EUR/GBP PRICE FORECAST:For Beginner Traders, Please Download Your Free Forex Guide Below Recommended by Zain Vawda Forex for

EUR/GBP PRICE FORECAST:

For Beginner Traders, Please Download Your Free Forex Guide Below

Recommended by Zain Vawda

Forex for Beginners

READ MORE: USD/CAD Retreats Following Lackluster US PMI, Mixed CAD Retail Sales Data

EUR/GBP came in for volatile price action yesterday thanks to both the Euro Area and UK PMI data releases. The pair traded below the psychological 0.8500 level briefly before doing a 360 to finish the day 0.24% up, around the 0.8540 handle.

PMI DATA AND CENTRAL BANKS

PMI data out of the Euro Area and the UK painted a grim picture yesterday as the economy begins to slow down with signs that inflation may remain stubborn. The data clearly adds to what was already a tough task for both the European Central Bank (ECB) and Bank of England (BoE) with market participants already adjusting their rate hike expectations for a lower peak rate. The data certainly leaves room for a pause from the ECB but a concern around rising services and cost pressures does leave the door open for the Central Bank to potentially squeeze in another hike before pausing.

On the other end we have the Bank of England (BoE) who in my opinion will definitely need at least one more rate hike and remain in a better position than the ECB to deliver. This despite a adjustment to the potential peak rate by the Bank of England being cut by 15bps following the PMI release yesterday. Over the medium to longer term and should the rate differential come into play I still believe one more leg to the downside and below the 0.8500 mark may materialize.

Given the overall dynamics at play with EURGBP I do expect consolidation to return in the short-term as the pair awaits further developments at the September batch of Central Bank meetings.

Trading Requires Constant Improvement, See What Traits Successful Traders Share and Download the Guide Below

Recommended by Zain Vawda

Traits of Successful Traders

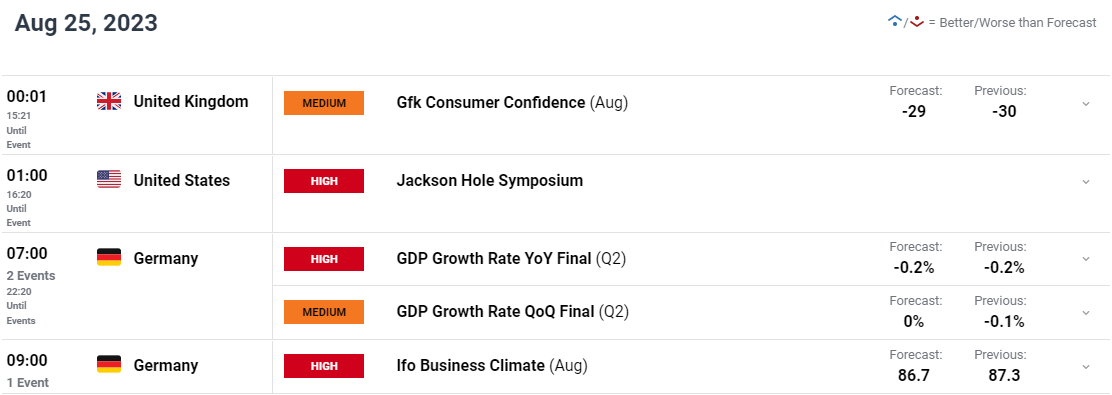

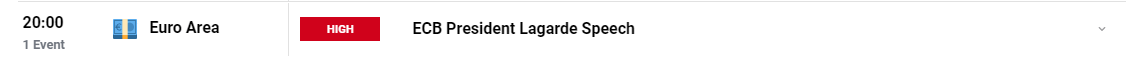

RISK EVENTS AHEAD

From a risk event perspective there isn’t a lot on the horizon for the Euro Area or the UK ahead of the weekend. There is German GDP and the IfO Business Climate data tomorrow which could give another peak at the health of Europe’s most industrialized economy.

ECB President Christine Lagarde has been quiet of late, but we will finally get to hear comments from her at Jackson Hole tomorrow with Deputy Governor Broadbent of the Bank of England also scheduled to speak. In the absence of high-impact data comments from the Central Bankers could help drive short-term volatility and price action.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

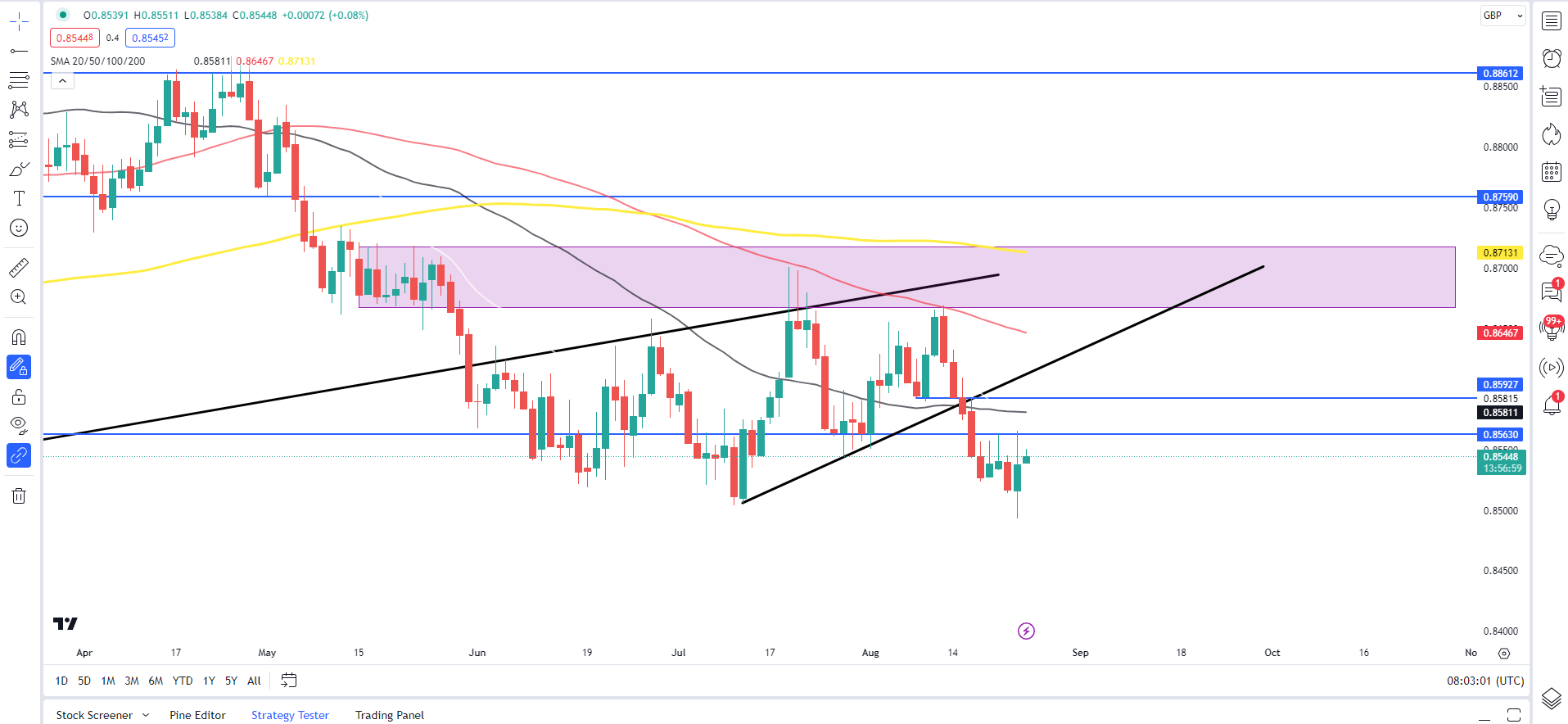

Looking at EURGBP from a technical standpoint and we have been stuck in a range since breaking below the 200-day MA at the beginning of May. Since bottoming out in Mid-July however, price action has been messy with a series of higher lows followed by lower highs sending mixed signals. The constant changes in rate hike probabilities have had a part to play but the lack of conviction looks likely to continue.

Key Levels to Keep an Eye On:

Support levels:

- 0.8500 (Psychological Level)

- 0.8430

- 0.8342

Resistance levels:

- 0.8563

- 0.8590

- 0.8646 (100-day MA)

EUR/GBP Daily Chart – August 24, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are currently Net-Long on EURGBP, with 70% of traders currently holding LONG positions.

To Get the Full IG Client Sentiment Breakdown as well as Tips, Please Download the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | -9% | 19% | -2% |

| Weekly | 1% | 8% | 3% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS