AUD/USD ANALYSIS & TALKING POINTSChinese inflation miss weighing on AUD.Fed speakers in focus.Ascending triangle remains in play but AUD weakness

AUD/USD ANALYSIS & TALKING POINTS

- Chinese inflation miss weighing on AUD.

- Fed speakers in focus.

- Ascending triangle remains in play but AUD weakness.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

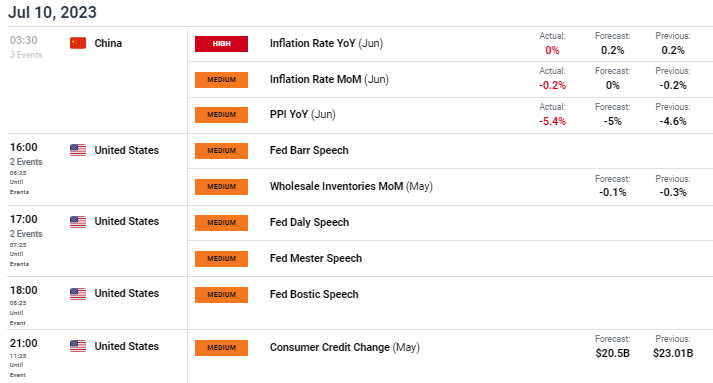

The Australian dollar opens the week on the backfoot beginning with Chinese CPI and PPI data (see economic calendar below) that missed forecasts underlying the lack of demand within the Chinese economy. Being a major exporter to China, the Aussie dollar is largely positively correlated to the Chinese environment and with the slump in growth, commodity demand is likely to decline leaving the AUD vulnerable to the downside.

In addition, the US dollar has regained some of its losses post-NFP on Friday and although NFP’s missed, the overall report maintained tight labor market conditions leaving the probability for a 25bps rate hike largely unchanged. The focal point this week will come via the US CPI release, expected to fall further on both headline and core metrics leaving the USD exposed to further weakness. The rest of today’s trading day includes several Fed speakers who should give some reaction to last week’s economic data.

Recommended by Warren Venketas

Get Your Free USD Forecast

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

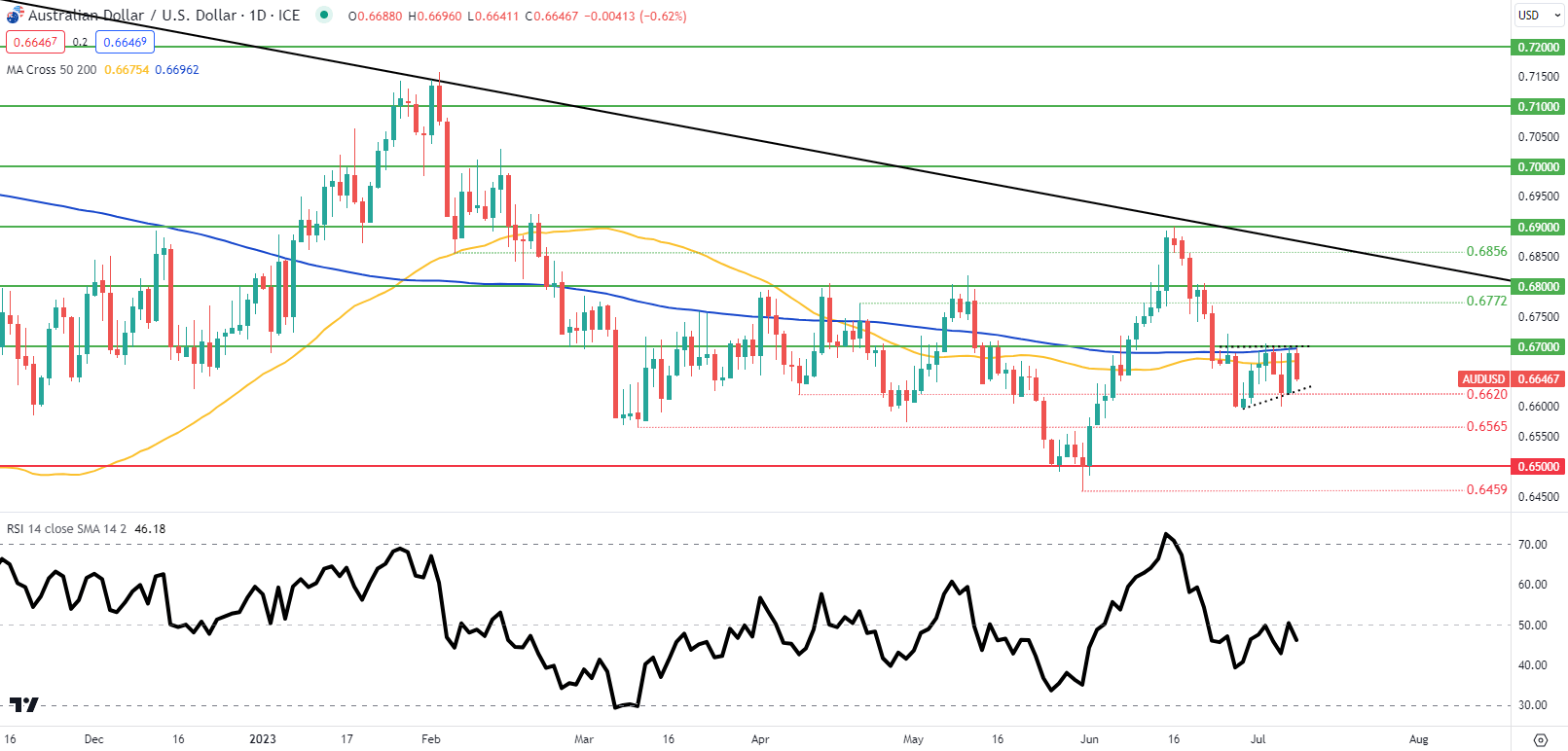

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action remains within the developing ascending triangle formation (dashed black line) but has since dipped below both the 50-day and 200-day moving averages respectively favoring short-term bearish momentum.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Key resistance levels:

- 0.6800

- 0.6772

- 0.6700/Triangle resistance

- 200-day MA (blue)

- 50- day MA (yellow)

Key support levels:

- Triangle support

- 0.6620

- 0.6565

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently net LONG on AUD/USD, with 67% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com