Canada wholesale trade for October -0.5% versus -1.1% expected | Forexlive

- Canadian October wholesale trade sales data

- Prior month +0.4% revised -0.6%

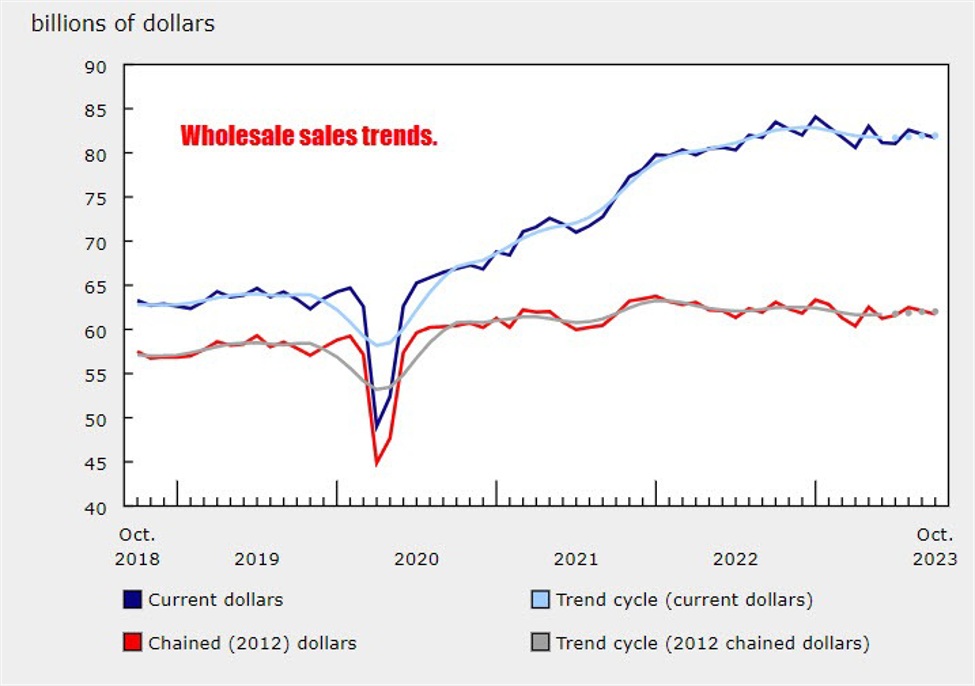

- October’s wholesale sales (excluding petroleum, petroleum products, other hydrocarbons, oilseed, and grain) dropped by -0.5% to $81.7 billion.

- Decreases were noted in five out of seven subsectors, most notably in machinery, equipment, supplies, food, beverage, and tobacco.

- Compared to the same month in the previous year, these wholesale sales were -2.1% lower.

- Petroleum products, oilseed, and grain data are available but excluded from the monthly analysis until sufficient historical data for monthly and annual analysis is gathered.

- In terms of volume, these wholesale sales decreased by -0.7% in October.

Details:

- The machinery, equipment, and supplies subsector saw a -1.6% decrease in sales to $17.7 billion in October, marking the second consecutive month of decline.

- Two main industry groups led this decline:

- Construction, forestry, mining, and industrial machinery, equipment, and supplies dropped 3.6% to $6.0 billion, following high shipments in the third quarter.

- Computer and communications equipment and supplies fell 2.9% to $5.0 billion, after two months of sales increases.

- The food, beverage, and tobacco subsector decreased by -1.1% to $14.9 billion in October.

- This was mainly due to a -1.3% drop in the food industry group sales to $13.1 billion, reversing strong growth observed in September.

- Partially offsetting these declines, the building material and supplies subsector increased by 1.1% to $12.1 billion in October.

- The lumber, millwork, hardware, and other building supplies group rose 1.2% to $5.9 billion.

- The electrical, plumbing, heating, and air-conditioning equipment and supplies group went up 1.8% to $3.9 billion.

Inventory data shows:

- October saw a 1.1% increase in wholesale inventories (excluding petroleum, petroleum products, other hydrocarbons, and oilseed and grain) to $129.3 billion, the largest monthly rise since February 2023.

- The recovery of wholesale inventories in October brought them back to levels similar to the first half of 2023.

- The inventory increase was driven by five of the seven subsectors, particularly the machinery, equipment, and supplies subsector, which rose 2.6% to $39.0 billion.

- The motor vehicle and motor vehicle parts and accessories subsector also contributed significantly, with a 2.3% increase to $17.5 billion.

- The inventory-to-sales ratio went up from 1.52 in September to 1.58 in October, indicating a longer time required to exhaust inventories at current sales levels.

www.forexlive.com

COMMENTS