The AUD/USD forex pair hit the month-to-month excessive since 18 September, at present seen at 0.6860 as a result of Individuals’s Financial insti

The AUD/USD forex pair hit the month-to-month excessive since 18 September, at present seen at 0.6860 as a result of Individuals’s Financial institution of China’s resolution and China information.

Individuals’s Financial institution of China (PBOC) modified the mortgage charge from 4.25% to 4.20%. The LPR is ready primarily based on the vary above the medium-term Mortgage Facility charge each month. On the financial entrance, China’s September Home Value Index fell to eight.4% from 8.8%.

Notably, Australian greenback’s sturdy shopping for cause might be constructive commerce headlines from China’s South Morning Publish, whereas warning by the following European Central financial institution President Christine Lagarde seems to be ignored.

Danger-sentiment stays unchanged regardless of Brexit uncertainty and blended commerce headlines. Consequently, the USA’ ten-years Treasury yields rose to 1.75%.

Moreover, as a result of lack of important information and occasions on the financial calendar, from now, buyers will hold their eyes on commerce and Brexit information for recent hints.

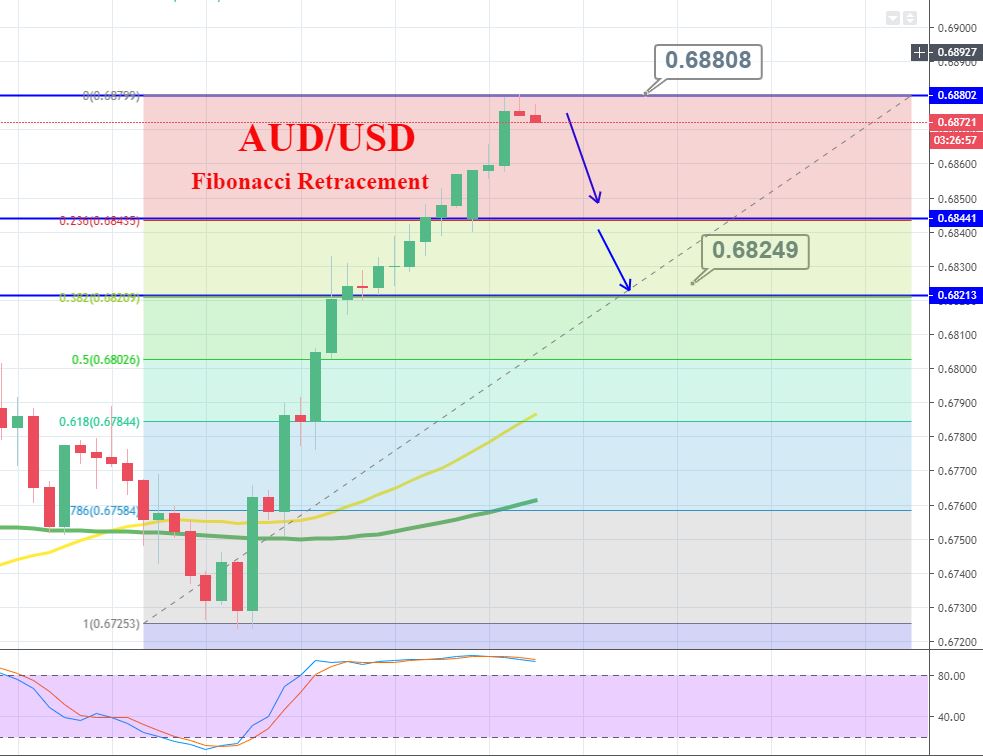

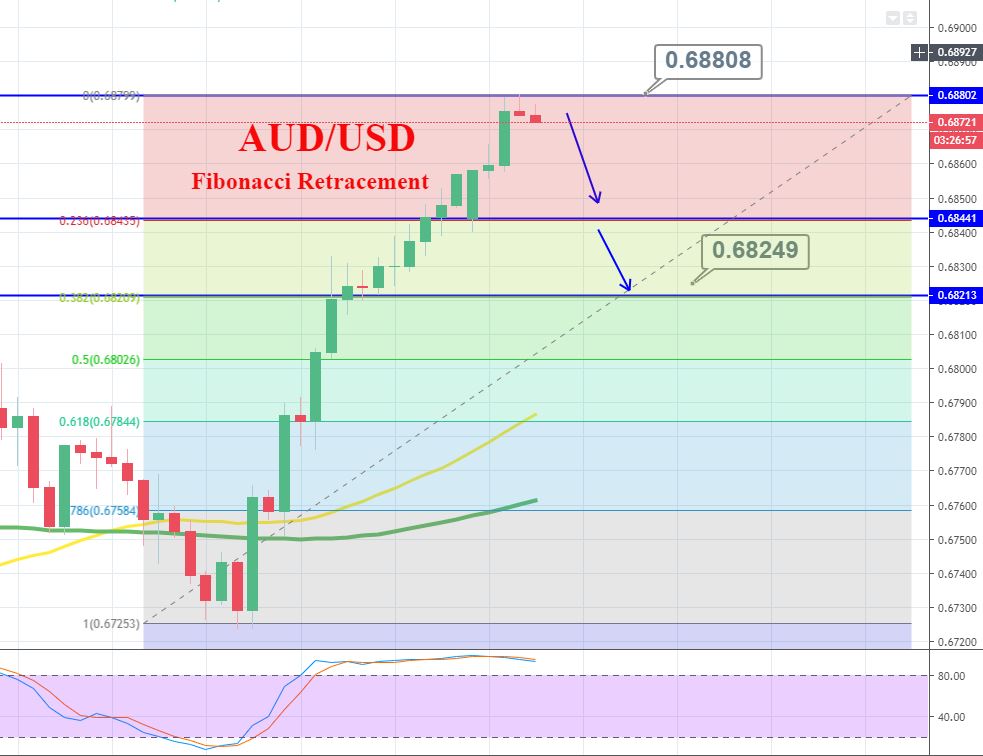

On the technical facet, the day by day closing above the 100-day degree of 0.6852 turns into essential for the pair to query September month excessive near 0.6900, delining to which may transfer AUD/USD again to 0.6810 and 50-day EMA degree of 0.6800.

Each day Help and Resistance

S3 0.6787

S2 0.6817

S1 0.6837

Pivot Level 0.6848

R1 0.6867

R2 0.6878

R3 0.6908

AUD/USD might commerce bearish beneath 0.6880 with a cease…