Aussie braces for dovish tilt by RBA as Australia battles second virus wave – Foreign exchange Information Preview

Aussie braces for dovish tilt by RBA as Australia battles second virus wave – Foreign exchange Information Preview

Posted on July 31, 2020 at 1:06 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

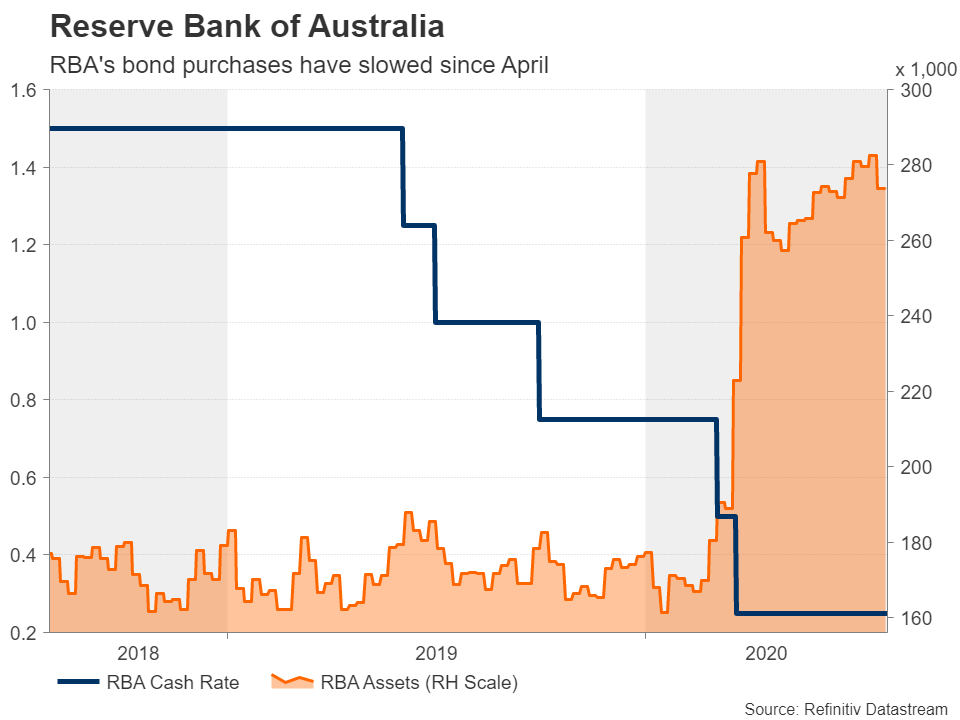

The Reserve Financial institution of Australia is about to face pat once more when it proclaims its newest coverage choice on Tuesday at 0430 GMT. Because the Australian financial system climbs out of its worst recession in a long time, policymakers are usually not anticipated to really feel the urge to behave in July. Nevertheless, with the nation persevering with to see an alarming surge in new coronavirus instances, it might solely be a matter of time earlier than further financial help turns into essential. Any hints on Tuesday that that’s the place coverage is headed might knock the wind out of the aussie’s rally.

Restoration in jeopardy as restrictions tightened

Out of all the key central financial institution responses in the course of the pandemic, the RBA has needed to make the least intervention within the monetary markets to revive calm and the sleek movement of credit score. A powerful response by Australia’s authorities in addition to by China – its largest buying and selling accomplice – to the virus outbreak put the nation within the lucky state of affairs of with the ability to reopen the financial system rapidly and safely.

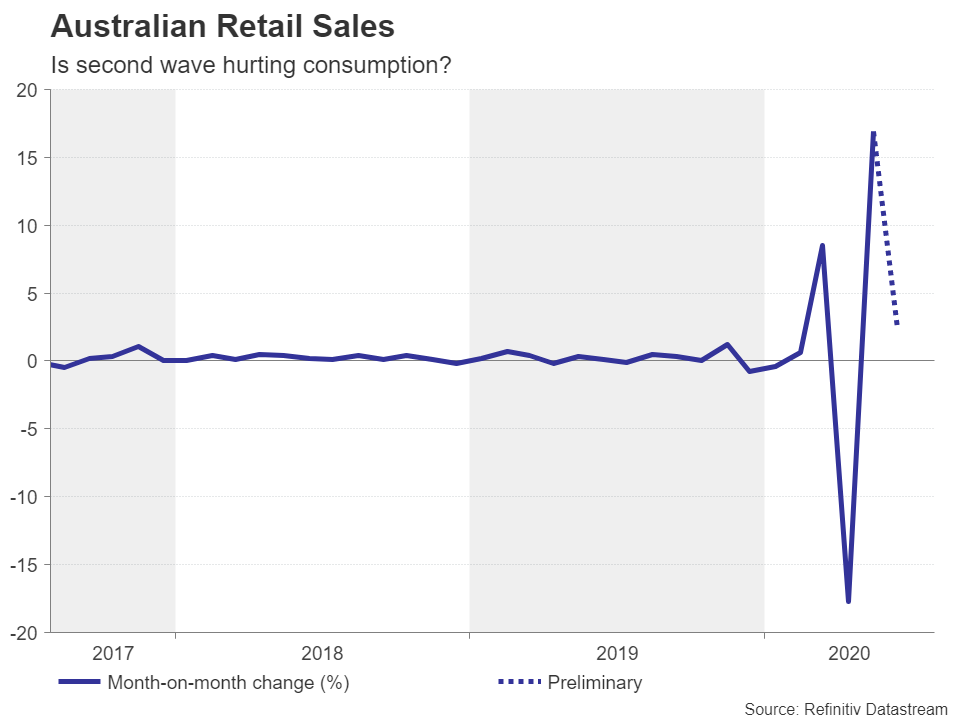

However that enviable place didn’t final lengthy because the current virus flare-up in Victoria has quick developed right into a second wave, forcing authorities to put all the state beneath lockdown. Different states have additionally tightened social distancing guidelines. However the influence of the most recent restrictions hasn’t but began to indicate up within the information, maybe except the preliminary retail gross sales numbers for June. After a robust bounce in Could, the rebound in retail gross sales moderated to 2.4% month-on-month in June. The ultimate print, which will likely be launched three hours earlier than the RBA’s choice, might be revised even decrease.

The subsequent employment report due in mid-August needs to be of even better significance as any signal that the tempo of hiring is slowing or, worse, jobs are being shed once more, might immediate the RBA to rethink its wait-and-see strategy. Inflation information launched up to now week are most likely already worrying policymakers as the patron worth index fell by 0.3% yearly within the first quarter – the bottom studying since 1997.

How dovish will the RBA sound?

Therefore, a dovish shift on the July assembly is kind of probably even when the Financial institution isn’t able to admit simply but that contemporary motion could also be wanted sooner somewhat than later. In case the coverage assertion on Tuesday doesn’t go far sufficient in offering readability, the quarterly Financial Coverage Assertion out on Friday (0130 GMT) ought to shed extra mild on whether or not policymakers are turning extra optimistic or adverse in regards to the outlook.

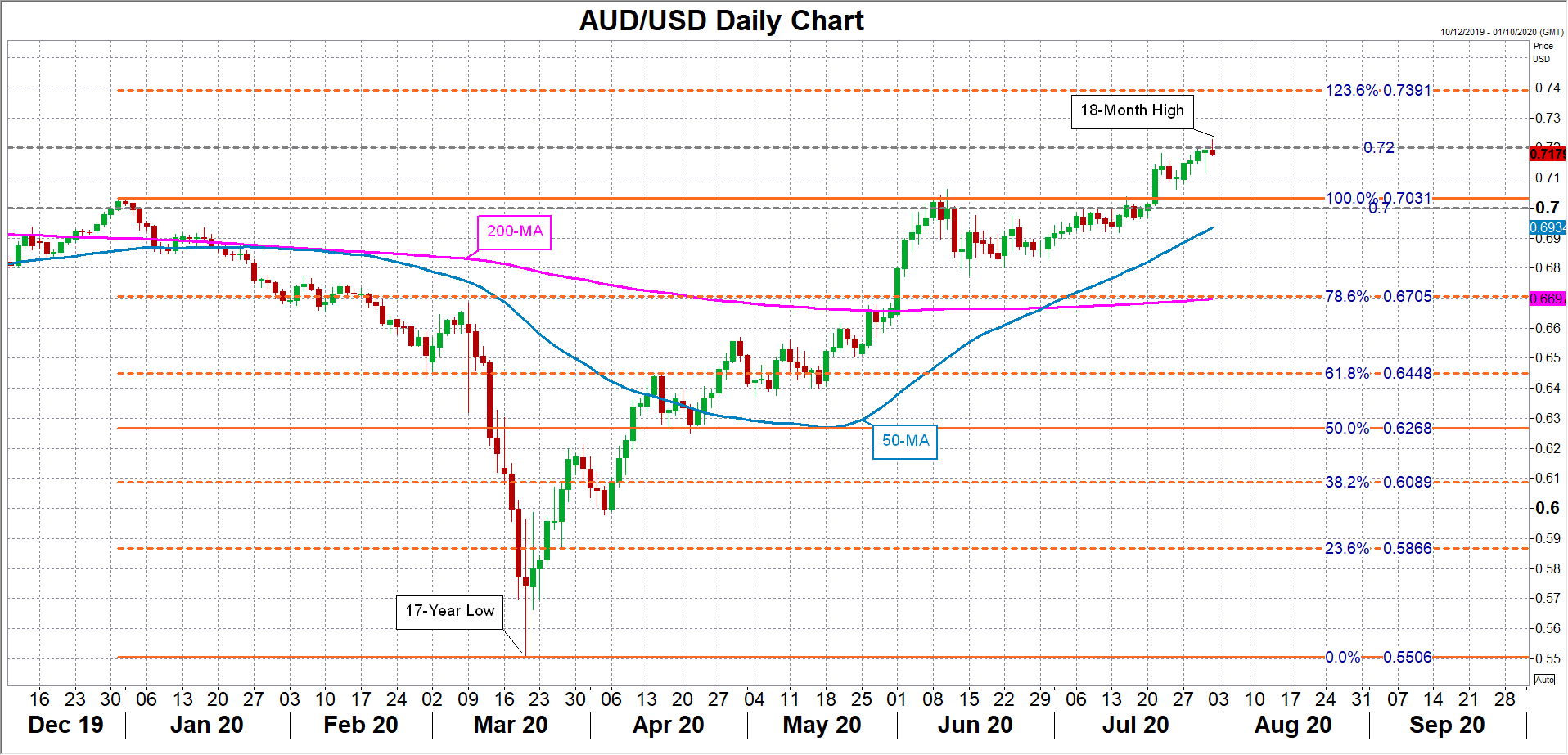

If there’s no change to the Financial institution’s total tone subsequent week, the Australian greenback is more likely to keep its bullish bias. The forex is at the moment making an attempt to clear the $0.72 hurdle. A profitable break above this key stage would open the way in which for the 123.6% Fibonacci extension of the January-March downtrend at $0.7391.

The aussie rally’s days could also be numbered

Nevertheless, ought to the RBA alter its language to a way more cautious one, the aussie might discover itself retreating in direction of the $0.70 stage, earlier than heading for the 50-day shifting common round $0.6935.

Within the extra medium-term image, there are important draw back dangers for the aussie because the restoration of the home financial system is sure to hit a stumbling block eventually. However apart from that, worsening US-China in addition to China-Australia tensions are dangers that haven’t been absolutely priced in by buyers, subsequently any adverse correction might become fairly sharp.

AUDUSD