Australian Dollar, AUD/USD, China, Japanese Yen, BoJ, Technical Outlook - Talking PointsAustralian Dollar may fall as China Covid cases rise, lockdow

Australian Dollar, AUD/USD, China, Japanese Yen, BoJ, Technical Outlook – Talking Points

- Australian Dollar may fall as China Covid cases rise, lockdowns return

- Japan signals possible currency intervention with a joint statement

- AUD/USD faces 23.6% Fib level amid strong downward momentum

Monday’s Asia-Pacific Outlook

Asia-Pacific markets may open lower today after Covid cases increased across several Chinese cities, prompting harsher lockdown measures thought to be behind the country a few weeks ago. Policymakers in Beijing pushed back reopening the city’s schools, which was planned forMonday. The capital reported 33 new community Covid cases on Sunday. AUD/USD, being a proxy for market sentiment, particularly in the Asia-Pacific region, may fall on the news.

Shanghai, another Chinese mega-city, also saw tightened restrictions over the weekend, with dining services being suspended at many establishments. The renewed lockdowns in Shanghai come just 12 days after the city exited a multi-month lockdown at the start of June, casting fresh doubt on China’s ability to balance its “Zero-Covid” strategy with economic stability. The country will be hard-pressed to meet its 5.5% growth target, especially given the new round of restrictions.

This morning, Japan is set to publish the Business Survey Index (BSI) Large Manufacturing report at 23:50 GMT. The Japanese Yen’s plummet continued last week, with the currency dropping nearly 3% versus the US Dollar and coming within 0.5% of levels not traded at since 1998. The Yen is in focus this week as the Bank of Japan rate decision approaches. Analysts expect no change in the BoJ’s benchmark rate. However, the central bank saidin a joint statement with the government on Friday that they are monitoring the decline with caution. This rare declaration may be a prelude to currency intervention, something that hasn’t happened in Japan in 20 years.

The rest of today’s session leaves little in the way of economic news-flow. The next major round of scheduled event risk comes in European hours, where traders will have fresh economic data out of the United Kingdom to analyze. The UK’s gross domestic product (GDP) growth and trade balance for April is set to cross the wires. Analysts see GDP growth in April falling to 3.9% year-over-year from the prior 6.4% rate. Later this week, the UK will report March labor market data. A better-than-expected slate of prints may help buoy the Sterling after back-to-back weekly losses.

AUD/USDTechnical Forecast

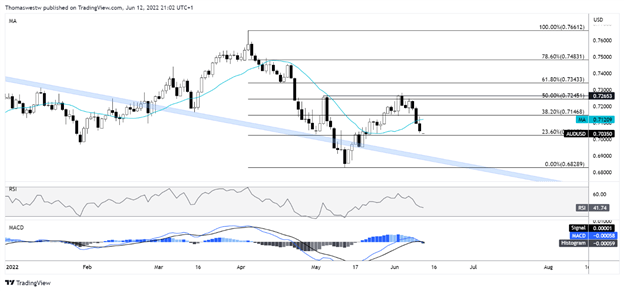

AUD/USD may find support from the 23.6% Fibonacci retracement level, which sits directly below the current price. However, last week’s downward momentum may continue. The Relative Strength Index (RSI) and MACD oscillators crossed below their respective mid-points last week, reflecting the move’s strength. A break below the 23.6% Fib puts the psychological 0.7000 level into focus.

AUD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com