Australian Dollar Vs US Dollar, Euro, British Pound – Price Setups:AUD jumped on reports that Chinese authorities have pledged to shore up the economy

Australian Dollar Vs US Dollar, Euro, British Pound – Price Setups:

- AUD jumped on reports that Chinese authorities have pledged to shore up the economy.

- Key focus is now on Australia CPI data due Wednesday.

- What is the outlook for AUD/USD, GBP/AUD, and EUR/AUD?

Recommended by Manish Jaradi

Get Your Free Equities Forecast

The Australian dollar surged against some of its peers after Chinese authorities pledged to stimulate the economy.

Markets took comfort after media reports quoted state news agency Xinhua saying China will shore up economic policy adjustments, focusing on expanding domestic demand, boosting confidence, and preventing risks. The agency also quoted President Xi Jinping as saying during a separate meeting that China will strive to achieve its annual development targets.

Beijing has announced a series of measures to cushion some of the downside risks to the economy, including cuts in key lending benchmarks, targeted measures toward new-energy vehicles, the property sector, and the booming generative artificial intelligence sector, and signaled the end of the years-long crackdown on the technology sector.

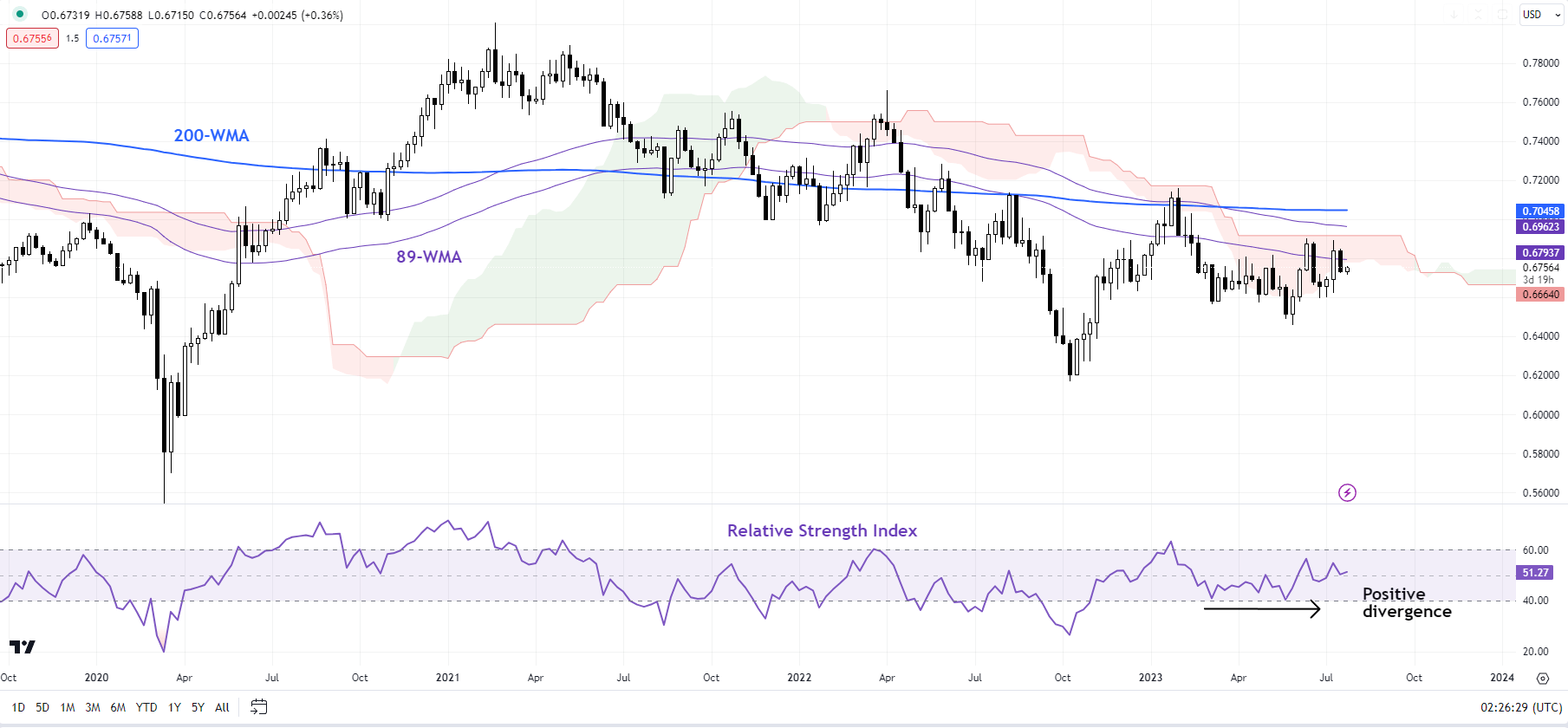

AUD/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

The focus is now on whether there are additional measures for the struggling property sector addressing the demand side and infrastructure. China is Australia’s largest two-way trading partner in goods and services. Any improvement in China’sgrowthoutlook bodes well for AUD prospects.

Meanwhile, data due on Wednesday is expected to show that Australia CPI eased to 1.0% on-quarter in the April-June quarter from 1.4% in the January-March quarter, and 6.2% on-year in Q2-2023 from 7.0% in the previous quarter. On a monthly basis, CPI is expected to have eased to 5.4% on-year in June from 5.6% in May. With Australia’s unemployment rate near five-decade lows, a slower-than-expected moderation in price pressures could make the August 1 RBA meeting a live one.

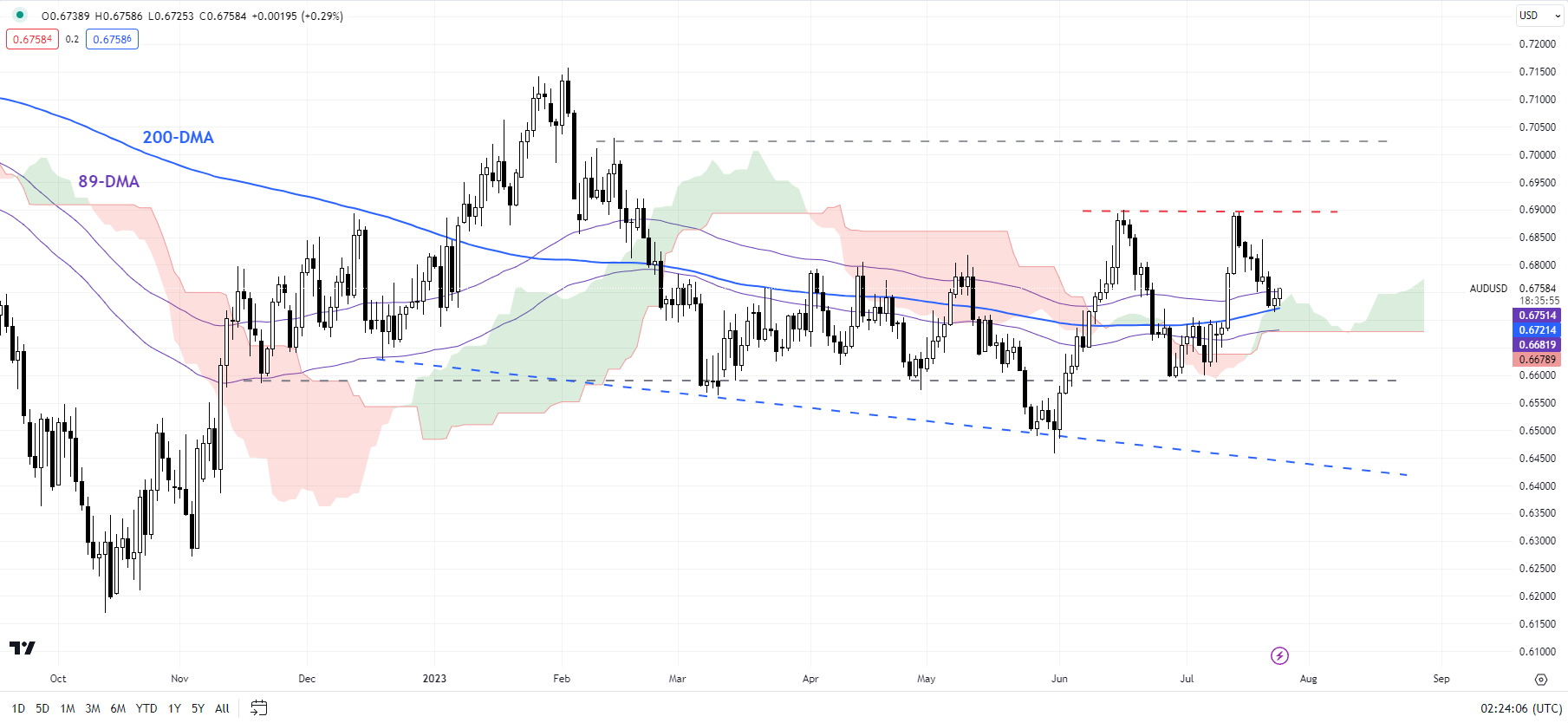

AUD/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

AUD/USD: Forming another base?

On technical charts, AUD/USD is holding above vital support on the 200-day moving average (now at about 0.6720). The rise above Monday’s high of 0.6750 raises the odds that the pair could be forming another base. This follows a higher low formed in late June/early July, opening the prospect of a higher-top-higher-bottom pattern from May.

Still, AUD/USD would need to break above the vital hurdle at the June and July highs of around 0.6900 to confirm that the trend had reversed to up from down. Until then, the path of least resistance remains sideways, within the recently well-established range of 0.6500-0.6900.

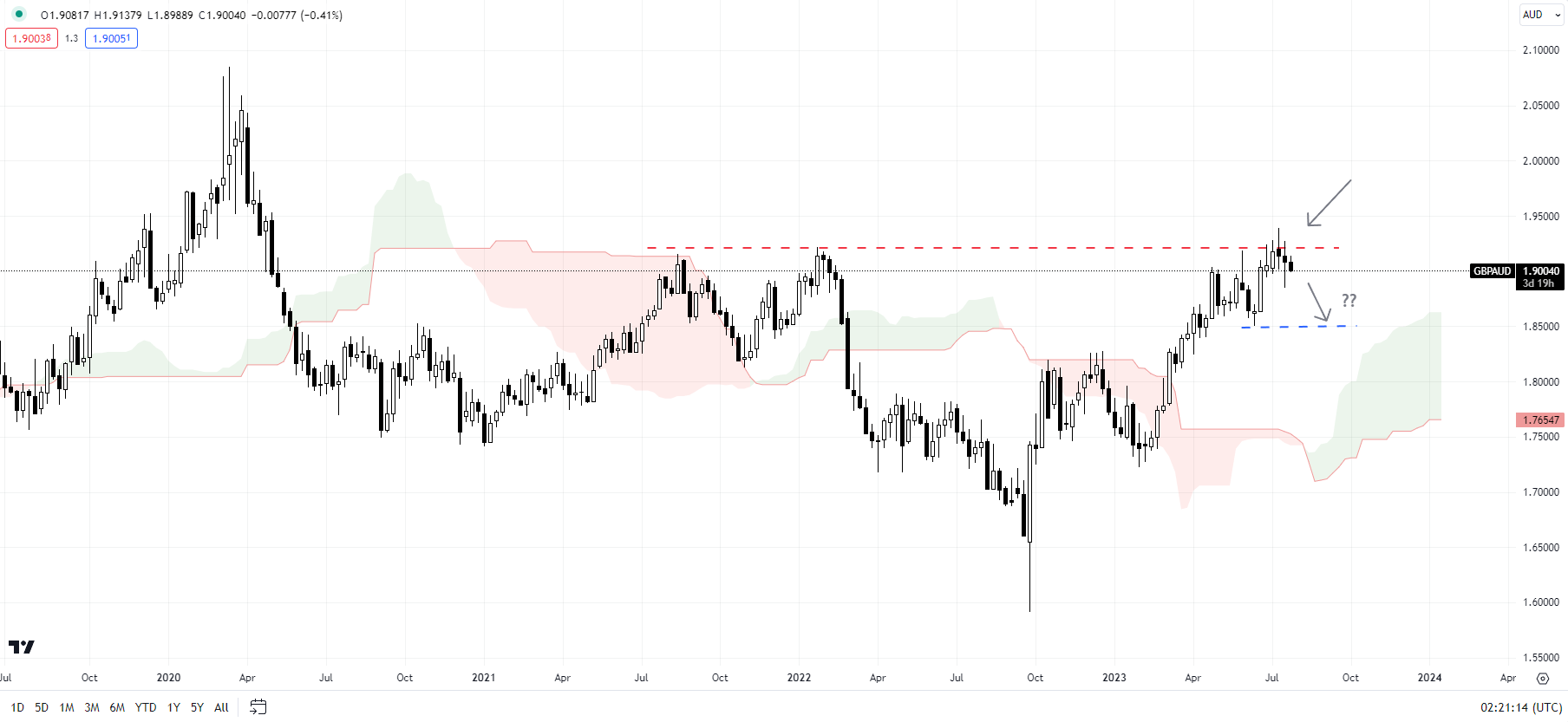

GBP/AUD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

GBP/AUD: Risks retreat

GBP/AUD has run into a major hurdle on a horizontal trendline from 2021, at about 1.9200.

A negative momentum divergence (rising price associated with a stalling in the 14-day Relative Strength Index) raises a risk of a drop toward the June low of 1.8500 in the near term. However, the broader upward pressure is unlikely to fade while the cross remains above the 200-day moving average (at about 1.8250).

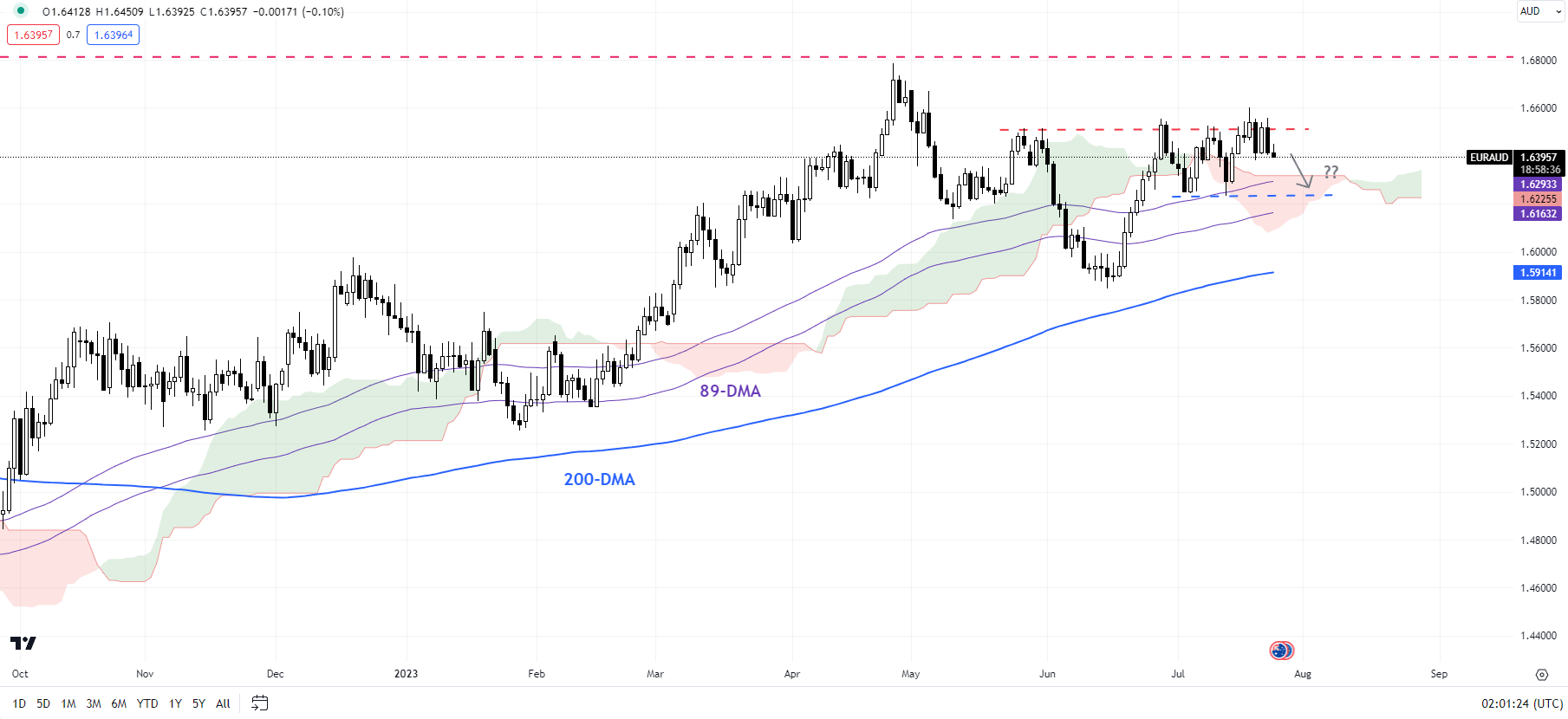

EUR/AUD Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/AUD: Upward pressure could be fading

After repeated failed attempts to break above the solid ceiling in the May of 1.6515, EUR/AUD appears set to be weak slightly in the near term. The cross could drop initially toward the mid-July low of 1.6230, potentially the 200-day moving average (now at about 1.5900).

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com