US Dollar, Chinese Yuan, USD/CNH, China Exports, Global Growth – Analyst PickUS Dollar may remain on the offensive against the Chinese YuanA slowing

US Dollar, Chinese Yuan, USD/CNH, China Exports, Global Growth – Analyst Pick

- US Dollar may remain on the offensive against the Chinese Yuan

- A slowing global economy poses a threat to China and its exports

- USD/CNH is range-bound for now, keep a close eye on 50-day SMA

Chinese Yuan at Risk of Slowing Exports as the Global Economy Weakens

The US Dollar may remain on the offensive against the Chinese Yuan in the medium term despite the recent consolidation in USD/CNH. On Wednesday, the same day the Federal Reserve delivered a whopping 75-basis point rate, the offshore Yuan rallied 1.24% against the greenback. That was the strongest performance for CNH since August 2019.

Better-than-expected Chinese economic data might have played a role here. In May, Chinese industrial production gained 0.7% y/y versus -0.9% anticipated. This is as retail sales shrank 6.7%, not quite as bad as the -7.1% estimate. These slightly more optimistic outcomes could be a sign that the nation is recovering from strict lockdowns earlier amid Xi Jinping’s “Zero-Covid” policy.

Meanwhile, the Fed seemed to restore some credibility in its ability to tame runaway inflation overnight. Last week, unexpectedly stronger US CPI data resulted in a rapid repricing of monetary policy estimates. This is how we arrived with a 75bps hike, where just days ago only 50 were seen. Wall Street pushed higher and Treasury yields pulled back, weakening the US Dollar.

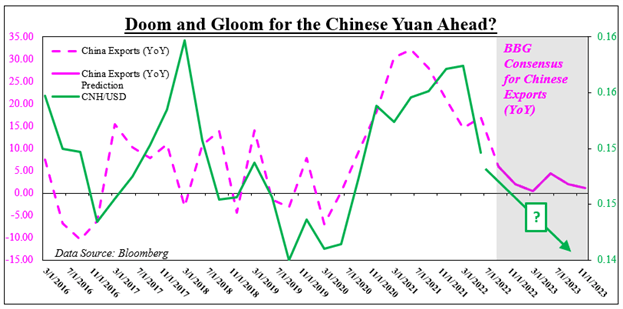

Still, the road ahead remains tough for the Chinese Yuan. On the chart below, CNH/USD can be seen closely following Chinese exports y/y. China’s external-facing economy means the Yuan can be quite sensitive to capital flows. We saw the Yuan rally throughout 2020 and 2021 as the world consumed more Chinese goods during the economic recovery from the pandemic.

Things have been changing. According to estimates from Bloomberg, Chinese exports are expected to continue materially slowing into the end of 2023 to levels before the pandemic. Hawkish central banks around the world pose a risk to global growth, and with it, China’s outward-facing economy. Thus, the case for USD/CNH may remain tilted to the downside ahead.

USD/CNH Technical Analysis

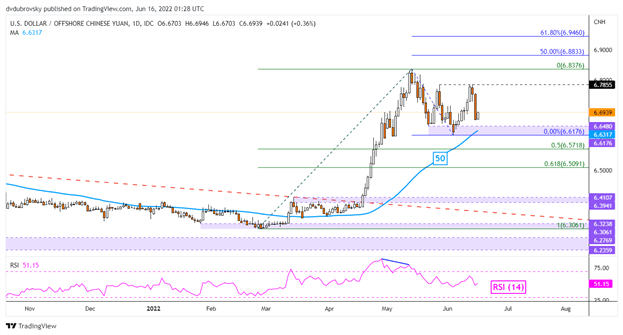

On the daily chart, USD/CNH is consolidating above key support. The latter seems to be a range between 6.6176 and 6.6480. Above, resistance appears to be around 6.7855 before the May peak at 6.8376 comes into focus. A confirmatory close under support could be a warning that the Yuan could have more room to recover in the short term. However, keep a close eye on the 50-day Simple Moving Average (SMA). The latter could reinstate the focus to the upside.

Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com