Photographer: Xaume Olleros/Bloomberg

Photographer: Xaume Olleros/Bloomberg

The Chinese language renminbi’s accelerating transformation from a sleepy backwater of the foreign-exchange market right into a foreign money match to rival international friends has merchants setting apart issues about how a lot additional it could possibly go with out reform and shopping for into its ascent.

In London — the world’s heart of international change — there’s extra yuan altering palms than ever earlier than. Choices on the Chinese language foreign money exceed these referencing the Japanese yen, and shopping for or promoting the yuan is now as low-cost as buying and selling the British pound. In opposition to this backdrop, there are indicators the renminbi is enjoying an more and more bigger function in influencing broad greenback strikes, in accordance with Wells Fargo & Co.

There have been many false dawns in China’s quest for the yuan to problem different main currencies. However underpinning the explosion this time lies a torrent of capital flowing into China’s markets, fueled by a frantic seek for returns with over $14 trillion of debt globally paying lower than 0%.

That urge for food for a number of the highest-yielding authorities bonds within the Group-of-20 nations has elevated curiosity in China to fever pitch and is producing demand for liquidity from traders seeking to finance and hedge their investments. It’s additionally spurring volatility and attracting speculators who missed the marketplace for years.

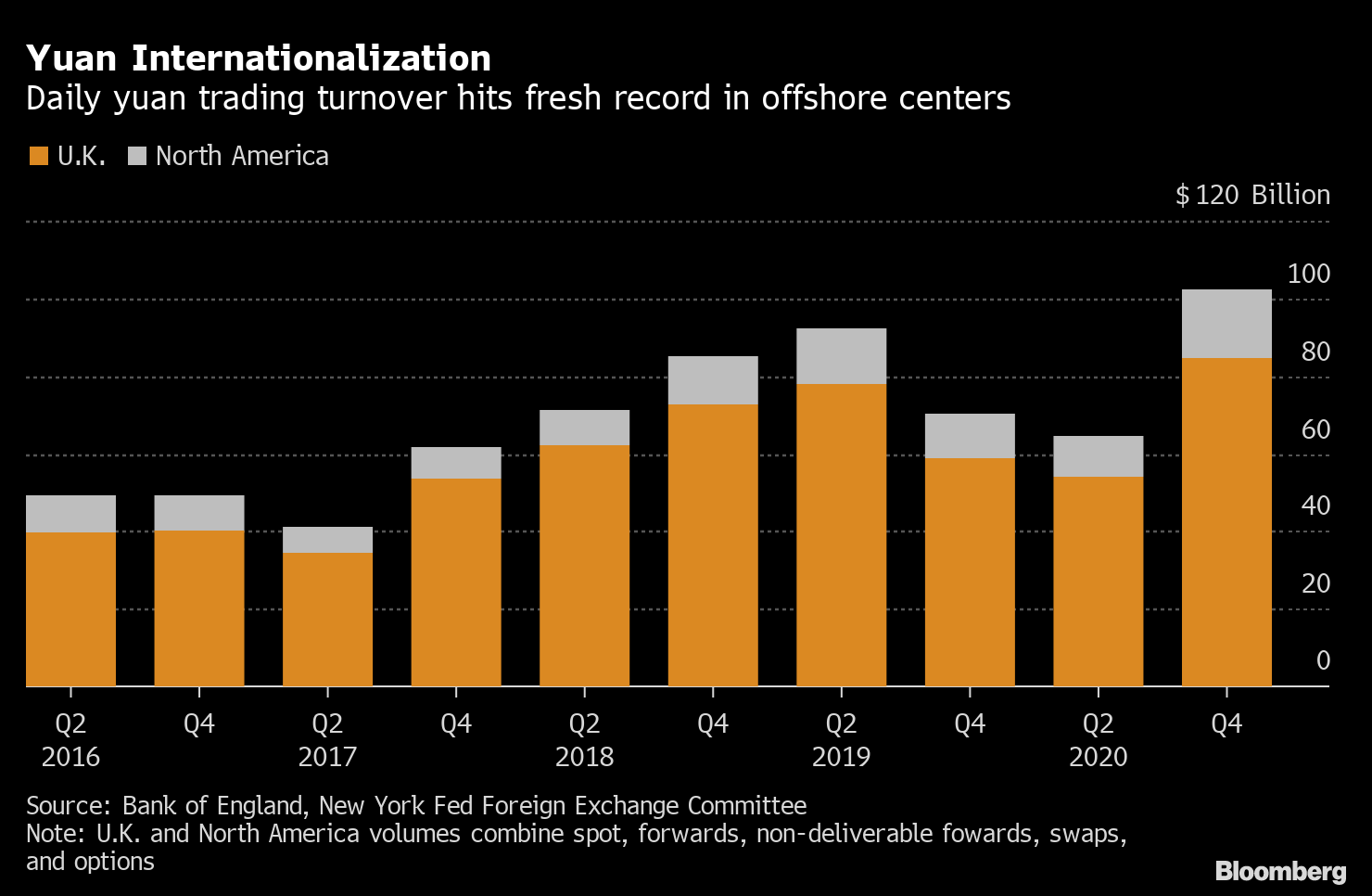

Yuan Internationalization

Each day yuan buying and selling turnover hits recent report in offshore facilities

Supply: Financial institution of England, New York Fed Overseas Trade Committee

“It’s actually a prime foreign money when it comes to the circulation that we’re seeing,” mentioned Kevin Kimmel, New York-based international head of digital FX at Citadel Securities, one of many world’s largest market makers. “Buying and selling exercise within the yuan has elevated considerably.”

Learn Extra: China Eases Foreign money Controls in Transfer Towards Liberal Yuan

The shift comes as China continues to relinquish management — albeit slowly — of its tightly-managed foreign money, a linchpin of Beijing’s long-term plan to encourage its better international use. The so-called internationalization of the yuan is an element and parcel of the federal government’s purpose to wean itself off a reliance on the U.S. greenback, and what some see as a geopolitical problem to the dollar’s supremacy.

For now, worldwide traders are inspired to make use of the offshore model of the foreign money, identified by its CNH designation in markets.

Whereas the offshore yuan is theoretically freely tradeable — which means its value can fluctuate together with demand, financial information and geopolitical developments — it often sticks pretty near the onshore unit, abbreviated as CNY. And since that’s permitted to stray simply 2% above and beneath a each day fee set by the central financial institution, China holds sway over the foreign money far past its borders — a quirk which will in the end sluggish adoption.

Development Spurt

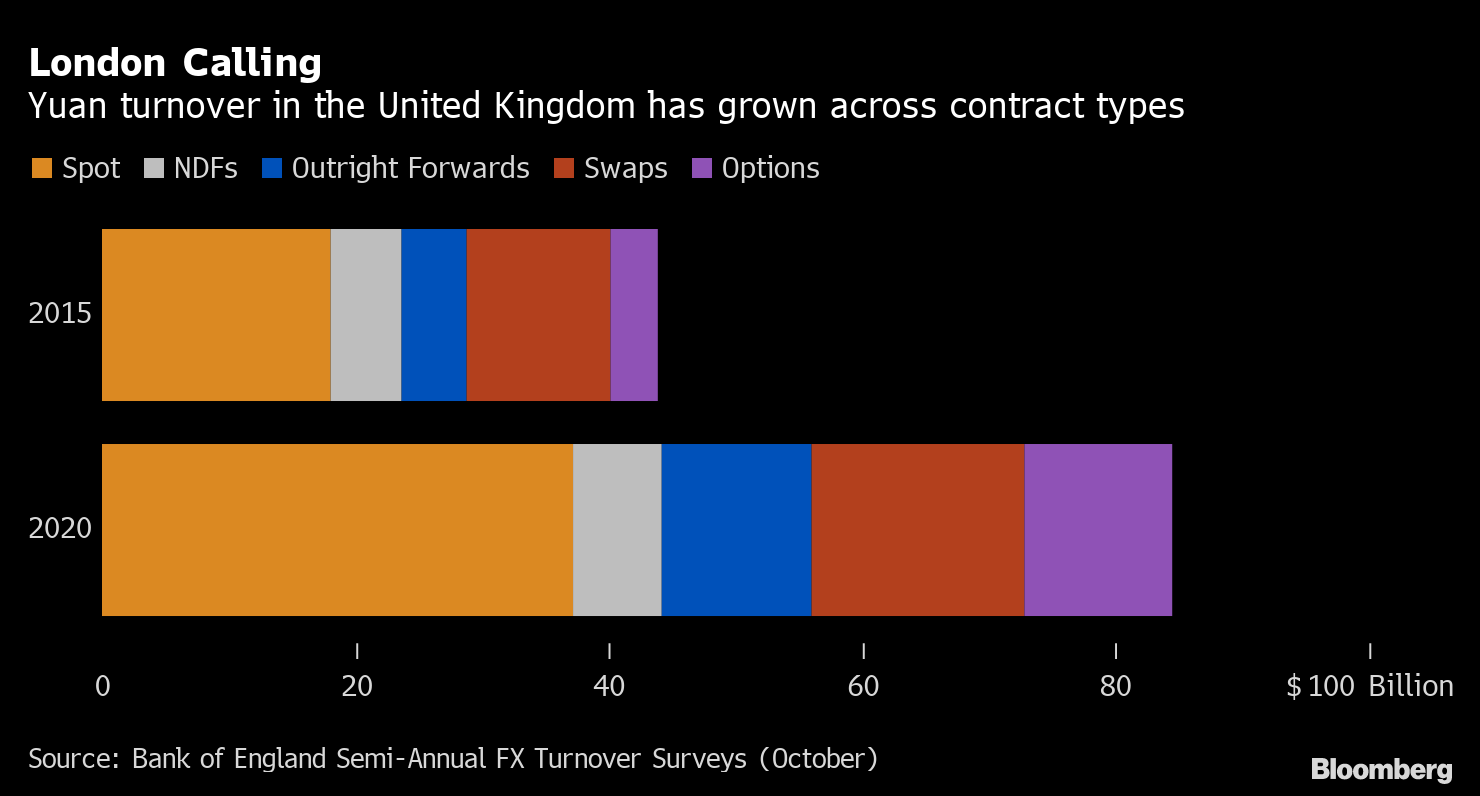

Nonetheless, regardless of the boundaries, common yuan turnover in London jumped to a report $84.5 billion per day in October, in accordance with a central-bank survey of the world’s largest FX buying and selling hub. In North America, each day volumes greater than doubled in comparison with the identical reporting interval final yr, to $7.eight billion per day. Trade big CME Group Inc.’s EBS says spot volumes on its platforms in London and New York are up 90% and 131%, respectively, from 2015 to 2020.

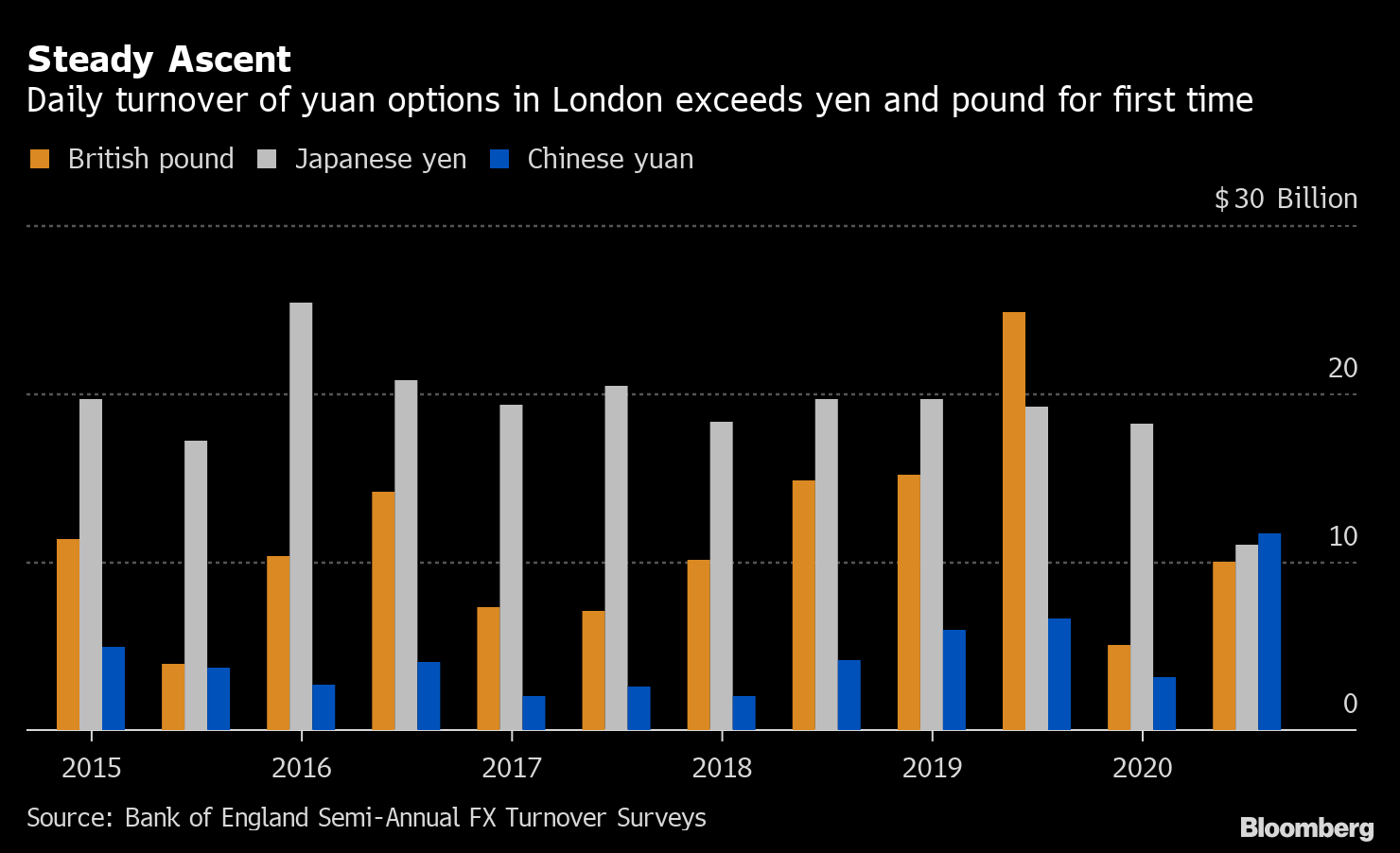

Together with this progress within the spot market, there may be additionally buoyant demand from traders for devices to hedge and commerce their foreign money threat. Each day possibility volumes on the yuan in London rose to a report $11.7 billion in October, whereas a mean of virtually $12 billion of ahead contracts modified palms every day, probably the most since 2019, in accordance with Financial institution of England information.

Learn Extra: Yuan Buying and selling Is Lastly Beginning to Win Traction in Europe

“It’s been the intention to permit the foreign money to drift extra freely out there,” mentioned James Hassett, Singapore-based co-head of world rising markets and G-10 linear FX at Barclays Plc. “That’s giving individuals extra confidence to commerce it.”

Regular Ascent

Each day turnover of yuan choices in London exceeds yen and pound for first time

Supply: Financial institution of England Semi-Annual FX Turnover Surveys

On the coronary heart of this metamorphosis are international funds, which have steadily poured money into China over the previous yr, including to their bond holdings on the quickest tempo on report in January. Many are chasing larger returns — China’s 10-year bonds yield 3.3%, in contrast with round 1.3% for equal U.S. Treasuries and fewer than 0% for German bunds. Others are including to their holdings to construct publicity to the nation’s property, which have been solely just lately included into a number of the world’s largest benchmark indexes.

Learn Extra: China’s Bond Market Opening Set to Reshape the World of Finance

Amid this shifting panorama, market gauges present the offshore yuan’s projected value swings over a one-month horizon are actually as large as for the euro and the yen. Whereas that’s partly a operate of fluctuations for these main currencies dropping within the face of unprecedented central-bank motion, yuan volatility is drawing in hedge funds and different fast-money traders seeking to make a revenue.

The additional liquidity has helped drive down the price of transacting within the yuan to about $20 for each million {dollars} traded, in accordance with Citadel Securities’ Kimmel. That’s much like the pound and compares to about $10 for the euro-U.S. greenback cross, the world’s most liquid pair. It’s properly beneath the unfold on emerging-market currencies, which “usually exceed” $100 per million, he mentioned.

London Calling

Yuan turnover in the UK has grown throughout contract sorts

Supply: Financial institution of England Semi-Annual FX Turnover Surveys (October)

The query is whether or not all this curiosity within the yuan can final, notably if yields climb in developed markets just like the U.S., in the end diminishing the relative enchantment of China. A few of the world’s largest banks are betting demand will stay, with the likes of Deutsche Financial institution AG and Citigroup International Markets Inc. boosting their China-dedicated personnel in hubs together with London, New York and Singapore.

The strikes echo HSBC Holdings Plc’s name final yr for the yuan to be included within the prime tier of international change. The traditional Group-of-10 FX label — which incorporates smaller Scandinavian currencies along with behemoths just like the greenback, euro and yen — is “outdated and misguided,” strategist Paul Mackel mentioned.

Regardless of its still-small share of world buying and selling — 4.3% as of 2019, in accordance with the most recent information from the Financial institution for Worldwide Settlements — the yuan instructions an outsized function within the foreign-exchange market as a result of its each day strikes function a key indicator of world investor sentiment. Wells Fargo strategists together with Erik Nelson argue that the Chinese language foreign money might even be exerting affect on the broad greenback index.

‘Paradigm Shift’

The offshore yuan could also be “pulling extra weight within the battle for international foreign money supremacy,” the strategists wrote in a word to purchasers this month. “If we proceed to see indicators that USD/CNH is having extra affect on broad greenback strikes, this could possibly be a major paradigm shift in FX markets,” they wrote.

Coming to America

Buying and selling in dollar-yuan has elevated in U.S. hours

Supply: New York Fed, Overseas Trade Committee Overseas Trade Quantity Survey

But Beijing’s ambitions to make the yuan a really international foreign money nonetheless face some very actual challenges.

The foreign money’s share in central financial institution reserves is nearly 2%, in comparison with virtually 21% for the widespread foreign money and simply over 60% for the U.S. greenback. That’s a woefully low proportion given the scale of its China’s financial output. At lower than 3%, the renminbi’s share in international funds is only a fraction of its larger rivals, regardless of elevated use.

Learn Extra: Yuan’s Reputation for International Funds Hits 5-12 months Excessive

However it’s the age-old challenge of restrictions on the motion of capital throughout Chinese language borders that is still one of many largest headwinds the foreign money faces, in accordance with Bipan Rai, head of foreign-exchange technique at Canadian Imperial Financial institution of Commerce in Toronto.

“China has made loads progress on this entrance, however it’s nonetheless not fairly on the degree of free capital circulation that you just are inclined to see in different developed markets,” Rai mentioned. “That is likely to be some methods away.”