Australian Q3 capex eyed forward of GDP information as aussie flies on vaccine information – Foreign exchange Information Prev

Australian Q3 capex eyed forward of GDP information as aussie flies on vaccine information – Foreign exchange Information Preview

Posted on November 25, 2020 at 9:16 am GMTMelina Deltas, XM Funding Analysis Desk

The Australian greenback is transferring barely larger in opposition to the US greenback over the past month as traders are ready for the capital expenditure information for the third quarter on Thursday at 00:30 GMT forward of the GDP determine on December 2. Within the meantime, the aussie is forming a optimistic construction on the again of the optimistic vaccine information, which have opened up a pathway to a protected Australia, with the primary doses set to be distributed to healthcare employees and the aged by March.

Will Capex have an effect on GDP numbers?

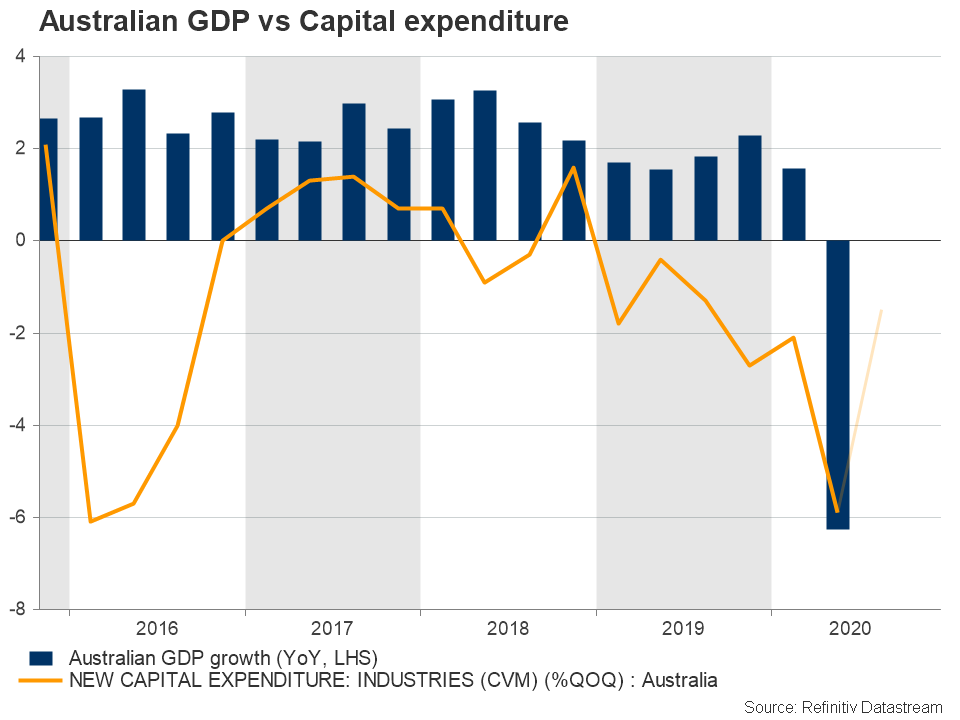

Capital expenditure slumped within the second quarter of the yr, falling by 5.9%, together with a –4.4% fall for constructing and constructions and a contraction of seven.6% in gear. The forecast for the third quarter is a decline of 1.5% quarter-on-quarter. Gear spending might fall by as a lot as 10% in Q3. The economic system is awash with extra capability and companies have been in survival mode in these unsure durations. Nevertheless, a unfavourable studying in capital expenditure couldn’t essentially trigger a decline in Q3 gross home product subsequent week.

The nation’s economic system contracted 7% q/q within the three months to June, following a 0.3% drop within the prior interval. It was the second consecutive quarterly discount and the sharpest on document, getting into the primary recession in 30 years because the coronavirus pandemic took an enormous toll on the economic system. In case of a powerful contraction in capex, the GDP quantity might fail to submit a rebound, exhibiting that full restoration will not be but on playing cards throughout these essential durations.

RBA money fee choice is coming subsequent week

Throughout November’s assembly, the RBA decreased the money fee to a document low of 0.1% from 0.25% beforehand, as extensively anticipated. The RBA additionally lower its goal fee for three-year bond yields to 0.1%, from 0.25%, to be in step with the money fee, which, it dedicated that can stay unchanged till inflation is sustainably inside its 2-3% goal band. Policymakers talked about they count on optimistic GDP progress in Q3, regardless of the restrictions in Victoria. The nation’s GDP progress is predicted to be round 5% over the yr to June 2021 and 4% in 2022. Moreover, the main focus will be on the unemployment fee, which is predicted to stay excessive, however to peak at somewhat beneath 8%, slightly than the 10% anticipated earlier than.

Aussie nonetheless consolidating in opposition to US greenback

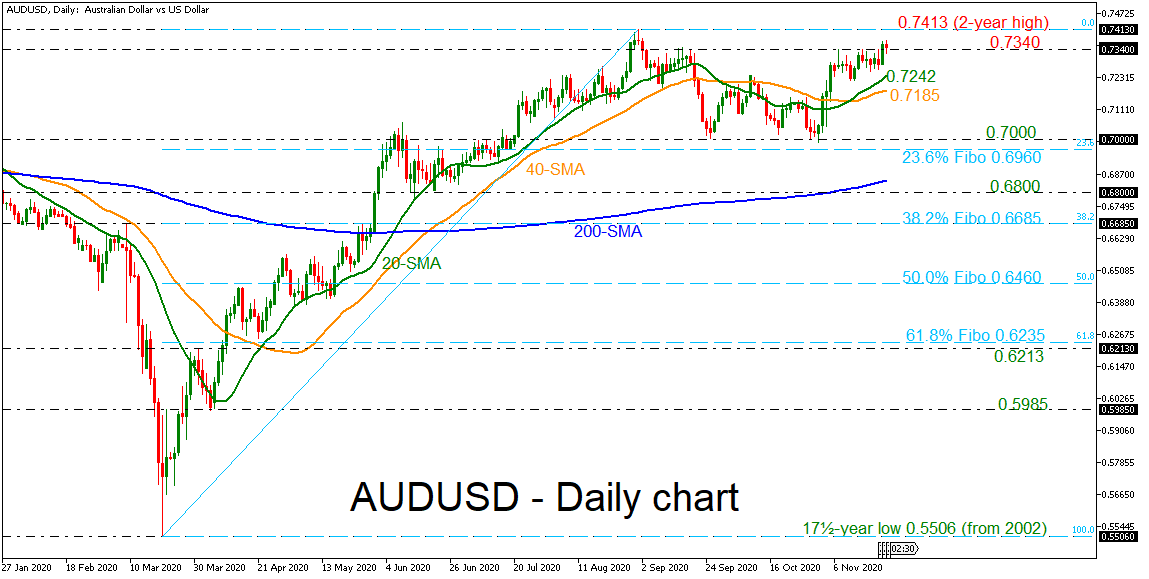

From the technical perspective, aussie/greenback has been buying and selling in a horizontal trajectory inside the 0.7000-0.7340 space since September 3. The worth could possibly be vulnerable to a bearish retracement if the capital expenditure quantity disappoints, nevertheless, vaccine information appears to be extra essential for important actions available in the market. Value motion is prone to rechallenge the 20- and 40-day easy transferring averages (SMAs) at 0.7242 and 0.7185, respectively. A leg beneath it may take the pair till the 0.7000 spherical quantity and the 23.6% Fibonacci retracement degree of the up leg from 0.5506 to 0.7413 at 0.6960, forward of the 0.6800 deal with.

Upbeat numbers are prone to propel the value larger in the direction of the two-year excessive of 0.7413 earlier than testing the 0.7490 resistance, taken from the height on July 2018, endorsing the long-term bullish outlook.

AUDUSD