This week is the primary full buying and selling week of Q3 and issues are going nicely on Wall Avenue. On the halfway level of the U.S. session,

This week is the primary full buying and selling week of Q3 and issues are going nicely on Wall Avenue. On the halfway level of the U.S. session, the DJIA DOW (+335), S&P 500 SPX (+42), and NASDAQ (+207) are all within the inexperienced. Secure-havens are additionally catching some bids, with the Swiss franc and GOLD main the best way. For now, it appears like nobody is excited about holding the USD as optimistic financial knowledge retains rolling in.

In the course of the U.S. early session, a number of stories had been launched to the general public. Listed below are the highlights:

Occasion Precise Projected Earlier

ISM Non-Manufacturing PMI (Might) 57.1 50.1 45.4

Markit PMI Composite (June) 47.9 46.8 46.8

ISM Non-Manufacturing Employment Index (Might) 43.1 30.7 31.8

The headliner of this group is the spike within the ISM Non-Manufacturing PMI. The 11.7 level month-over-month achieve is rock-solid, suggesting restoration. That is one other robust knowledge set, suggesting {that a} strong financial restoration is nicely underway. Now, the one query is whether or not or not the U.S. will lockdown for a second time as confirmed COVID-19 instances develop.

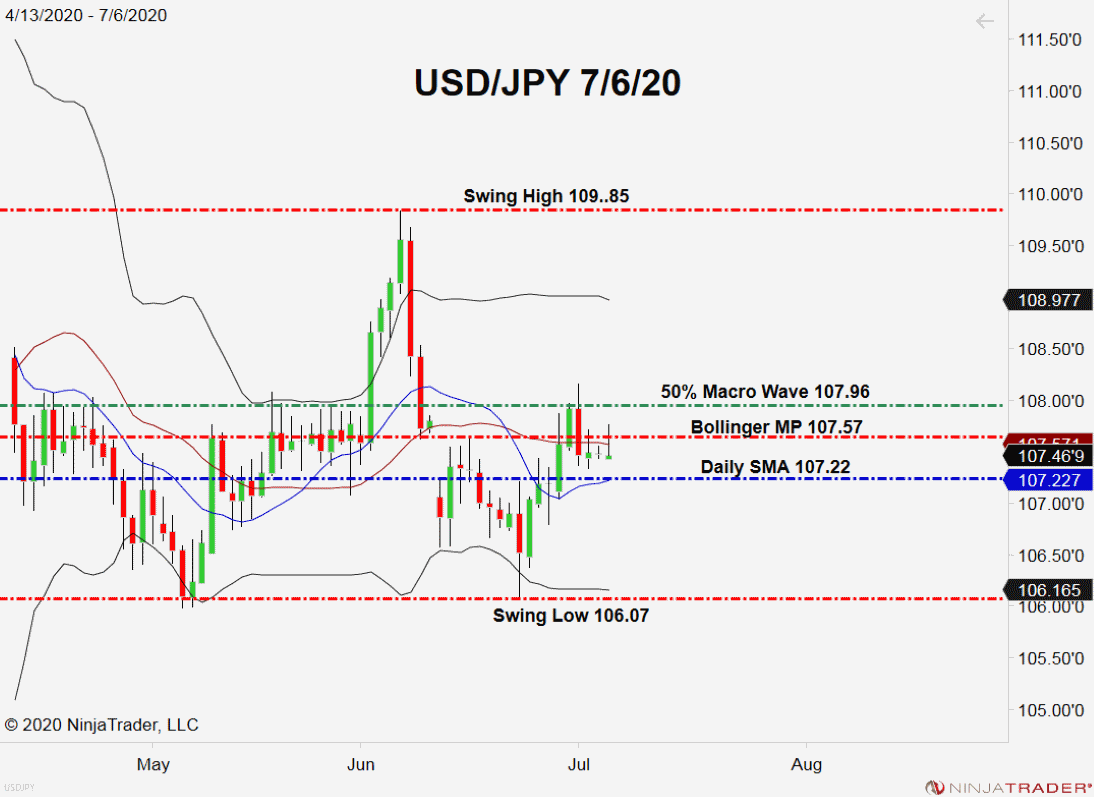

Sturdy Financial Knowledge Prompts Modest Motion In The USD/JPY

After a bullish early foreign exchange session, the USD/JPY has reversed course. Charges stay in a noncommittal space for the third consecutive buying and selling day.

+2020_07_06+(10_29_52+AM).png)

Listed below are two ranges to look at for the close to future:

- Resistance(1): Bollinger MP, 107.57

- Assist(1): Day by day SMA, 107.22

Backside Line: Tight buying and selling situations may be optimistic given the right data-dependent technique. Within the case of the USD/JPY, a scalping setup might come to move if charges fall to the Day by day SMA. Till Tuesday’s closing bell, I’ll have purchase orders within the queue from 107.26. With an preliminary cease loss at 107.09, this commerce produces 12-15 pips on a rejection of the 107.25 quarter-handle.