Last week, EUR/GBP shifted to a bearish trend and experienced a decline of approximately 150 pips. The decline occurred from its high of 0.87 on July

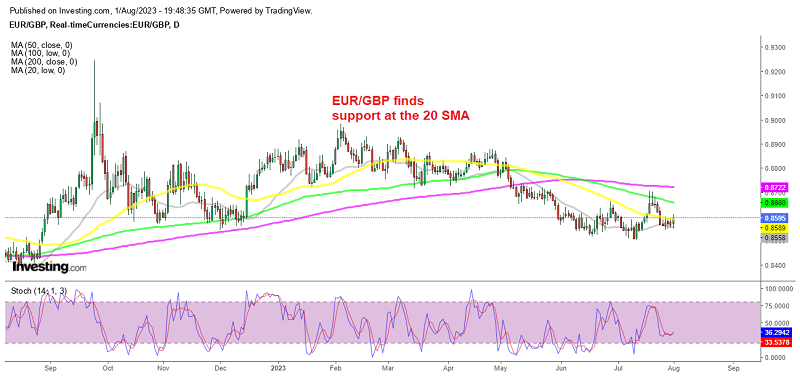

Last week, EUR/GBP shifted to a bearish trend and experienced a decline of approximately 150 pips. The decline occurred from its high of 0.87 on July 19, 2023, to a low of 0.8550s on in late July where it seems to have formed a decent support zone. The price was finding resistance at the 20 SMA (gray) on the H4 chart, but it seems like now this moving average has turned into support as it helped hold the decline in EUR/GBP around the 0.8550 mark.

After forming a number of doji candlesticks above the 20 SMA in the last several trading days on the daily chart, this forex pair made a bullish move yesterday and climbed around 50 pips from the bottom, forming a bullish reversing pattern. The price broke above the 50 daily SMA (yellow) and seems to be holding there.

The EUR/GBP currency pair reached a high price of 0.8608 yesterday, but its upward momentum stalled eventually as the European markets headed to a close. On the other hand, the low price late in the day retreated towards the 0.85970 level, and so far, it has held as a support level. If the 0.8590 level continues to provide support, there is still a possibility of further upside movement in the pair.

However, if the price falls back below the 0.8590 level, it could signal a failure in breaking above the previously mentioned levels, leading to potential disappointment for traders. In that case, the next target on the downside would be the swing high from Friday and yesterday, which is near 0.8589, and breaking below that level could lead to further downward movement. The move higher came after the Eurozone CPI (consumer price index) report which showed a 2-point decline from 5.5% to 5.3% in headline inflation, but core CPI remained sticky at 5.5%. That won’t do the ECB much comfort in trying to spin the narrative for a September pause.

July Eurozone CPI Inflation Report From Eurostat – 31 July 2023

- July preliminary CPI YoY +5.3% vs +5.3% expected

- June final CPI YoY was +5.5%

- July Core CPI YoY+5.5% vs +5.4% expected

- Prior core CPI YoY was +5.5%

EUR/GBP Live Chart

EUR/GBP

www.fxleaders.com