China might return to progress in Q2 amid geopolitical bullying woes – Foreign exchange Information Preview

China might return to progress in Q2 amid geopolitical bullying woes – Foreign exchange Information Preview

Posted on July 15, 2020 at 1:13 pm GMTChristina Parthenidou, XM Funding Analysis Desk

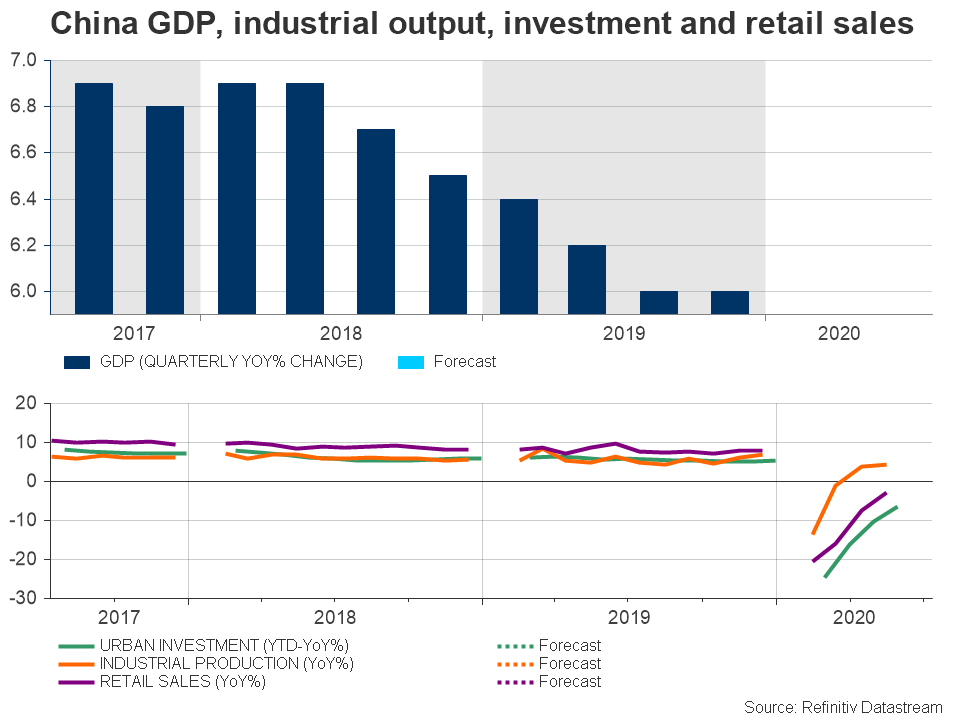

China releases GDP readings for the second quarter on Thursday at 02:00 GMT together with industrial manufacturing for June, retail gross sales and glued funding knowledge. All figures are forecast to strengthen, indicating that the world’s second largest financial system is recovering albeit steadily after contracting at a file charge. The information might enhance threat sentiment, although China’s cloudy political background might be a purpose for merchants to undertake a wait-and-see strategy.

China might develop by 2.5% y/y in Q2

China’s GDP slumped by 6.8% y/y and 9.8% q/q within the first three months of the yr when Covid-19 was first found in Hubei’s province Wuhan, forcing Beijing and the worldwide financial system thereafter to lock their economies. The strict measures, nevertheless, proved to be efficient, and the federal government was the primary worldwide to steadily revive enterprise actions in March, additionally offering important financial and monetary assist to re-boost the financial system.

Within the second quarter, the nation skilled a slight resurgence in new virus circumstances. Nonetheless, not like the US, the second outbreak appeared extra contained and the resumption of some restrictions have been much less painful, permitting the financial system to regain some energy. In response to forecasts, China’s GDP bounced again into the constructive territory, rising by 9.6% q/q and a couple of.5% y/y in Q2.

Individually, month-to-month knowledge for June are anticipated to indicate that retail gross sales and industrial manufacturing prolonged their restoration, with the previous rising by 0.3% m/m after tumbling by 2.8% in Might and the latter increasing barely sooner by 4.7% versus the 4.4% improve beforehand. City funding will likely be intently watched too after China allowed native governments to subject particular bonds value 3.75 trillion yuan to fund infrastructure tasks. Analysts challenge the measure to have halved final month’s decline, from -6.Three to -3.3%.

Geopolitical tensions increase on a number of fronts

On the one hand, stronger knowledge might echo that the nation is headed for better prosperity, because the Chinese language media acknowledged final week, triggering a loopy rally in inventory markets. Then again, political circumstances inside and out of doors the financial system stay cloudy and will weigh on risk-sensitive markets for a while. What the world wouldn’t prefer to face throughout the present virus state of affairs is the resurfacing of geopolitical tensions. However the US and China have solely managed to toughen their tone to date and change threats, signalling that issues could worsen earlier than getting higher. Notably, conflicts have worryingly expanded on a number of fronts, from commerce to questions relating to who’s guilty for the Covid-19 unfold to Hong Kong’s safety regulation and, most not too long ago, to territorial disputes over the South China sea. And the bullying wind towards China retains blowing because the UK determined earlier this week to ban telecom firms who purchase new Huawei 5G gear after the top of this yr and requested these firms to take away the agency’s Chinese language 5G equipment from their networks by 2027. Australia can also be amongst nations to oppose Hong Kong’s safety regulation, whereas China-India relations is one other open query after a violent conflict within the disputed border in the Himalayas.

Aussie might welcome constructive knowledge, however some warning must be warranted

Markets might welcome encouraging knowledge releases, particularly if the outcomes beat expectations. Recall that China’s export and import figures arrived stronger-than-expected on Tuesday, therefore upside surprises can’t be dominated out. Even so, geopolitical disputes in the midst of a pandemic with an unsure trajectory might solely lead to extra uncertainty, though the impression on markets has been muted to date. Therefore, property that are delicate to Chinese language information, such because the Australian greenback, could cheer on upbeat readings, although positive factors will not be sustainable.

Towards the US greenback, the aussie has been buying and selling sideways for the reason that starting of June, unable to choose up steam above 0.7000. Ought to GDP figures ship the worth above that ceiling, the bulls might pause across the 0.7080 barrier earlier than assembly the 0.7200 mark.

To the draw back, the 20-day easy transferring common (SMA) might assist the worth if the readings disappoint. If not, the promoting stress might prolong in direction of 0.6790, a break of which might see the retest of the 0.6670 degree.

AUDUSD