rhetoric later in the year, the US Dollar got a kick along with monetary policy tightening anticipated by the market.

The upcoming US CPI could provide clues for the Fed’s approach to rate hikes and the consequences for the US Dollar.

The ascending USD trend might resume, or a break lower could signal a turn.

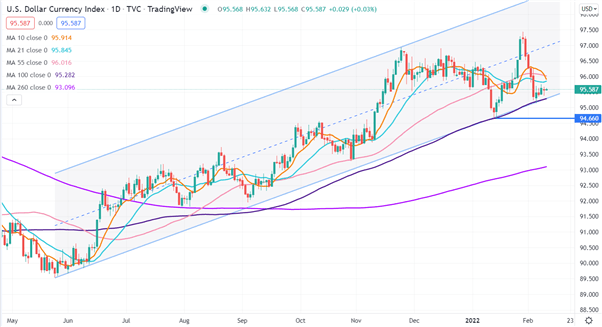

The US Dollar Index is also known as the DXY Index and is a compositionally weighted against EUR (57.6%), JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%) and CHF (3.6%).

Looking at the top 4 components, we can see ascending USD trend lines. The descending trend lines on the EUR/USD and GBP/USD charts represents strengthening USD.

Chart created in TradingView

The recent price action has seen the short and medium term simple moving averages (SMA)

crossed in all 4 currency pairs. None of the pairs have crossed the 260 SMA.

This may signal short and medium momentum is neutral, while longer term momentum might remain bullish, which could indicate a stall in the USD ascending trend.

The most noticeable headwinds for USD can be seen in GBP/USD. It has broken above the descending trend line but overall, it has maintained a series of lower highs and lower lows.

The changing picture in GBP/USD could reflect the rate hikes by the Bank of England (BoE).

Despite a limited degree of hawkishness, the European Central Bank (ECB), the Bank of Japan (BoJ) and the Bank of Canada (BoC) remain on the sidelines for policy tightening relative to the BoE and the Fed.

It is this relative nature which is most pertinent for markets. This potentially makes the upcoming US CPI number significant for the Fed’s decision making. A Bloomberg survey has expectations of the head-line rate annual rate coming in at 7.2%.

A large beat or miss could have ongoing ramifications for the Fed and consequently for the US Dollar. The market has been baying for 5 rate hikes from the Fed for this year. But a number of Fed speakers in the last week or so have been playing that down and have been trying to signal that 3, or 4 hikes might be appropriate.

If CPI is much higher than 7.3%, the Fed may not have much choice. If it is much lower, the Fed could have some breathing space on the hiking timeline. In any case, the US Dollar has potential to rocket either way.

A high CPI number could prompt the Fed to hike more than scheduled and may see the ascending trend for USD continue. Vice versa, a low CPI has the potential to see near term USD weakness that may manifest itself into further losses.

The price may confirm the next large move for the US Dollar Index. It is currently near the lower bound of an ascending trend channel, which coincides with the 100-day SMA. A break below could see some bearish momentum unfold.

A move below the previous low would add to concerns that USD bullishness has come to an end for now.

US Dollar Index (DXY)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com