Australian Dollar, AUD/USD, US Dollar, Unemployment, RBA, China, Fed – Talking PointsThe Australian Dollar recovered some lost ground on strong jobs

Australian Dollar, AUD/USD, US Dollar, Unemployment, RBA, China, Fed – Talking Points

- The Australian Dollar recovered some lost ground on strong jobs numbers

- The RBA meeting has taken on a new light with signs the economy remains hot

- The Fed and China have also been chiming in on AUD/USD

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The Australian Dollar reversed early losses on Thursday after a solid jobs report that saw a dip in the unemployment rate which could reignite price pressures that might see the RBA’s July meeting become a little more interesting.

The unemployment rate was 3.6% in May against the 3.7% anticipated and prior. 75.9k Australian jobs were added in the month, which was notably above the 17.5k expected to be added and -4.3k previously.

Of note was the full-time boost of 61.7k and the nudge higher in the participation rate to 66.9% from 66.7%.

The RBA hiked rates by 25 basis points (bp) earlier this month to 4.10%. Before today’s numbers, the overnight index swaps (OIS) market ascribed about a 20% chance of a hike in the cash rate by the RBA at its July monetary policy meeting. They now see a bit over 40% probability of a 25 bp lift.

Recommended by Daniel McCarthy

Traits of Successful Traders

For the Aussie Dollar though, the robust domestic data was offset to an extent by weak Chinese numbers. Year-to-date industrial production was 3.6% to the end of May rather than the 3.9% anticipated, although the year-on-year figure was in line at 3.5%.

Retail sales year-on-year were 12.7%, missing estimates of 13.7% and 18.4% prior. Fixed-asset investment growth was 4% year to date, weaker than forecasts of 4.4%. The surveyed unemployment rate in urban areas was unchanged at 5.2% as expected.

On Tuesday, the People’s Bank of China (PBOC) gave markets a slight boost when they cut the 7-day reverse repo rate from 2% to 1.9%. Then today they cut the rate on the 1-year medium-term lending facility to 2.65% from 2.75%.

The sluggish economic performance of the world’s second-largest economy has led to speculation of further stimulus measures from Beijing.

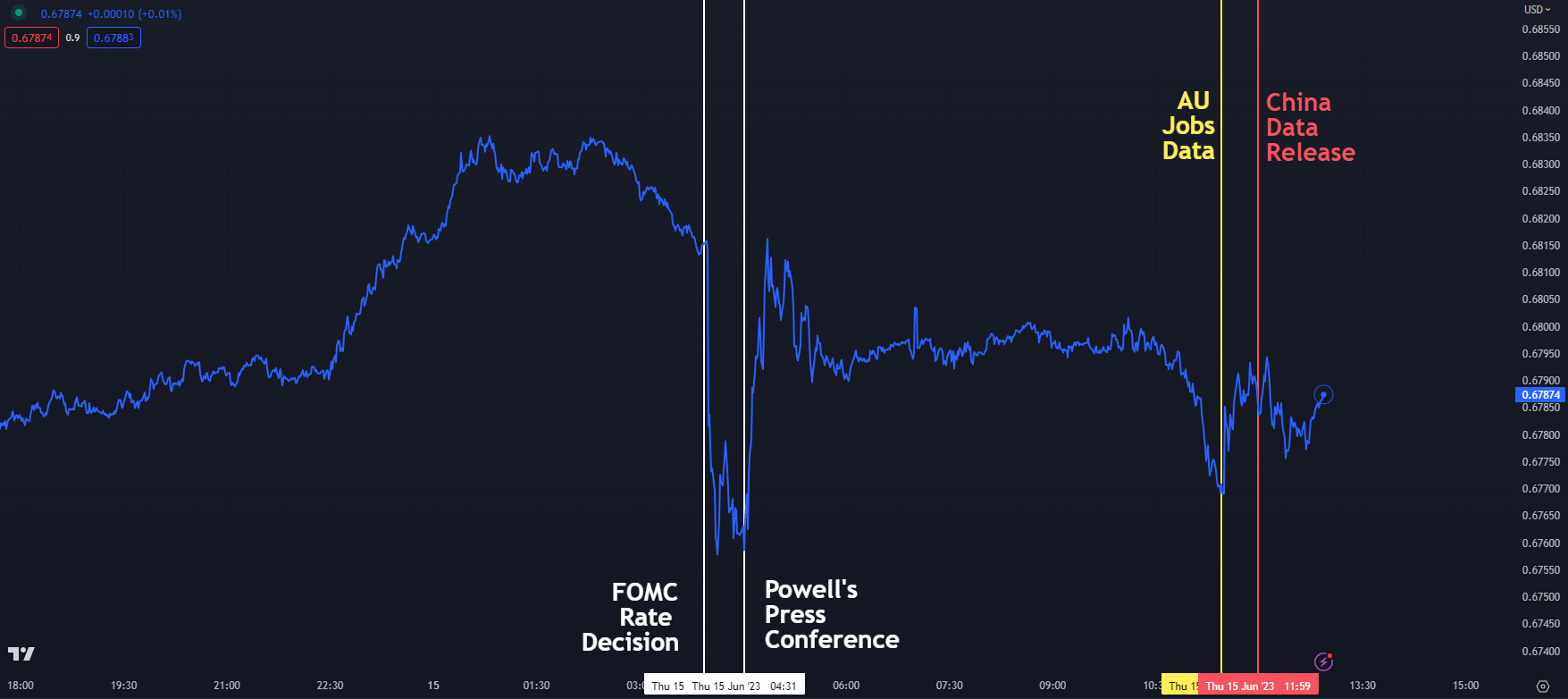

The overnight decision by the Federal Open Market Committee (FOMC) to keep its target rate unchanged followed by the subsequent statement and press conference provided some fireworks for AUD/USD.

Looking ahead, the factors that may play a role in AUD direction could be the pricing of an RBA rate move, Fed speak around more hikes and the economic outlook for China if there is a notable change in policy there.

AUD/USD PRICE REACTION TO JOBS, THE FED DECISION AND CHINA DATA

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com