The April assembly of the FOMC is now within the books and never a lot has modified. COVID-19 financial considerations persist and dovish coverage

The April assembly of the FOMC is now within the books and never a lot has modified. COVID-19 financial considerations persist and dovish coverage continues to be the plan of action. Following this afternoon’s Fed Bulletins, the American indices are experiencing modest participation. With only some hours left within the Wall Avenue session, the DJIA DOW (-148), S&P 500 SPX (+1), NASDAQ (-12) are buying and selling combined.

On the foreign exchange entrance, April has been a difficult month for the Buck. Immediately has been no completely different as efficiency is combined. Beneficial properties for the U.S. greenback have been posted by the EUR/USD (-0.03%) and USD/JPY (+0.21%). Then again, the USD/CAD (-0.44%) is trending south. For now, it appears like immediately’s Fed Bulletins have barely weakened sentiment towards the greenback.

EUR/USD

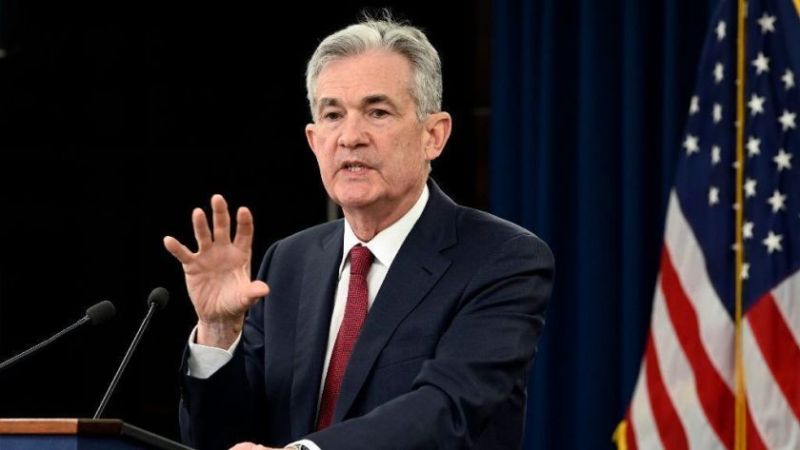

April Fed Bulletins: Updates & Highlights

Throughout the monetary world, not a lot was anticipated from immediately’s Fed Bulletins. Listed here are just a few of the important thing quotes and statements from the third ready launch of 2021:

- The Federal Funds Charge has been held static at 0.0-0.25%.

- “Amid progress on vaccinations and robust coverage help, indicators of financial exercise and employment have strengthened.”

- “The sectors most affected by this pandemic stay weak however have strengthened.”

- “Inflation has risen, largely reflecting transitory elements. Total monetary circumstances stay accommodative.”

- “The Federal Reserve will proceed to extend its holdings of Treasury securities by at the very least $80 billion per thirty days; at the very least $40 billion per thirty days in mortgage-backed securities.”

Backside Line: Immediately’s Fed Bulletins have come and gone as anticipated. QE limitless is to stay in place for the foreseeable future ― zero charges and big bond buys look like new norms. A minimum of for 2021, it appears just like the Fed goes to carry its exceedingly dovish pandemic stance.