Canadian jobs information may add to restoration hopes in Q3 – Foreign exchange Information Preview Posted

Canadian jobs information may add to restoration hopes in Q3 – Foreign exchange Information Preview

Posted on September 3, 2020 at 12:10 pm GMTChristina Parthenidou, XM Funding Analysis Desk

Canadian employment readings might be carefully watched on Friday at 12:30 GMT as markets weigh the prospects of Canada recovering sooner than the US within the coming quarters. Forecasts recommend a decline within the jobless price and a softer rise in employment, which may endorse the rising optimism, particularly if the numbers are available brighter-than-expected, additional fuelling the rally within the loonie.

Canada’s fortunes could possibly be higher than US’s

The loonie scored 5 consecutive inexperienced months towards the US greenback however August introduced the majority of features, including 2.8% to its worth primarily due to the US political uncertainty. Though President Donald Trump briefly prolonged unemployment advantages, the Congress recessed in August with divisions over a second fiscal stimulus package deal remaining large open between Republicans and Democrats at a time when the EU and different key economies have their monetary plans already settled.

The Canadian prime minister Justin Trudeau can also be going through stress over his management this month amid a charity scandal that pressured him to prorogue the Parliament and name for a confidence vote within the authorities on September 23 after Murneau’s resignation as a Minister of Finance. But, Trudeau managed to right away appoint the deputy PM Chrystia Freeland within the place and prolong CERB funds for an additional 4 weeks, whereas additionally making the employment insurance coverage program (EI) extra accessible to unemployed people who find themselves actively looking for employment. Furthermore, after his throne speech on September 23, which can present an replace on how the nation will transfer ahead with the pandemic measures, the opposition events may set off an election in the event that they vote towards his management, although in contrast to the US, political dangers are at present minimal because the polls recommend that Trudeau could possibly be re-elected.

Moreover, though Canadian an infection circumstances have registered some spikes lately, the numbers don’t seem like a second wave of Covid-19 but, giving some reduction to Trudeau and rising optimism that an financial rebound within the third quarter could possibly be sooner in Canada than within the US because the reopening measures got here into impact in Canada as nicely and financial stimulus kicked in.

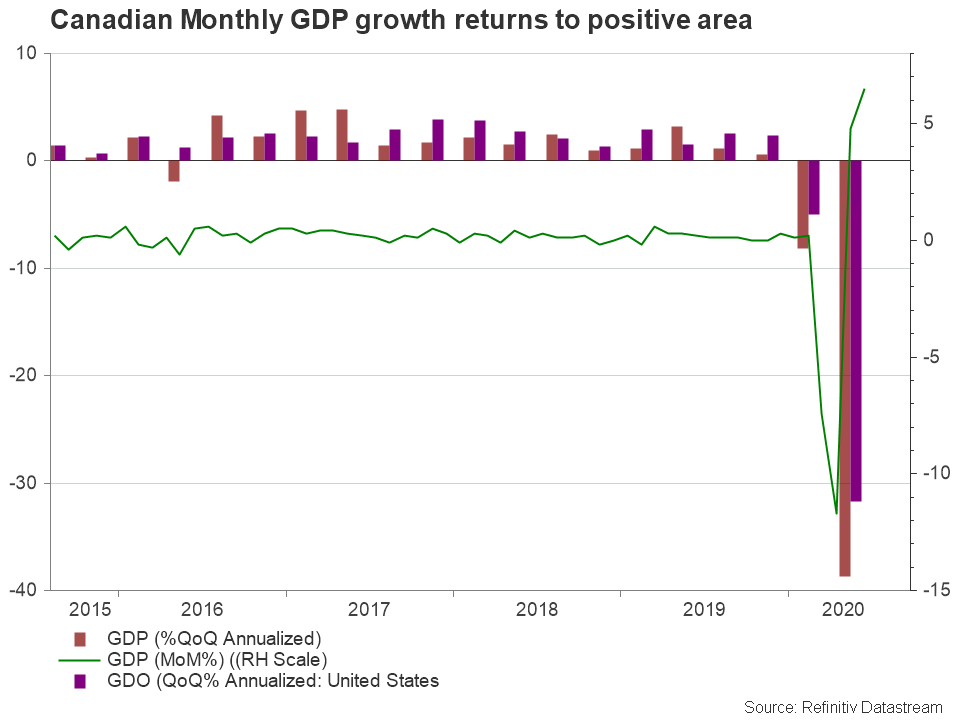

The second quarter was traditionally one of many worst for Canada and was uglier than the one within the US , with GDP plunging by an annualized price of 38.7%. Family consumption and housing funding had been down by half and the plunge in exports was not excellent news for commodity-dependent Canada. Nevertheless, month-to-month GDP readings for June arrived stronger-than-expected, exhibiting a progress of 6.5% and suggesting that the economic system might need entered the third quarter on the correct foot. The six largest banks in Canada estimate on common that the economic system may rebound by 36% annualized in Q3 versus the 20% enlargement within the US due to a better success in controlling the virus unfold.

Unemployment price to maintain declining

Friday’s employment readings may endorse that view if the unemployment price ticks down for a 3rd consecutive month, from 10.9% to 10.1% in August. New employment is predicted to extend at a softer tempo of 275ok versus 418ok seen within the previous month, however this could possibly be thought of as a return to pre-pandemic regular ranges after the extraordinary spike in June. A extra livid rise may sign that much more individuals are returning to work. So, in both case, the employment change might not have a unfavorable influence on the loonie so long as the unemployment price retains falling.

Adverse dangers are nonetheless in place

Nevertheless, it could possibly be too early to hope for a comparatively stronger Canada sooner or later given its shut borders with the US and the truth that 75% of its exports are touchdown within the greatest economic system of the world. Therefore, any financial deterioration within the States may simply spill over into Canada. Policymakers are definitely conscious of that reality, they usually should additionally grapple with the best way to additional stimulate the economic system if well being circumstances worsen and an efficient vaccine will not be confirmed by the top of the 12 months. The central financial institution has already pushed rates of interest to a document low of 0.25% and has no intention to push them under zero, particularly if different nations keep away from doing so. Concerning quantitative easing, asset purchases have been exploding over the previous few months, reaching nearly 30% of GDP, therefore there’s not a lot left to do when the Financial institution of Canada’s subsequent coverage assembly takes place on September 9.

Talking on the Jackson Gap Symposium in Wyoming, the BoC chief defined the significance of partaking with the general public about how the central financial institution’s actions serve financial goals after releasing its “Let’s discuss inflation” survey to assemble opinions. Therefore, discussions may flip round value concentrating on within the 12 months forward following the Fed’s determination to chill out its inflation aim and the plunge in CPI measures. Observe that the households saving price, which is negatively correlated with inflation, has been steadily rising in uncharted territory over the previous few months.

Nonetheless, the financial institution may take the again seat for now and let the federal government act first on the finish of the month.

USD/CAD ranges to look at

Wanting on the information influence, the well-known US Non-farm payrolls (NFP) report is popping out on the similar time on Friday. Therefore, the loonie’s response could possibly be a matter of which of these studies will suprise higher. If the NFP disappoints, an encouraging employment report out of Canada may benefit the loonie, pushing USD/CAD in the direction of the 1.3040-1.2860 assist area. Barely decrease, the 1.2880 barrier might be carefully watched in case of steeper declines.

Alternatively, if the NFP numbers beat expectations, it might be interestig to see if the pair can pierce the descending channel and the damaged long-term ascending trendline at 1.3200 and run in the direction of the 1.3300 mark.

USDCAD