China set to publish report Q1 GDP progress, however bounce could also be short-lived – Foreign exchange Information Preview

China set to publish report Q1 GDP progress, however bounce could also be short-lived – Foreign exchange Information Preview

Posted on April 15, 2021 at 1:59 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

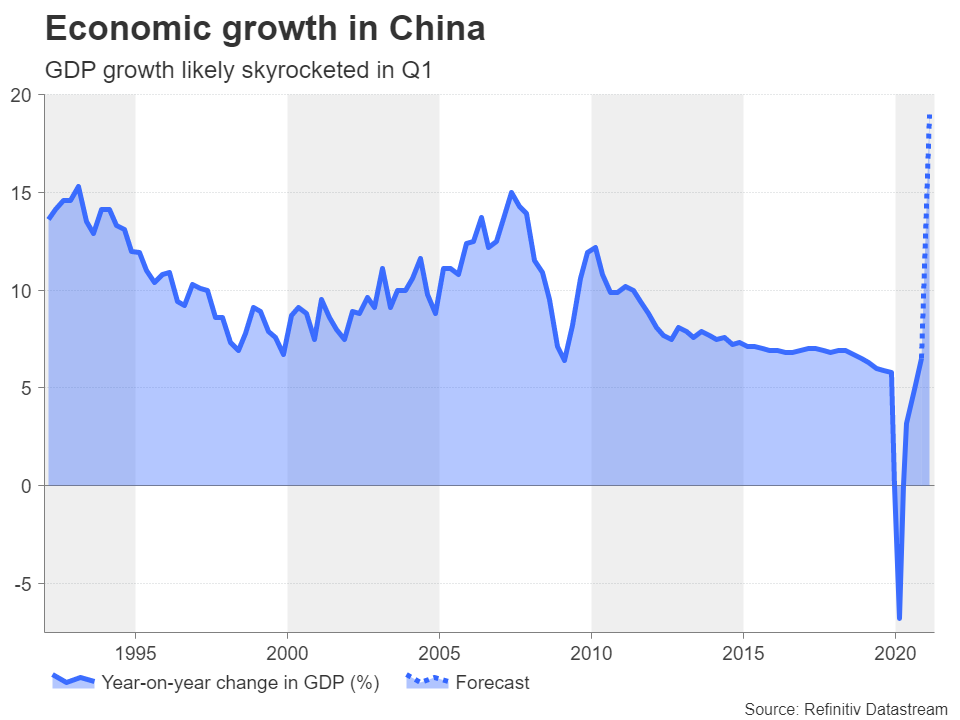

China was the one main economic system in 2020 that managed to develop for the total yr, proving that it’s attainable to go away the pandemic wreckage behind. The tempo of the restoration is anticipated to have accelerated within the first quarter of 2021 and the nation is on monitor for double-digit annual progress when it reviews its GDP estimates on Friday (3:00 GMT). Nevertheless, this progress surge is extra probably right down to the low base impact from Q1 2020 when China turned the primary nation to be pressured into lockdown to include the unfold of the coronavirus. Therefore, buyers would possibly overlook phenomenal numbers and as an alternative break down the GDP knowledge to scrutinize the underlying energy of the economic system.

First in, first out

China’s spectacular restoration has change into synonymous with the phrase ‘first in, first out’ as authorities’ powerful and swift response to the preliminary outbreak of Covid-19, whereas devastating the economic system within the first quarter, has ensured that a lot of the nation has been capable of keep away from extra lockdowns. And because the second quarter, progress has outpaced all different industrialized nations. Booming exports have been the primary driver of this enviable rebound.

Exports have now greater than recovered from the Q1 droop and soared to an all-time excessive in December. Apart from the truth that the manufacturing sector globally has not needed to adhere as strictly to lockdown guidelines as different sectors and there was some return to normalcy within the second half of 2020, Chinese language producers have loved notably sturdy demand for high-tech merchandise, whereas the pandemic has boosted gross sales of medical gear.

An export-led restoration

The exceptional turnaround in industrial exercise from the depths of the virus crash probably lifted GDP progress to a report excessive within the first three months of 2021. Gross home product is forecast to have expanded by 19.0% in Q1 in comparison with the identical interval a yr in the past. Nevertheless, on a quarterly foundation, GDP progress is projected at 1.5%, which is nearer to pre-pandemic ranges and per annualized progress of 6%.

That determine additionally occurs to be corresponding to the federal government’s modestly bold progress goal of above 6%. However extra importantly, it suggests the Q1 progress explosion is nothing greater than a statistical blip and progress is sort of sure to reasonable in the remainder of the yr.

Nevertheless, that’s not the true concern as 6% progress would most likely be adequate to maintain threat urge for food within the wider monetary markets. The primary fear is that when digging beneath the floor, issues aren’t as rosy as they appear because the restoration has to this point been uneven. Primarily, the growth in exports has not been matched by the same rise in consumption.

Rebound in consumption is lagging

Though home consumption has been recovering steadily, it stays subdued, with households nonetheless cautious amid the continued pandemic. The opposing developments in shopper and producer costs underlines the uneven efficiency. China’s annual CPI price has solely simply stabilized and stood at 0.4% in March, however producer costs jumped by 4.4% to a close to three-year excessive. The federal government had been struggling to lift private consumption as a share of GDP even earlier than the pandemic and the problem has change into even better now.

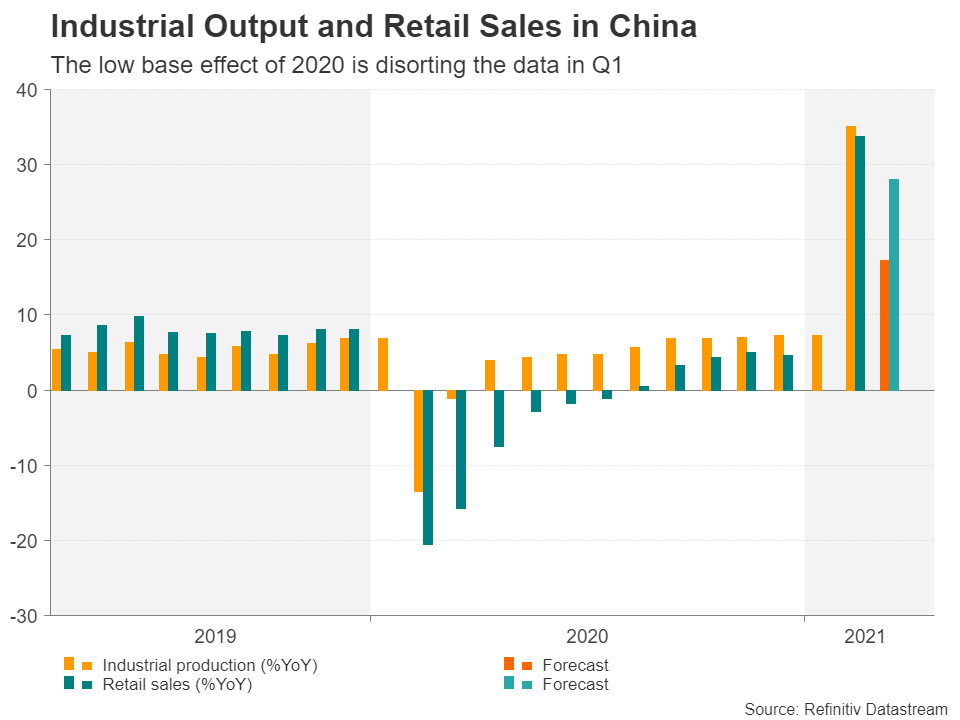

Retail gross sales had been up simply 4.6% y/y in December earlier than the distortion of the Lunar New 12 months and final yr’s low base impact pushed them as much as 33.8% in January/February. The forecast for March is 28.0%. Industrial manufacturing additionally acquired a transitory increase, surging to 35.1% y/y. It’s anticipated to have eased to 17.2% in March.

Aussie appears to be like to the China knowledge to beat key resistance

Any shock uptick within the March readings can be seen as a optimistic signal that the restoration tempo just isn’t slowing. However the April numbers can be extra telling concerning the broader development, thus, market response to the GDP and March figures may be muted.

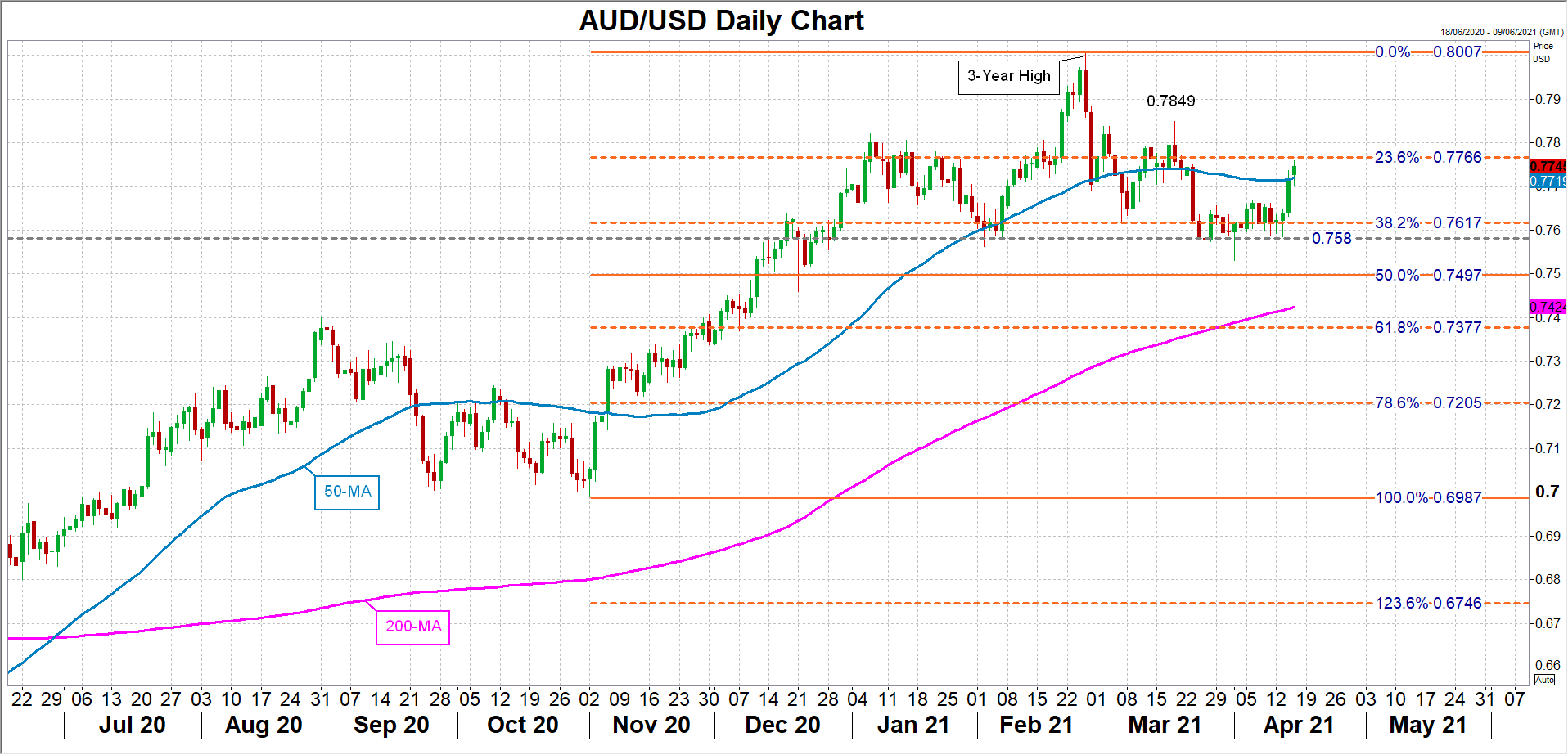

The Australian greenback is more likely to see the largest response to the information as Australia’s personal restoration depends on wholesome Chinese language demand for commodities. The aussie is at the moment testing the 23.6% Fibonacci retracement of the November-February upleg at $0.7766. Upbeat Chinese language indicators may propel the forex above this main resistance degree and in the direction of the March prime of $0.7849.

To the draw back, disappointing progress figures may push the aussie again under its 50-day transferring common and in the direction of the regularly visited help zone round $0.7580. A steeper decline would convey the 50% Fibonacci of $0.7497 into vary.

AUDUSD