Australian Dollar Vs US Dollar, Australia Monthly CPI – Talking Points:AUD fell after Australia monthly CPI eased more than expected.AUD/USD has pull

Australian Dollar Vs US Dollar, Australia Monthly CPI – Talking Points:

- AUD fell after Australia monthly CPI eased more than expected.

- AUD/USD has pulled back from key resistance.

- What’s next for AUD/USD and AUD/JPY?

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

The Australian dollar fell after consumer price inflation moderated more than expected last month, reinforcing the view that the Reserve Bank of Australia (RBA) will keep interest rates on hold in the foreseeable future.

Australia’s CPI eased to 4.9% on-year in July vs. 5.2% expected, and down materially from 5.4% in June. The softening in price pressures is a welcoming sign, coinciding with the RBAs view that the worst is probably over for inflation. Having said that, the monthly CPI figures tend to be volatile and not necessarily a good predictor of the quarterly CPI, which holds more relevance from RBA’s perspective.

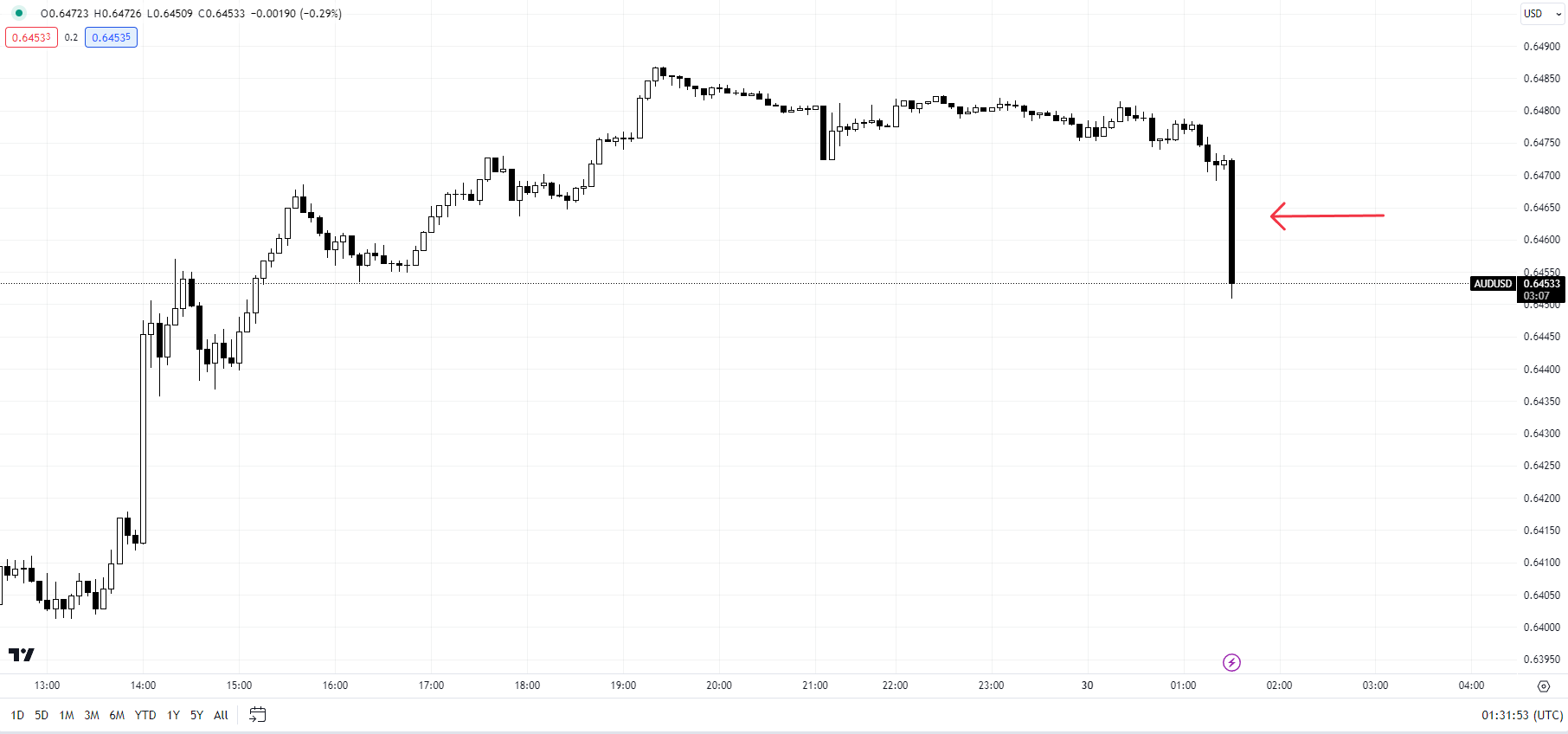

AUD/USD 5-minute Chart

Chart Created by Manish Jaradi Using TradingView

Nevertheless, the disinflation trend is likely to give comfort to RBA as it seeks to engineer a soft landing. The Australian central bank held rates steady at 4.1% at its previous two meetings, and markets are pricing in a high chance that the central bank will stay pat when it meets next week amid worsening growth prospects, early signs of cooling of the labour market and a deteriorating growth outlook in China. In a sign that consumer demand is softening, Australian retail sales rebounded last month, but the annual rate slowed further.

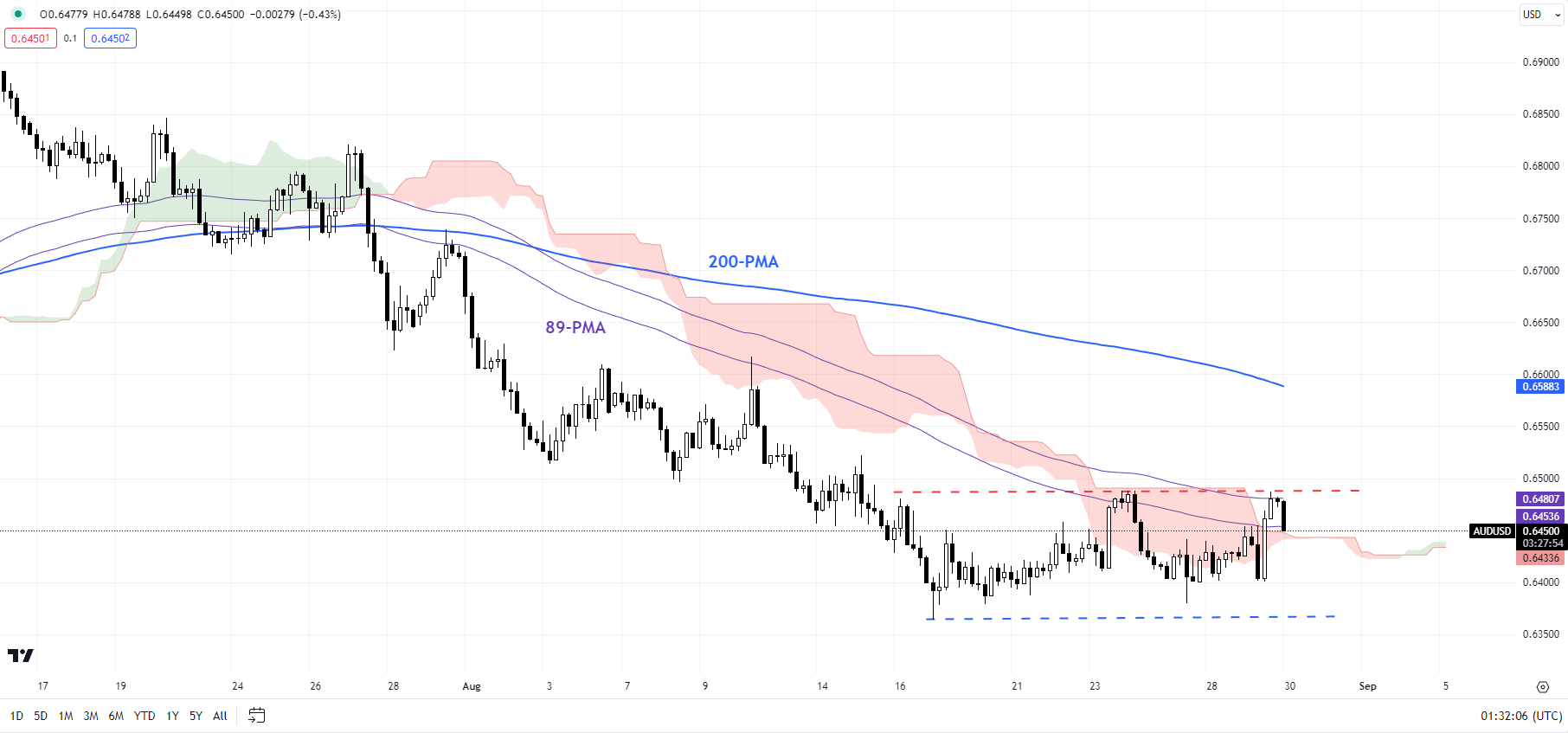

AUD/USD 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

Notwithstanding last week’s weak US activity data, broadly the US economy appears to be outperforming some of its peers, especially China and Europe. The resilience of the US economy has boosted the US dollar. Powell’s remarks at Jackson Hole last week were largely balanced, but with a slightly hawkish tilt, further offering some support to the greenback. Moreover, the perception that RBA is done hiking rates has weighed on AUD.

Recommended by Manish Jaradi

Lessons From Top Women Traders

However, risk appetite appears to have stabilized for now, thanks to the retreat in US yields, recent support measures from Chinese policymakers, and stretched bearish sentiment.

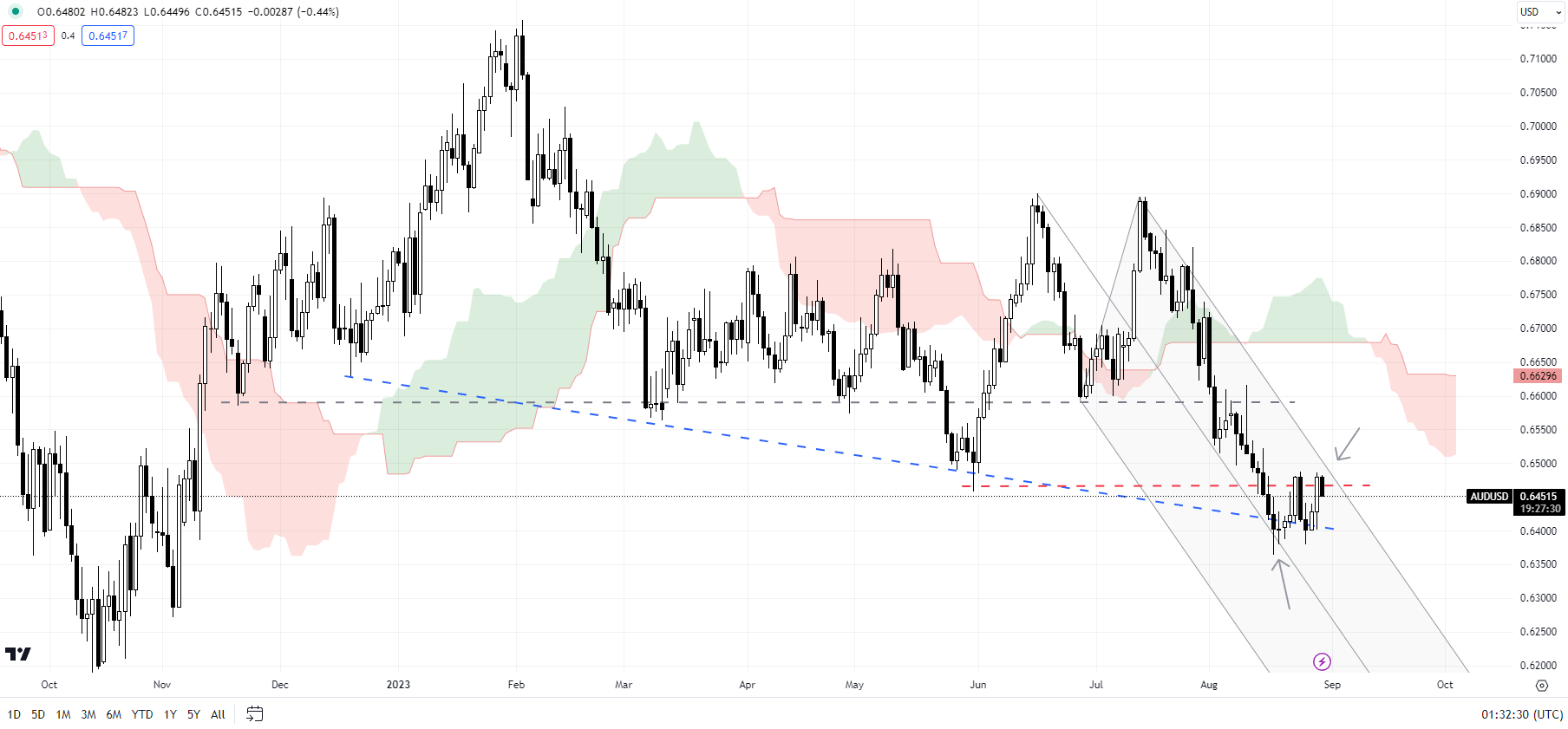

AUD/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

AUD/USD: Not out of the woods yet

On technical charts, the bearish pressure on AUD/USD has eased somewhat – a possibility highlighted in the previous update. See “US Dollar Flirts with Resistance After Powell; EUR/USD, GBP/USD, AUD/USD Price Action,” published August 28, and “Australian Dollar Looks to Recoup Losses Ahead of CPI; AUD/USD, AUD/NZD, AUD/JPY,” August 29. However, for the downward pressure to fade meaningfully, AUD/USD needs to break above last week’s high of around 0.6500. Such a break could pave the way initially toward the 200-period moving average on the 240-minute charts (now at about 0.6600).

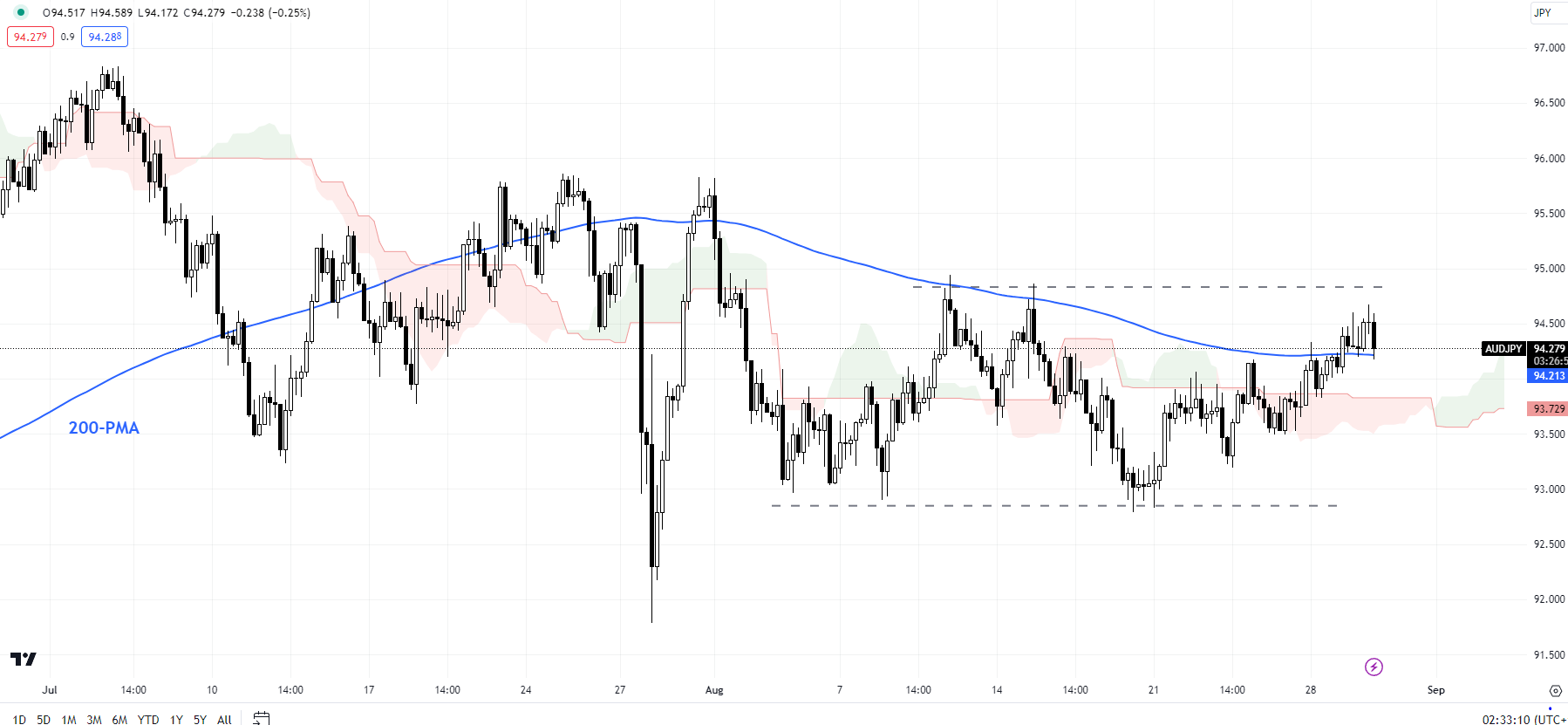

AUD/JPY 240-Minute Chart

Chart Created by Manish Jaradi Using TradingView

AUD/JPY: Attempting to break above key resistance

AUD/JPY is re-attempting to break above the key resistance area on the 200-period moving average on the 240-minute charts, roughly coinciding with the August 10 high of 95.00. Previous attempts since mid-July haven’t been fruitful, so a break above would be significant from a trend perspective. Such a break could be a strong sign that the bearish pressure is fading – a point highlighted in the previous update. See “Australian Dollar Looks to Recoup Losses Ahead of CPI; AUD/USD, AUD/NZD, AUD/JPY,” August 29.

Recommended by Manish Jaradi

How to Trade AUD/USD

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS