Australian Dollar, AUD/USD, US Dollar, China, PBOC, Japan, Commodities - Talking PointsThe Australian Dollar bounced despite data that would normally

Australian Dollar, AUD/USD, US Dollar, China, PBOC, Japan, Commodities – Talking Points

- The Australian Dollar bounced despite data that would normally undermine it

- China’s economy will every bit of the rate cut from the PBOC today as its woes continue

- If the USD resumes its ascension, where will that leave USD/JPY and AUD/USD?

Recommended by Daniel McCarthy

Introduction to Forex News Trading

The Australian Dollar scoped out yesterday’s 10-month earlier today before rebounding on a bunch of data domestically and from Japan and China.

The backdrop to today’s move in the Aussie, and broader markets, has been the rise of the US Dollar being fanned by higher Treasury yield tailwinds.

The benchmark 10-year Treasury note eclipsed 4.20% in early Asian trade today after having hurdled the level overnight for the first time since November last year.

That move coincided with AUD/USD dipping toward its low, assisted by a weaker-than-expected wage price index of 3.6% year-on-year to the end of July, missing estimates of 3.7%. The soft read led to speculation of a less hawkish RBA.

That data point was soon surpassed by Chinese numbers that revealed a weaker than forecast economy.

Year-on-year to the end of July saw industrial production at 3.7% rather than the 4.3% anticipated, retail sales were 2.5% instead of the 4.0% estimated and fixed asset investment ex-rural came in at 3.4%, below the 3.7% forecast.

The statistics showed why the Peoples Bank of China (PBOC) had cut the 1-year medium-term lending facility (MLF) just prior. The Yuan tumbled lower with USD/CNY rallying toward 7.3000.

Recommended by Daniel McCarthy

Traits of Successful Traders

Elsewhere today, Japanese GDP figures printed way above expectations at 6.0% annualised for 2Q to the end of July, above the 2.9% expected by economists.

There was little reaction in markets with most of the boost emanating from exports and thereby lacked the impetus to move the dial on speculation of a tilt to the Bank of Japan’s yield curve control (YCC) program.

USD/JPY continues to tread water above 145.50 and the Nikkei 225 modest gains along with Australian and Korean indices. Not surprisingly, Chinese and Hong Kong bourses are lower on the day.

Futures are pointing toward a steady start to markets across Europe and Wall Street.

Commodity markets have had a relatively subdued start to Tuesday although soft (grains) commodities are slightly weaker.

Natural gas is a little higher on concerns of strikes at Woodside and Chevron, some of the world’s largest producers. Spot gold has been unable to recover recent losses as it trades near US$ 1,900 an ounce.

Looking ahead, after UK jobs data and the German ZEW survey, Canada will see CPI figures while the US will also see job statistics.

The full economic calendar can be viewed here.

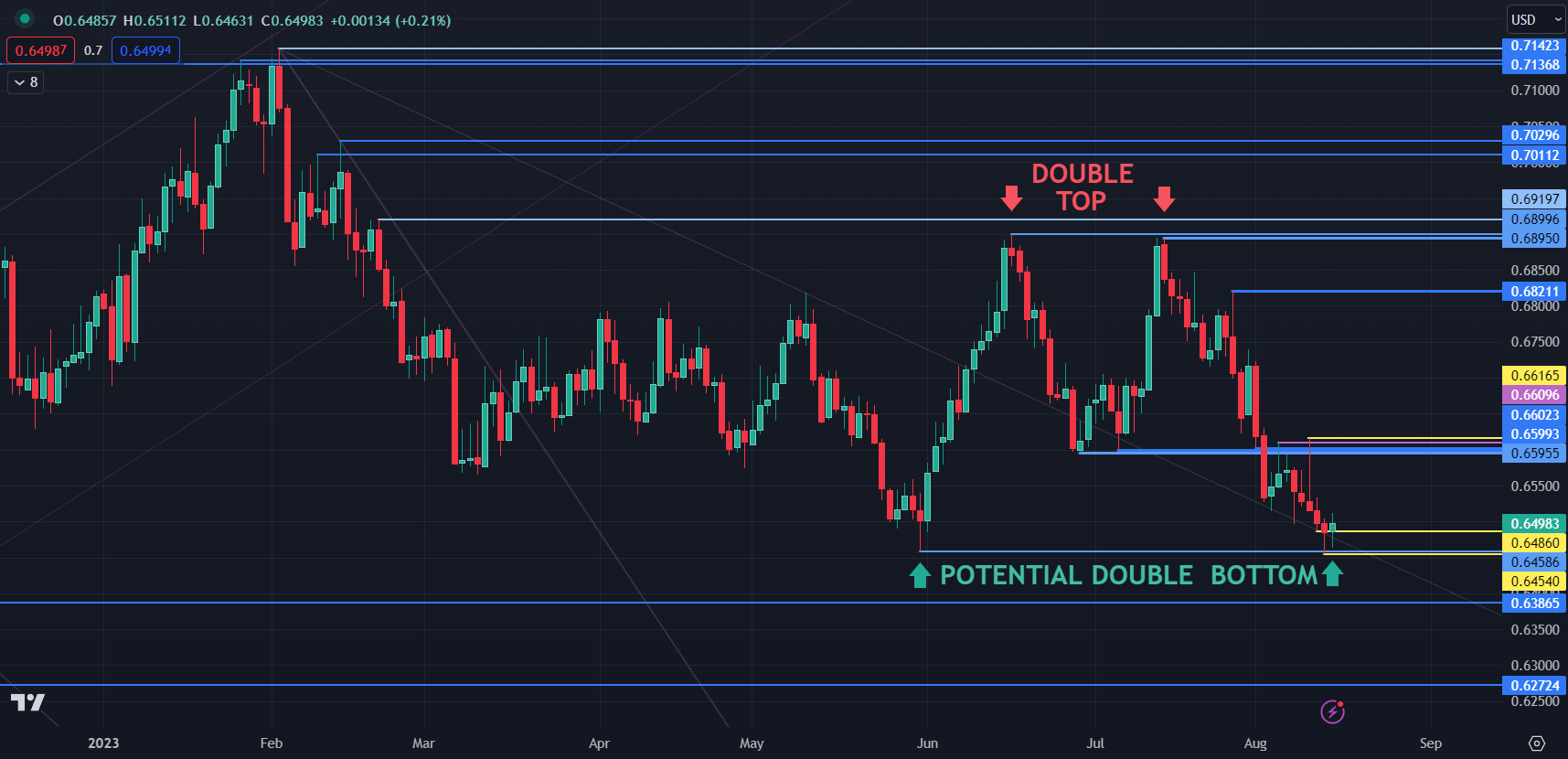

AUD/USD TECHNICAL ANALYSIS SNAPSHOT

Overall, AUD/USD marginally broke the lower bound of the six-month trading range of 0.6459 – 0.6900 when it traded at 0.6554.

If the price fails to run lower in the next few sessions, it might be regarded as a false break. That scenario may also indicate that a Double Bottom could be in place.

For more information on range trading, click on the banner below.

Nearby resistance could be at a cluster of breakpoints and prior peaks in the 0.6595 – 0.6615 area. On the downside, support might be near the recent lows of 0.6486 and 0.6459.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS