Brief AUD/USD, AUD/JPY as FX Market Correction in Focus for 2Q 2021 AUD/USD Weekly ChartChart ready by David Tune, created with B

Brief AUD/USD, AUD/JPY as FX Market Correction in Focus for 2Q 2021

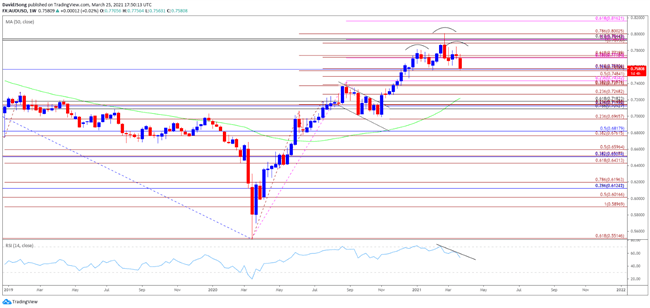

AUD/USD Weekly Chart

Chart ready by David Tune, created with Buying and selling View

AUD/USD prolonged the V-shape restoration from 2020 to briefly commerce above the 0.8000 deal with in February, however a head-and-shoulders formation seems to be taking form into the primary quarter’s finish. With the Relative Energy Index (RSI) exhibiting the same dynamic because the indicator establishes a downward development through the first quarter of 2021, merchants needs to be conscious.

It stays to be seen if the decline from the February excessive (0.8007) will develop into a correction within the broader development or a key reversal in market conduct. The 50-Week SMA (0.7220) continues to trace a optimistic slope, however a break/shut beneath the ‘neckline’ round 0.7560 (50% enlargement) to 0.7580 (61.8% enlargement) on a weekly timeframe would convey the draw back targets onto the radar. The broader outlook for AUD/USD could align with the measured transfer for the head-and-shoulders sample so long as the RSI retains the bearish development from earlier this yr. In that case, the alternate price could proceed to slender the hole with the 50-Week SMA (0.7220) if it pushes beneath the previous resistance zone round 0.7370 (38.2% enlargement) to 0.7390 (38.2% enlargement).

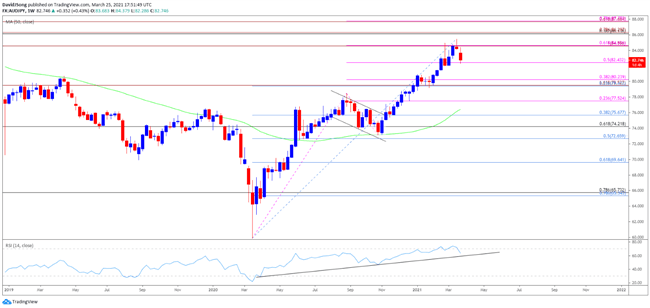

AUD/JPY Weekly Chart

Chart ready by David Tune, created withBuying and selling View

AUD/JPY has additionally prolonged the V-shape restoration from 2020 amid the continued rise in world fairness costs, with the RSI pushing above 70 for the primary time since 2013 throughout the identical interval. The low curiosity atmosphere could proceed to prop up AUD/JPY because the 50-Week SMA (76.44) retains a optimistic slope, however latest developments within the RSI warn of a bigger correction within the alternate price because it falls again beneath 70 to point a textbook promote sign.

In flip, the RSI could proceed to indicate the bullish momentum abating if it snaps the upward development carried over from the earlier yr, with a detailed beneath the 82.40 (50% enlargement) area. On a weekly timeframe, that brings a Fibonacci overlap round 79.40 (23.6% retracement) to 80.20 (38.2% enlargement) onto the radar. Nevertheless, the decline from the March excessive (85.45) could develop into a correction within the broader development moderately than a shift in AUD/JPY conduct as main central banks depend on their emergency instruments to realize their coverage targets. Ought to that show the case, there’s potential for former resistance areas to behave as assist on the advance in investor confidence.

Beneficial by David Tune

Get Your Free High Buying and selling Alternatives Forecast

ingredient contained in the

ingredient. That is in all probability not what you meant to do!nn Load your utility’s JavaScript bundle contained in the ingredient as a substitute.www.dailyfx.com