USD/CAD, BOC Value Evaluation & InformationBoC Anticipated to Stand Pat on Coverage All Eyes on Accompanying Assertion and Go

USD/CAD, BOC Value Evaluation & Information

- BoC Anticipated to Stand Pat on Coverage

- All Eyes on Accompanying Assertion and Governor Macklem’s Speech

OVERVIEW: The Financial institution of Canada is broadly anticipated to face pat on financial coverage with the in a single day price to stay at 0.25% alongside no change within the present tempo (CAD 4bn/week) or composition of QE purchases. In gentle of not too long ago introduced provincial lockdowns, there have been slight ideas that the BoC might choose of a micro-cut (lower than the traditional 25bps). Nevertheless, with analysts unanimously calling for charges to be unchanged and OIS markets implying no probability of a transfer, a micro-cut seems most unlikely.

Really useful by Justin McQueen

Buying and selling Foreign exchange Information: The Technique

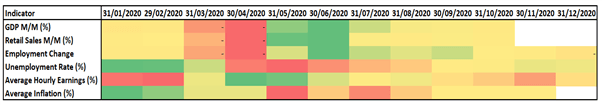

ECONOMIC DATA: Because the December assembly, financial knowledge has been marginally higher than anticipated. The BoC’s Enterprise Outlook Survey reported on rising optimism amid the announcement of efficient vaccines. Though it’s value holding in thoughts, that the survey interval had been Nov 10-Dec 1 and subsequently previous to elevated lockdown measures. Elsewhere, the month-to-month GDP (Oct) determine rose 0.4%, printing forward of expectations of 0.3%. Nevertheless, with Canada again beneath strict lockdown measures, the main focus is much less on how the economic system carried out on the finish of final 12 months and as an alternative extra on how the economic system might be impacted in Q1 2021. Moreover, the most recent CPI report highlighted that the common of the BoC’s measure of inflation remained regular at 1.7%. The labour market has been considerably combined with the latest studying confirmed a contraction in jobs created (-62okay). That stated, this had been solely as a result of contraction in part-time employees, whereas full-time jobs created noticed a marginal enhance.

Canadian Information Heatmap

Supply: Refinitiv, DailyFX

Really useful by Justin McQueen

Traits of Profitable Merchants

MPR OCTOBER ASSUMPTIONS

Brent near $40 (At the moment $55)WTI near $40 (At the moment $52)WCS near $30 (At the moment $41)

Oil costs have surged 40% for the reason that October MPR assumptions with an increase for the reason that December assembly. In flip, whereas the short-term outlook is prone to replicate powerful lockdown measures, H2 2021 might be considerably brighter with the rollout of the COVID vaccine a contributing issue for optimism.

CAD STRENGTH: With the Canadian Greenback buying and selling round multi-year highs in opposition to the dollar and the CAD TWI at circa 3-year highs. Loonie power has change into a subject of debate as soon as once more for the Financial institution of Canada with each the Governor and Deputy Governor making a point out in regards to the change price.

- BOC’S MACKLEM“RECENT C$ APPRECIATION IS HURTING COMPETITIVENESS OF CANADIAN EXPORTERS IN U.S. MARKET”

- BOC’S BEAUDRY: “STRONG C$ IS ONE ELEMENT OF MANY WE ARE LOOKING AT AS WE PREPARE JANUARY MPR”

Nevertheless, whereas a stronger CAD might certainly tighten monetary circumstances, appreciation within the forex has largely resulted from a softer US Greenback. Due to this fact, extra stimulus might have little impression in altering the trajectory in CAD in opposition to the USD. As such, an try and curtail the Loonie might stem from a reiteration of current rhetoric within the post-decision press convention. Of word, the present stance within the coverage assertion is that “a broad-based decline within the US change price has contributed to an additional appreciation within the Canadian Greenback”.

| Change in | Longs | Shorts | OI |

| Day by day | 7% | 28% | 15% |

| Weekly | 0% | 56% | 17% |

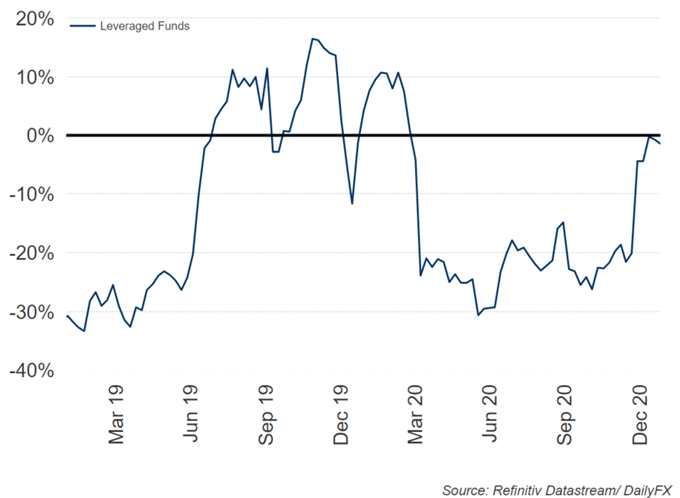

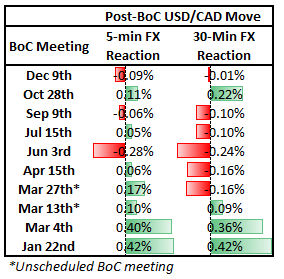

MARKET REACTION: A call by the Financial institution of Canada to keep up present coverage, may see a slight downtick in USD/CAD given the slight threat of a micro-cut, nonetheless, the transfer is prone to be marginal at greatest as a micro-cut could be very unlikely. As an alternative, focus might be on the accompanying assertion and Governor Macklem’s press convention. Due to this fact, a sign that coverage will stay on maintain for the foreseeable future regardless of the current lockdowns may very well be sufficient to result in a modest transfer decrease in USD/CAD. Nevertheless, speaking down of the forex might see any strikes decrease in USD/CAD shortly retraced. Based on the choice markets, the implied transfer is at 0.45%, which is considerably elevated given the current USDCAD response to BoC conferences. Elsewhere, heading into the assembly, quick cash accounts (leveraged funds) are barely brief the Canadian Greenback (bullish USD/CAD), thus a extra constructive assertion from the BoC might see a extra outsized transfer on the draw back.

USD/CAD Reactions Have Been Moderately Muted in Current Months

Quick Cash Accounts Barely Bearish CAD Heading into BoC Assembly