COME HERE FOR LIVE COVERAGE OF CHINA Q3 GDP DATA AT 1: 45 GMTAustralian Greenback, China Q3 GDP, IMF World Financial Outlook, Aus

COME HERE FOR LIVE COVERAGE OF CHINA Q3 GDP DATA AT 1: 45 GMT

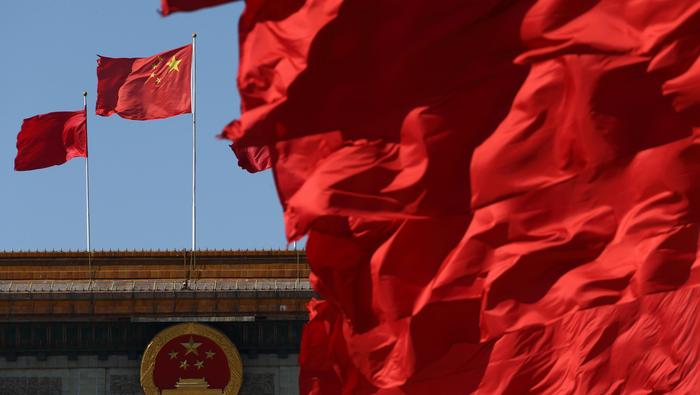

Australian Greenback, China Q3 GDP, IMF World Financial Outlook, Australia-China Commerce Tensions:

- Upcoming financial information out of China may gas the Australian Greenback’s push to retest its yearly excessive.

- Nevertheless, deteriorating Australia-China relations threatens to gas a interval of great danger aversion.

IMF Forecast China to Lead International Financial Restoration

Contemporary information prints popping out of China might sway AUD/USD, as Australia’s largest buying and selling companion is predicted to develop 5.5% within the third quarter of 2020.

Ought to this expansionary print come to move, it might present that the Chinese language financial system has recovered all misplaced floor from its document 6.8% contraction within the first quarter and continues to guide the worldwide financial rebound from the coronavirus-induced doldrums.

In actual fact, the Worldwide Financial Fund’s (IMF) newest projections point out that China is the one main nation anticipated to develop this yr, on the again of a surge in export demand and its success in containing the outbreak of the extremely infectious coronavirus.

DailyFX Financial Calendar

Furthermore, the Chinese language authorities has but to unleash trillions of yuan in stimulus, after promoting a document quantity of bonds this yr, which suggests {that a} extra in depth restoration might be within the offing.

Beijing has ordered regional governments to promote 3.75 trillion yuan of bonds by the tip of October, constructing on the two.27 trillion already issued by the tip of July and surpassing the overall quantity of debt issued in 2019.

Due to this fact, with a considerable fiscal stimulus safety-net in place it seems the world’s second-largest financial system is about to proceed increasing this yr, which can finally buoy regional danger urge for food and in flip put a premium on the cyclically-sensitive Australian Greenback.

Beneficial by Daniel Moss

Get Your Free AUD Forecast

Australia-China Tensions Limiting AUD

Nevertheless, escalating tensions with China might hamper the trade-sensitive AUD, after two Australian cotton trade teams launched a joint assertion stating that “it has grow to be clear to our trade that the Nationwide Growth Reform Fee in China has lately been discouraging their nation’s spinning mills from utilizing Australian cotton”.

These measures are the newest in a tit-for-tat change that has seen Australia’s largest buying and selling companion impose 80% tariffs on barley exports, launch an anti-dumping and anti-subsidy probe into the nation’s wine, and verbally ban imports of Australian thermal and coking coal.

Given China accounts for 40% of Australia’s exports, a marked deterioration in relations would have devastating penalties for the native financial system and will probably result in $80 billion price of iron ore exports falling into the Asian powerhouse’s crosshairs.

To that finish, the event of this pivotal relationship ought to be intently watched by market contributors, with a notable escalation in trade-based actions greater than doubtless fuelling a interval of danger aversion and in flip hampering the efficiency of the Australian Greenback.

Australia Exports by Nation

Supply – Buying and selling Economics

AUD/USD Each day Chart – 100-DMA Nurturing Rebound

From a technical perspective, the AUD/USD change charge appears poised to climb larger regardless of collapsing by means of Ascending Channel assist and the pivotal 61.8% Fibonacci (0.7131), as worth stays constructively perched above the 100-day transferring common (0.7059).

With AUD/USD carving out a Bull Flag formation simply above key assist and the RSI eyeing a cross again above its impartial midpoint, the trail of least resistance appears skewed to the topside.

A each day shut again above the 61.8% Fibonacci (0.7131) would most likely generate a retest of the month-to-month excessive (0.7243), with a break and shut above the 0.7250 mark wanted to carve a path to check the September excessive (0.7413).

Conversely, a break under the 100-DMA (0.7059) may ignite a extra in depth pullback and produce key psychological assist on the 0.7000 degree into focus.

AUD/USD each day chart created utilizing TradingView

— Written by Daniel Moss, Analyst for DailyFX

Comply with me on Twitter @DanielGMoss

Beneficial by Daniel Moss

Constructing Confidence in Buying and selling