Australian Dollar, AUD/USD, AUD/NZD, US PPI, RBA, AU CPI, RBNZ, Fed – Talking PointsThe Australian Dollar roared to new highs on a plummeting US Doll

Australian Dollar, AUD/USD, AUD/NZD, US PPI, RBA, AU CPI, RBNZ, Fed – Talking Points

- The Australian Dollar roared to new highs on a plummeting US Dollar

- The New Zealand Dollar also posted a solid rally in the ‘risk on’ vibe

- The RBA, RBNZ and Fed have differing rate paths. Will they drive currency moves?

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

The Australian Dollar leapt higher again overnight after US PPI sent markets into a tailspin that saw the US Dollar face renewed pressure to the downside. The Aussie and the Kiwi Dollars were the biggest beneficiaries with the commodity complex also soaring.

To recap, US PPI final demand was below estimates at 2.7% year-on-year to the end of March rather than the 3.0% anticipated and 4.6% previously. The March month-on-month read was -0.5% instead of a flat number forecast and -0.1% prior.

While equity indices, commodities and high beta currencies such as the Aussie and Kiwi got a boost, Treasury yields lingered near current levels. Although the back end of the curve ended the day a handful of basis points (bps) higher.

The interest rate market barely changed its view of the probability of the Federal Reserve hiking rates in early May by 25 bps and it remains near 70%.

From a macro perspective, with PPI slipping further below CPI, this opens the possibility for companies to either cash in wider profit margins or pass on lower prices to consumers. Either way, Wall Street liked it.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The positive sentiment spread to commodity markets with gold and silver printing fresh highs, as did most industrial metals, although iron ore struggled.

AUD and NZD are viewed by the market as being sensitive to the global growth cycle and with stocks and commodities sailing north, so did they.

AUD/NZD had a look above 1.0800 but was unable to maintain the gain and the struggle might reflect the disparity in monetary policy between the RBA and the RBNZ. The latter is expected to hike 25 bp in late May by the interest rate market, while the RBA is anticipated to be on hold at its meeting in early May.

Both central banks will get CPI updates in the coming weeks, and these could be crucial for the direction in AUD/NZD. The RBNZ’s official rate is 165 bp above the RBA at 5.25%, despite Australia’s last quarterly CPI print being above New Zealand’s.

The RBA has been citing the less accurate monthly inflation gauge as reassurance for their relatively dovish stance. A benign quarterly CPI number on April 26th will support their bearing but another hot read to the topside may force them to reassess their current posture.

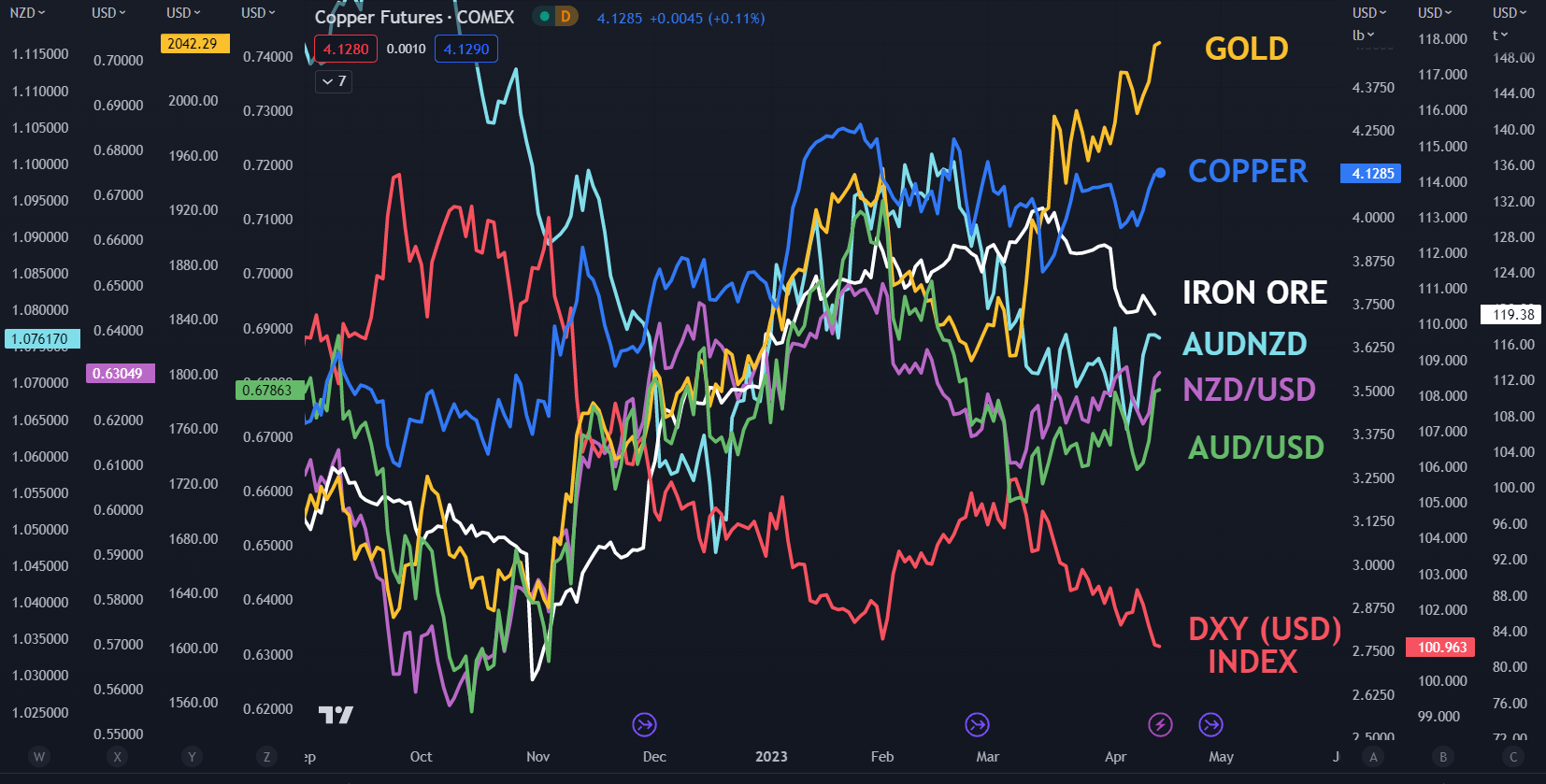

AUD/USD, NZD/USD, AUD/NZD, DXY (USD) INDEX, GOLD, COPPER, IRON ORE

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com