Oil (Brent Crude, WTI) AnalysisEIA crude oil inventories dropped more than expected last weekWTI pullback extends – Deteriorating Chinese data, stron

Oil (Brent Crude, WTI) Analysis

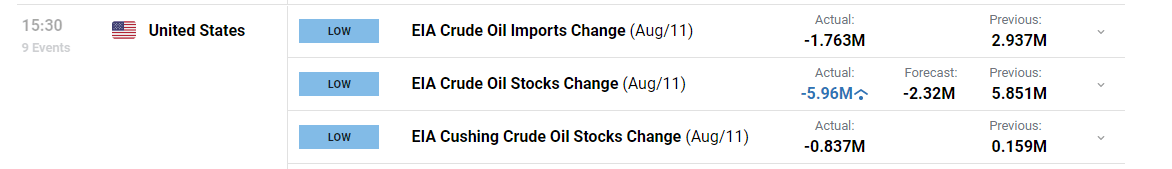

- EIA crude oil inventories dropped more than expected last week

- WTI pullback extends – Deteriorating Chinese data, strong USD worsens oil outlook

- Brent crude oil drops – $82 mark and 200 SMA remain key levels to the downside

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

EIA Crude Oil Inventories Dropped More than Expected Last Week

US crude stocks declined by nearly 6 million in the week ended August the 11th having little effect on the price of WTI this week where the pullback continues. The current pullback is the deepest since the bullish advance began at the end of June.

Customize and filter live economic data via our DailyFX economic calendar

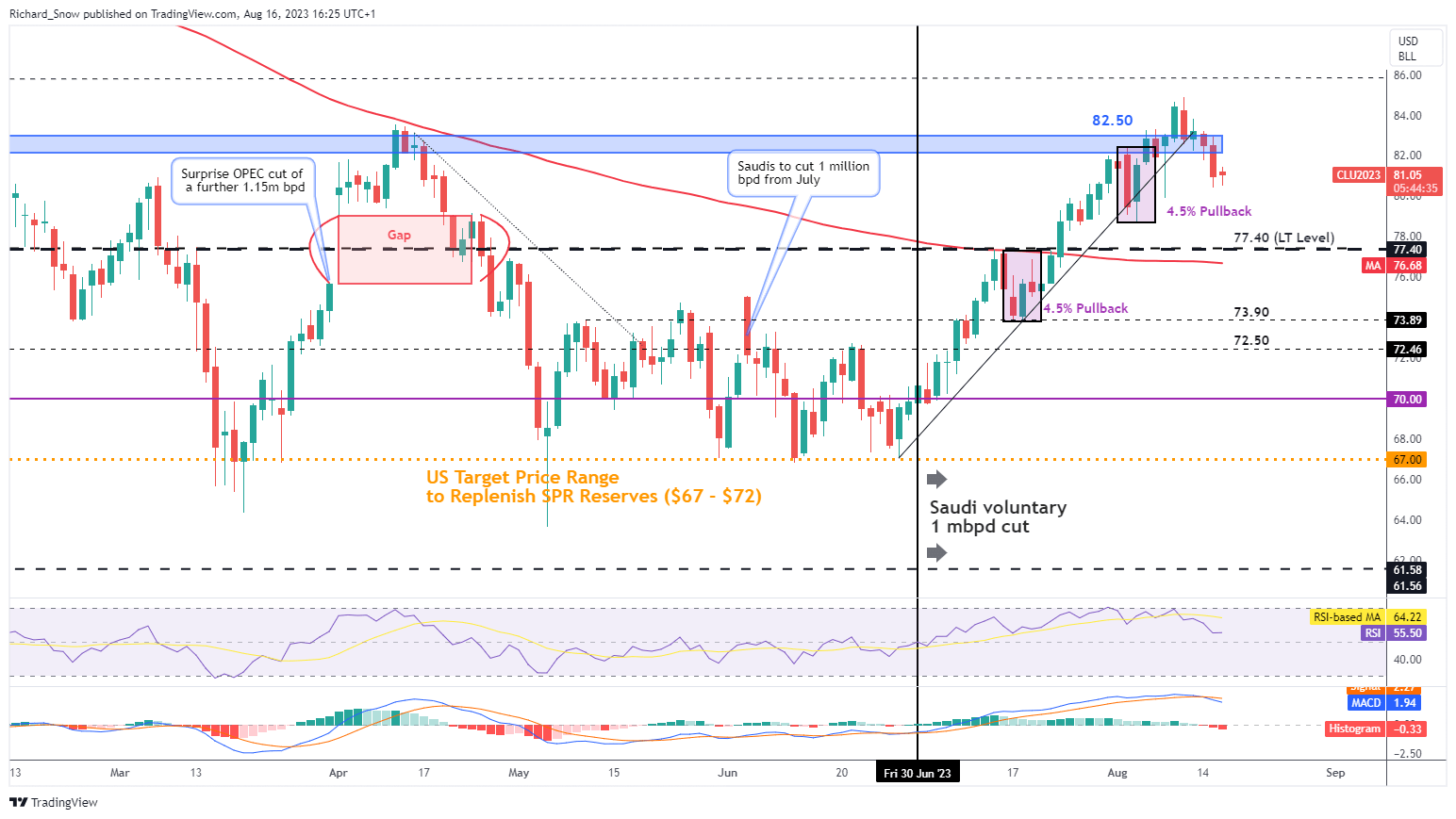

WTI Pullback Extends – Chinese Data Deteriorates and Worsens Oil Outlook

The current oil pullback is the deepest experienced throughout the current bullish advance, spanning more than 5%. The two prior pullbacks both measured around 4.5% before resuming the bullish trend but the current move appears more stubborn.

The next level of support appears at the spike low at $80 before the long-term level of $77.40 comes into view with the 200 simple moving average not far behind. This week and last week, Chinese data has deteriorated further, adding more uncertainty to the global growth slowdown and appetite for oil into the end of the year. In addition, the US dollar maintains its bullish trend as US yields grind higher.

However, oil supply remains tight as Saudi Arabia and Russia extend supply cuts over and above previously agreed OPEC cuts despite the US making great strides, increasing production. In the event the bullish trend resumes, $82.50 becomes relevant once again, followed by $84.90 – the August and yearly high.

WTI Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade Oil

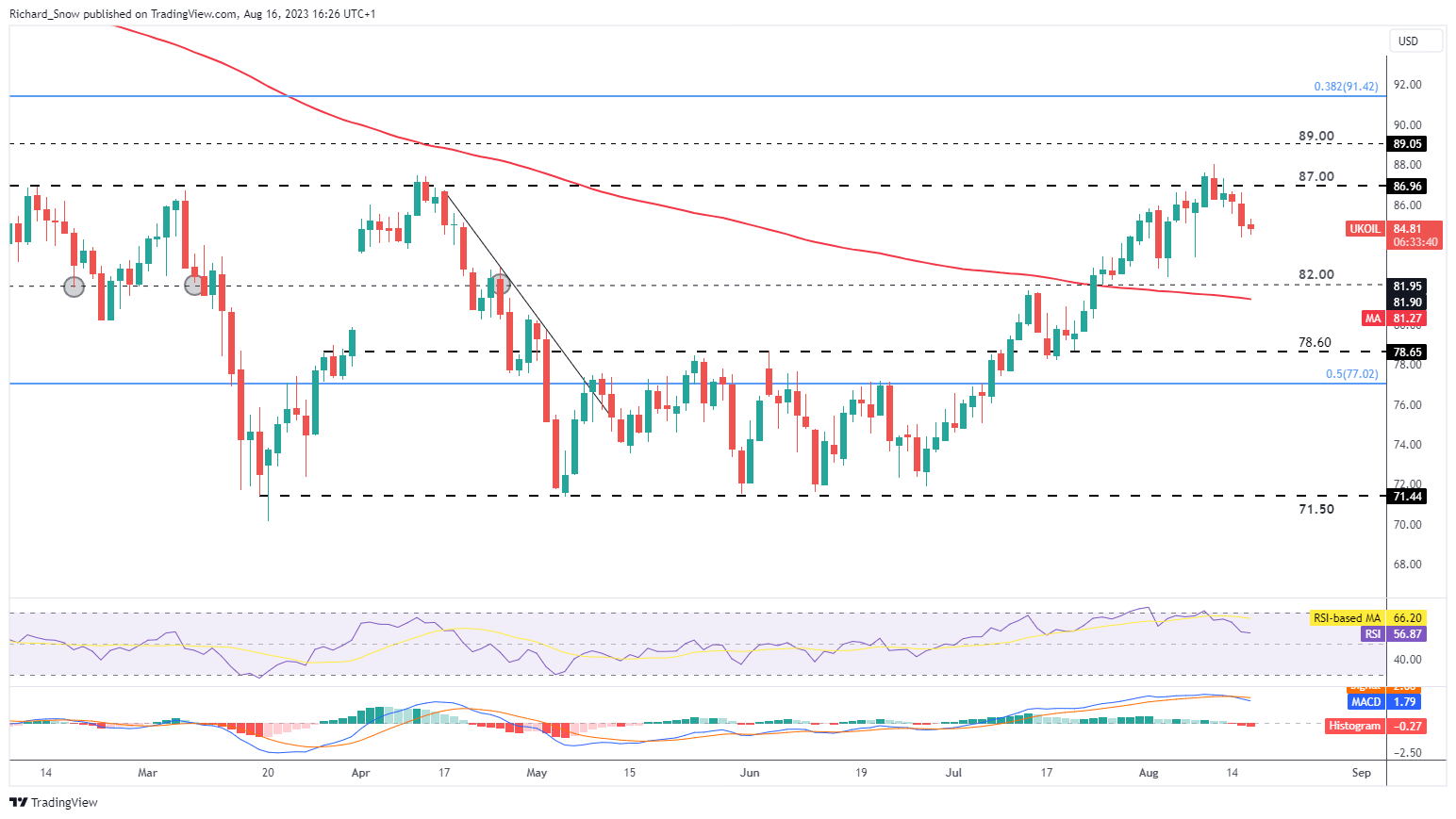

Brent crude oil heads lower after failing to break above $87 with any momentum. The $87 mark has been a pivot point multiple times earlier this year. Prices continue to selloff, heading towards $82 – which remains the next significant level of support, also providing a pivot point for oil markets at the start of the year.

A bullish continuation remains constructive while prices trade above the 200 SMA, with a retest of $87 not out of the question and even a test of $89.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

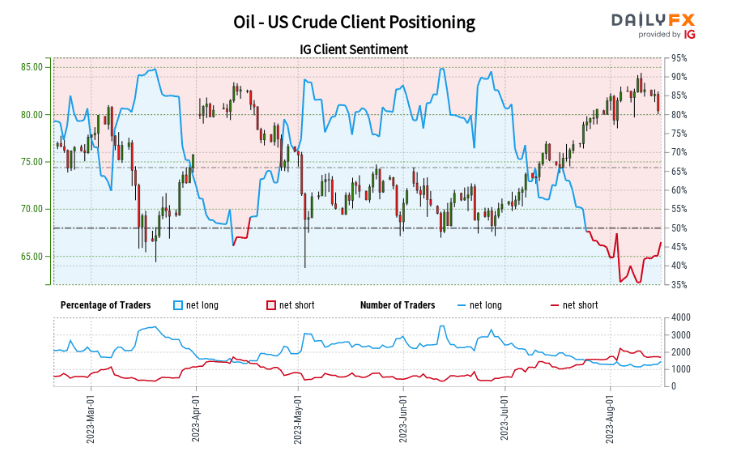

Oil- US Crude:Retail trader data shows 45.25% of traders are net-long with the ratio of traders short to long at 1.21 to 1.

Source: IG client sentiment, prepared by Richard Snow

Find out more about IG client sentiment, how to read it and why it is considered a contrarian indicator by reading the guide below:

| Change in | Longs | Shorts | OI |

| Daily | -2% | 1% | 0% |

| Weekly | 18% | -13% | -1% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS