USD/JPY 1Q Forecast: Can the BoJ Hold Up With the Breakneck Tempo of the FOMC? 12 months-long projections are difficult in any ba

USD/JPY 1Q Forecast: Can the BoJ Hold Up With the Breakneck Tempo of the FOMC?

12 months-long projections are difficult in any backdrop, however the one which we discover ourselves inside proper now appears particularly harmful. At this level forward of the New 12 months, there’s lots optimism priced in for 2021 and far of that’s primarily based on simply how tough 2020 has been. Whereas a world pandemic has shuttered economies for a big chunk of the 12 months, the prospect of a vaccine and a attainable return to regular subsequent 12 months retains hope alive for a return of development. This has helped to drive contemporary all-time-highs in a variety of danger markets: It might probably even be stated that, at this level, fairness markets are ‘priced for perfection,’ absolutely anticipating greatest case eventualities in a variety of tenuous areas, resembling prognostications round a vaccine.

For subsequent 12 months, I need to search for a continuation of US Greenback weak spot. I feel that the Fed goes to wish to stay very lively to proceed guiding the US financial system by way of the pandemic. The massive query is which forex to mesh that projection with, as there aren’t actually many Central Banks which are brazenly speaking concerning the prospect of upper charges and, as of this writing, each EUR/USD and GBP/USD are perched close to multi-year highs so, that doesn’t appear an amenable venue both. However, one pocket of attainable alternative is in USD/JPY.

USD/JPY: Can the Three Pillars Stand With out the Architect Abe

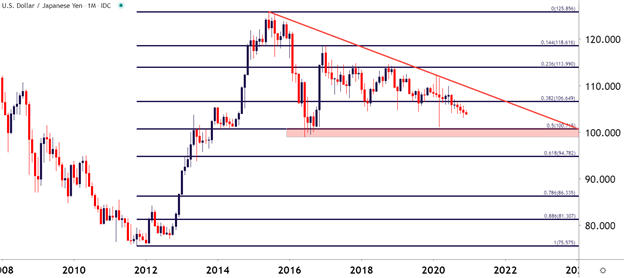

Given the tumult of 2020 it appears as if one of many bigger political shifts went with out a lot consideration, and that was the handover of the Japanese PM place when Shinzo Abe stepped down. Abe is the architect of Abenomics, the financial technique out of Japan designed to reverse many years of lagging inflation; and key for that strategy was Yen-weakness which confirmed aggressively from 2012-2015 because the Financial institution of Japan coordinated with the Japanese authorities on a sequence of initiatives. About 50% of that newfound Yen-weakness was priced out in 2016, nevertheless, as worries started to construct round Chinese language markets, inflicting a dose of danger aversion that created unwind in lots of carry trades. However – with Shinzo Abe now now not main Japan, can these Abenomic-fueled Yen losses stay?

The massive space of focus for USD/JPY is the 100.00 degree. This value got here into play in the summertime of 2016, serving to to set the lows. A draw back break of this space on the chart opens the door to a doubtlessly giant fall, in the direction of the 95.00 degree on the chart.

USD/JPY Month-to-month Worth Chart

Chart ready by James Stanley, created with TradingView

Really useful by James Stanley

Get Your Free Prime Buying and selling Alternatives Forecast