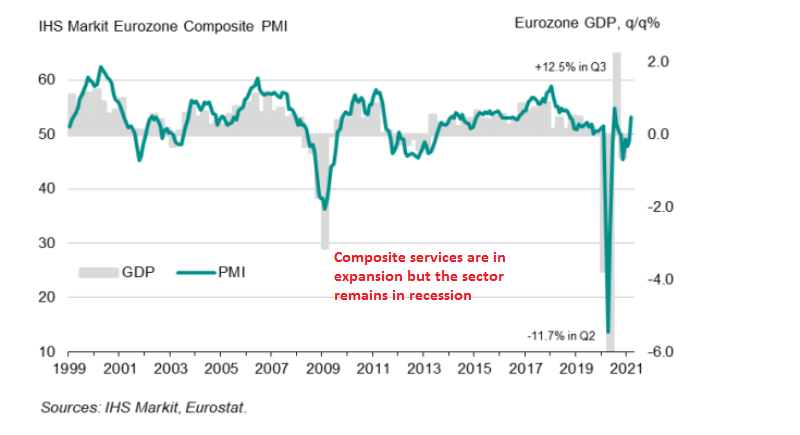

The service sectors has been probably the most affected by the coronavirus and the restrictions that adopted. This sector fell in recession worldwi

The service sectors has been probably the most affected by the coronavirus and the restrictions that adopted. This sector fell in recession worldwide in spring final 12 months and was gradual to come back again to life, in contrast to manufacturing which bounced proper again and has been surging in latest months. Within the US, companies are surging as effectively, with restrictions being a lot lighter, whereas in Europe companies fell again in recession in autumn as restrictions stay powerful and the European leaders are pushing for extra lock-downs.

Eurozone March Ultimate Companies

- March remaining companies PMI 49.6 vs 48.eight prelim

- Composite PMI 53.2 vs 52.5 prelim

Some modest upside revisions to the ultimate readings as additionally seen within the earlier French and German stories. The composite studying is the best since final July as financial exercise stabilised in the direction of the top of Q1.

The manufacturing sector continues to take the lead with companies exercise seen bettering barely amid tighter restrictions. That will but stay the case in Q2 because the virus scenario continues to pose a menace in the meanwhile. Markit notes that:

“Eurozone enterprise exercise bounced again in March, returning to progress after 4 months of decline with a fair stronger growth than signaled by the forecast-beating ‘flash’ information.

“Manufacturing is booming, led by surging manufacturing in Germany, and the hard-hit service sector has come near stabilizing as optimism concerning the outlook improved additional through the month. Companies’ expectations of progress are working on the highest for simply over three years amid rising hopes that the vaccine roll-out will enhance gross sales within the coming months.“Strengthening demand has already led to the most important rise in backlogs of uncompleted work seen for nearly three years, encouraging growing numbers of corporations to tackle extra workers. Enhancing labour markets developments ought to assist additional elevate shopper confidence and spending as we head into the second quarter.

“The survey subsequently signifies that the economic system has weathered latest lockdowns much better than many had anticipated, because of resurgent manufacturing progress and indicators that social distancing and mobility restrictions are having far much less of an affect on service sector companies than seen this time final 12 months. This resilience suggests not solely that firms and their prospects are looking forward to higher instances, however have additionally more and more tailored to life with the virus.”

UK March Ultimate Companies PMI

- March remaining companies PMI 56.three vs 56.eight prelim

- Composite PMI 56.four vs 56.6 prelim

Minor downward revisions as the ultimate readings simply reaffirm a modest rebound in general exercise in March as output and incoming new work noticed sturdy will increase final month.

Enterprise expectations for the 12 months forward was the strongest since December 2006 in anticipation of the continued success within the vaccine rollout. Markit notes that:

“UK service suppliers have been again in growth mode in March as confidence within the roadmap for relieving lockdown restrictions supplied a robust uplift to new orders. Whole enterprise exercise elevated on the quickest fee since August 2020 and this return to progress ended a four-month sequence of decline.

“Ahead bookings for shopper companies and rising optimism about restoration prospects resulted in further workers hiring throughout the service economic system for the primary time because the begin of the pandemic. Enterprise optimism improved for the fifth month working in March and was the best since December 2006.

“Round two-thirds of the survey panel forecast a rise in output through the 12 months forward, which mirrored indicators of pent up demand and a lift to progress projections from the profitable UK vaccine rollout. Of the small minority citing downbeat expectations in March, this was usually linked to uncertainty about worldwide journey restrictions.

“There have been additional indicators that sturdy value pressures have spilled over from producers to the service economic system, particularly for imported gadgets. Larger costs paid for uncooked supplies, alongside rising transport prices and utility payments, meant that working bills throughout the service sector elevated on the strongest fee since June 2018.”