Aussie to take a particular take a look at Australian CPI – Foreign exchange Information Preview Posted on

Aussie to take a particular take a look at Australian CPI – Foreign exchange Information Preview

Posted on April 26, 2021 at 1:44 pm GMTMelina Deltas, XM Funding Analysis Desk

Australian CPI figures for the primary quarter shall be entrance and centre on Wednesday at 01:30 GMT, with the nation being one of many world’s success tales in the coronavirus pandemic. Nonetheless, the nation has been slower than others to immunize its inhabitants with delays to the supply of vaccine orders, which could have an effect on the aussie as nicely, though it’s on a considerably firmer footing currently.

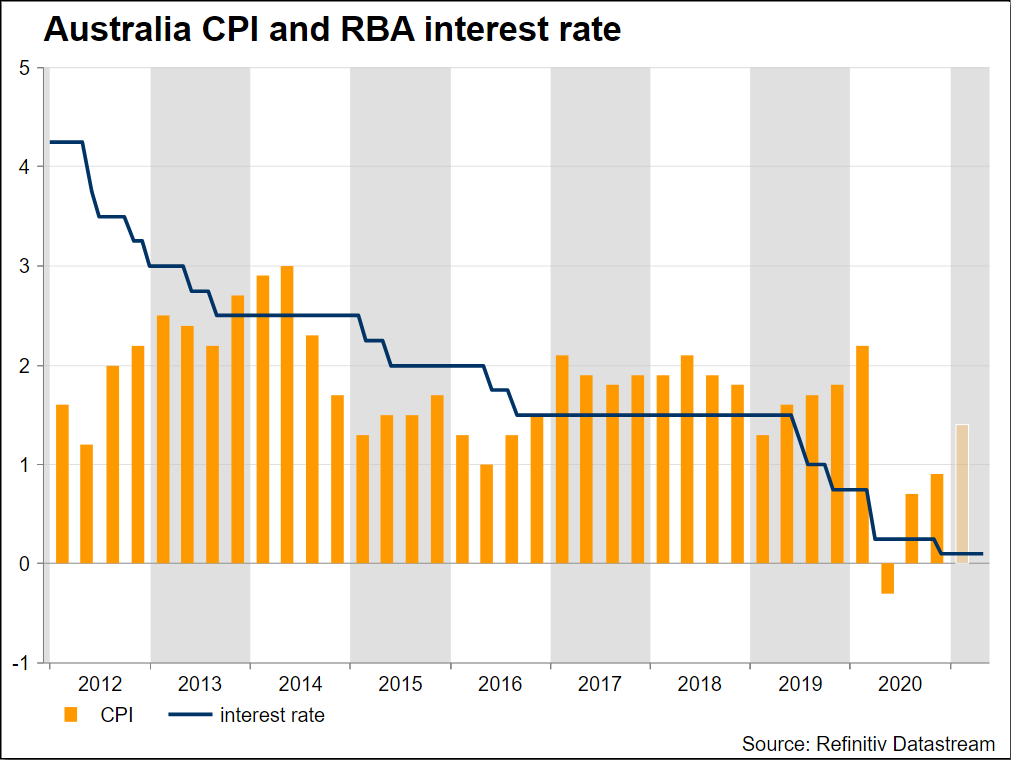

The inflation report is predicted to print 0.5% q/q for the trimmed imply, pushing the annual charge as much as 1.4% from 0.9% for the primary quarter of 2021, beneath of the RBA’s 2–3% goal inflation vary. Beforehand, the This autumn CPI jumped to a quarterly 0.9% charge – the best determine in three quarters – which is anticipated to stay unchanged. Furthermore, GDP superior 3.1% in the final quarter of the earlier yr and with out a robust labour market, wage development will stay weak, and inflation will disappoint. The foreign money is buying and selling greater as we speak round $0.78 so a correction could also be on the playing cards on weaker-than-expected knowledge.

Inflation and labour market are the essential themes for RBA

Inflation and employment are the objectives for the RBA, which continues to have a deal with the housing market as nicely, particularly in borrowing and lending requirements. Within the final assembly in April, the financial institution stored its money charge regular at a file low of 0.1%. When it comes to inflation, CPI is predicted is to rise due to the reversal of coronavirus-led worth reductions.

With respect to the RBA’s yield curve management (YCC) exit technique, policymakers, indicated within the minutes of the final two months Board conferences that they won’t prolong the maturity of the bonds they’ll buy on the money charge nor will they elevate the acquisition yield on longer maturity bonds. Concerning the timeline on when the RBA will reduce its YCC, expectations are for an announcement at subsequent yr’s February Board assembly when the RBA could start tapering its QE program to $50bn and restrict the YCC goal to the November 2024 bond.

Aussie rises after a number of flat days

In FX markets, aussie/greenback has been below robust strain during the last two months, nonetheless, it’s at the moment selecting some steam, buying and selling close to five-week highs round 0.7780.

Disappointing figures could enhance hypothesis for a rise in QE, sending the pair in the direction of the 20- and 40-day easy shifting averages (SMAs) round 0.7685. Decrease than that, eyes would flip to the 0.7570 barrier, earlier than flirting with the 0.7464 stage, which overlaps with the 200-day SMA.

Ought to inflation beat forecasts, aussie/greenback may prolong positive aspects in the direction of the 0.7840 resistance. An even bigger shock within the knowledge might also open the door for the more-than-three-year excessive of 0.8006. Above that, the long-term bullish outlook come into play once more, assembly the 0.8130 impediment, registered in January 2018.

AUDUSD