USD/JPY ANALYSISBoJ meeting minutes unsurprisingly dovish but poses more questions than answers.Is YCC still required?Bulls knocking on the 145.00 do

USD/JPY ANALYSIS

- BoJ meeting minutes unsurprisingly dovish but poses more questions than answers.

- Is YCC still required?

- Bulls knocking on the 145.00 door.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen eked out marginal gains against the greenback today after the Bank of Japan’s (BoJ) meeting minutes and key economic data – see calendar below. Later today we look forward to multiple Fed speakers which should provide some currency volatility across USD pairs.

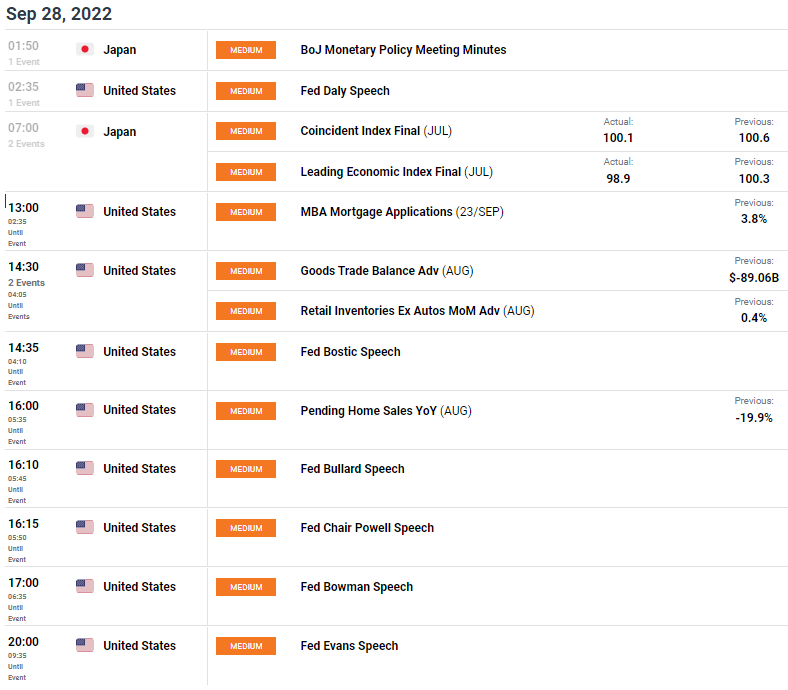

ECONOMIC CALENDAR

Source: DailyFX economic calendar

Introduction to Technical Analysis

Trade the News

Recommended by Warren Venketas

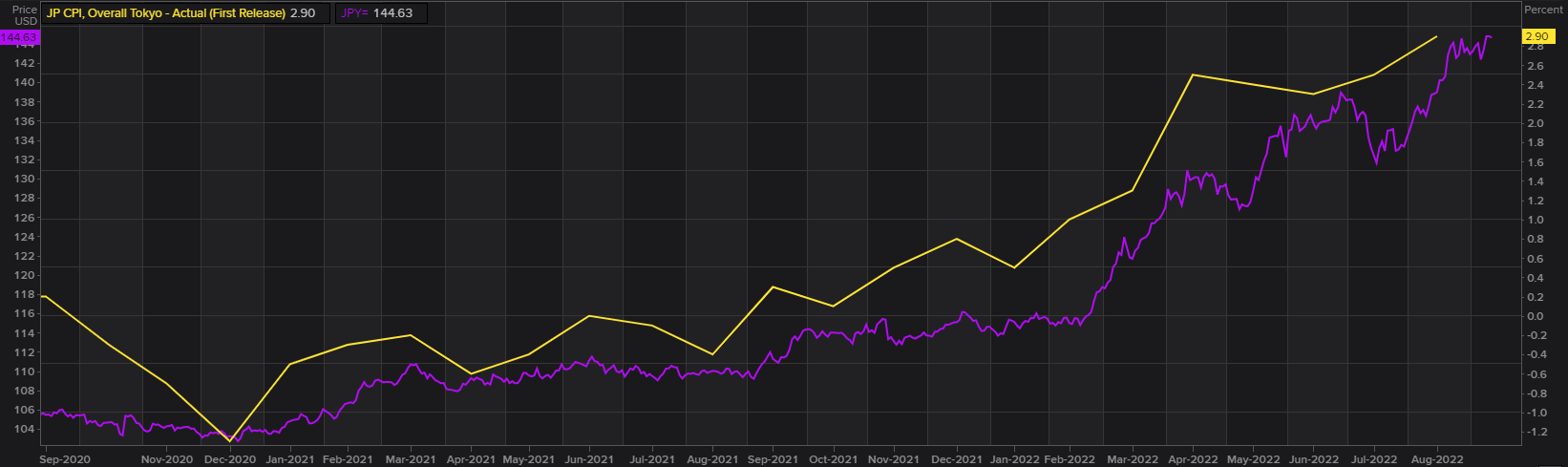

Earlier this morning the BoJ’s meeting minutes revealed concern around Japan’s rising inflation (now above the 2% target) and a weakening yen as shown in the figure below. While this is worrying, there was no pressure to hike interest rates and/or change the current loose monetary policy stance but rather pinning hopes on a global recession to support the Yen and the BoJ’s current policies. This includes Yield Curve Control (YCC) which aims to maintain a certain yield for Japanese Government Bonds (JGBs).

JAPANESE INFLATION VS USD/JPY

Source: Refinitiv

The initial purpose for YCC was to promote inflation in Japan (coinciding with Yen weakness) which was has been in a deflationary environment for many years. Now with inflation exceeding their targets, the purchase of bonds and hence the selling of JPY in what is an inflationary setting, serves an exponential weakening of the local currency. Does the BoJ need to change its policy stance or alter the YCC dynamic? I believe this should be the case and considering the fact that Bank of Japan Governor Haruhiko Kuroda is set to leave next April, this possible change needs to be explored further. In short, a continuation of YCC will leave JPY exposed to further downside and vice versa.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

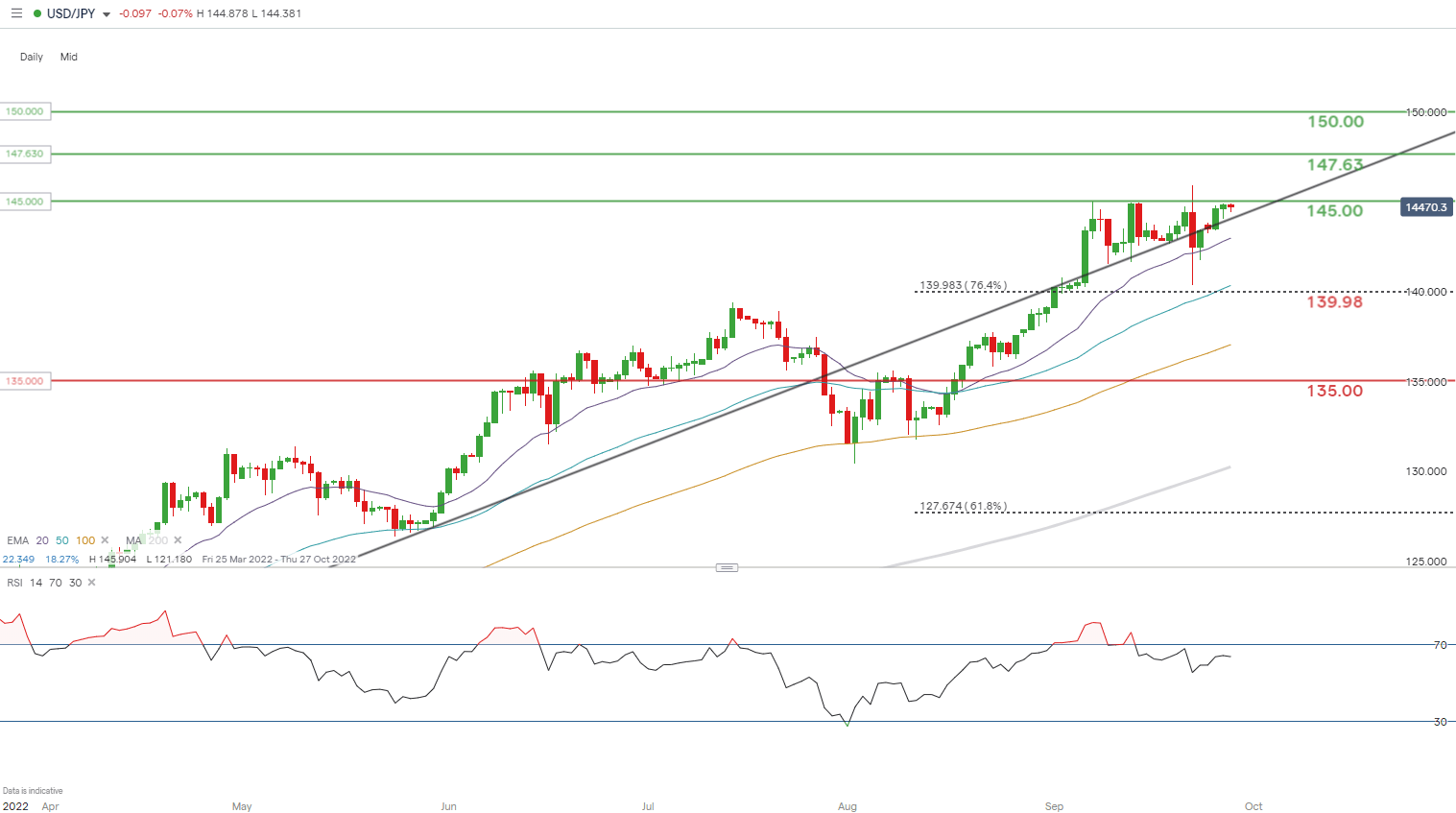

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

The daily USD/JPY chart shows the 145.00 psychological resistance level under threat once more after last week’s FX intervention. This level is likely to be breached once more in my opinion supported by a key technical pattern. Current daily price action mimics an ascending triangle that traditionally points to an upside breakout. What makes this situation tricky to call is the fact that a breakout may not lead to additional upside due to FX intervention so it will be interesting to see whether Japan re-enters the FX markets for a second time this year.

Key resistance levels:

Key support levels:

- 20-day EMA (purple)

- 139.98 (76.4% Fibonacci)/50-day EMA (blue)

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Warren Venketas

IG CLIENT SENTIMENT POINTS TO SHORT-TERM UPSIDE

IGCS shows retail traders are currently net SHORT on USD/JPY, with 77% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment, suggestive of a bullish bias.

Contact and followWarrenon Twitter:@WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com