Australian Greenback Basic Forecast: BlendedThe notable drop-off in Chinese language iron ore demand could also be behind AUD’s c

Australian Greenback Basic Forecast: Blended

- The notable drop-off in Chinese language iron ore demand could also be behind AUD’s current slide decrease in opposition to its main counterparts.

- Higher-than-expected jobs knowledge may underpin the foreign money within the close to time period.

- Upcoming inflation report could decide the trajectory of the Australian Greenback within the coming weeks.

Really useful by Daniel Moss

Get Your Free AUD Forecast

Drop in Chinese language Iron Ore Demand Weighing on AUD

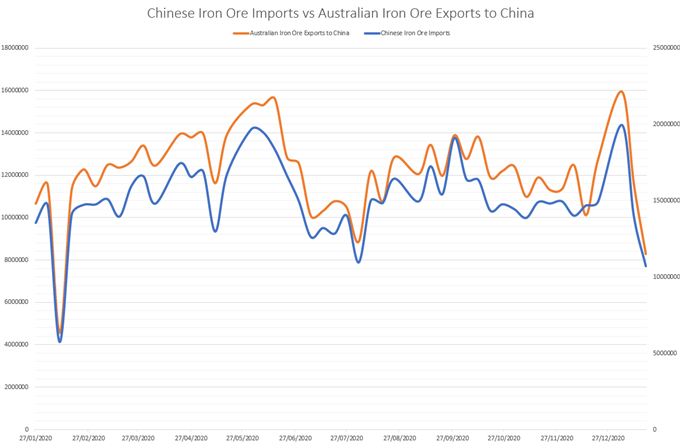

As famous in earlier reviews, the notable drop-off in iron ore exports to China could also be behind the flip decrease seen within the AUD/USD trade charge in current days, as total demand drops to its lowest since late-July 2020.

This substantial discount in exports could possibly be as a result of newest outbreak of coronavirus on the mainland, with residents in Shanghai banned from leaving the town after a six coronavirus instances have been detected. An extra 47 instances have been additionally reported in Heilongjian province on Friday.

After all, given China’s earlier success in suppressing outbreaks, it appears comparatively unlikely that case numbers will markedly transfer larger and drive restrictions to be in place for an prolonged time period.

Supply – Bloomberg

Nonetheless, with Chinese language New 12 months celebrations simply across the nook there may be vital danger that home journey may result in an exponential unfold of the virus.

Certainly, native well being authorities have warned that the most recent pressure has been discovered to “last more, unfold wider, and transmit sooner, with the next share of aged and rural sufferers”.

With that in thoughts, merchants ought to maintain a watchful eye on ongoing well being developments. A notable decide up in an infection numbers in all probability leads to the imposition of tighter restrictions and should finally restrict total iron ore demand within the close to time period.

Sturdy Financial Restoration to Underpin AUD

From a neighborhood standpoint, the Australian economic system has continued to rebound robustly, because the island nation’s profitable suppression of Covid-19 has allowed a return to a stage of normality.

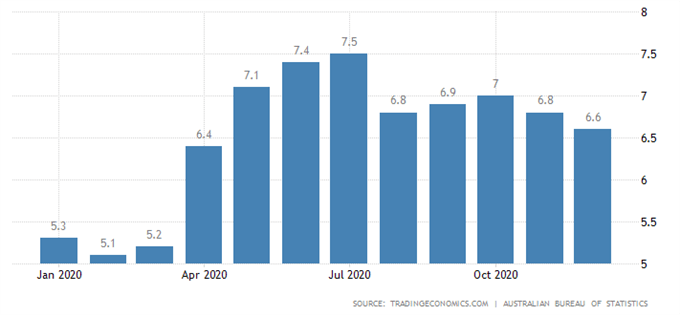

The unemployment charge slid to six.6% (prev. 6.8%) in December whereas the nation’s composite PMI studying for January rose to 56 (prev. 55.6), as progress proceed however a slower tempo than that seen in July of 2020.

Australian Unemployment Charge

Nevertheless, preliminary retail gross sales figures for December registered its first drop in client spending since September, as an outbreak of the novel coronavirus in New South Wales and Victoria – Australia’s two most-populous states – pressured the imposition of social distancing measures and restrictions.

Nonetheless, with case numbers nationwide persevering with to hover in single digits, and with nearly all of contaminated folks remoted in resort quarantine, the nation’s economic system appears to be like set to maintain its restoration considerably unabated. This will likely finally put a premium on the cyclically-sensitive foreign money within the coming months.

Inflation Information in Focus

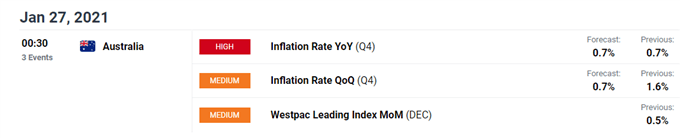

Wanting forward, This fall inflation knowledge shall be keenly eyed by regional traders to find out the potential path ahead for financial coverage from the Reserve Financial institution of Australia.

A bigger-than-expected rise in client worth progress would in all probability diminish the potential for additional easing from the RBA within the close to time period and in flip propel the Australian Greenback larger in opposition to its main counterparts.

DailyFX Financial Calendar

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Really useful by Daniel Moss

Prime Buying and selling Classes