Copper Costs, XCU/USD, Commodities – Speaking Factors:Copper costs seem poised to climb larger amid a optimistic elementary backd

Copper Costs, XCU/USD, Commodities – Speaking Factors:

- Copper costs seem poised to climb larger amid a optimistic elementary backdrop and bullish technical setups.

- Symmetrical Triangle break might gasoline push to multi-year highs.

Copper’s 56% surge from the March low is displaying little indicators of abating, after the value of the ductile metallic soared to a contemporary two-year excessive (3.0945) at first of the month on the again of rebounding international manufacturing exercise and hovering Chinese language demand.

With value now breaking out of a number of bullish continuation patterns on a number of timeframes, copper seems poised to proceed its latest run larger as a strengthening elementary backdrop begins to assist optimistic value developments.

Really helpful by Daniel Moss

Traits of Profitable Merchants

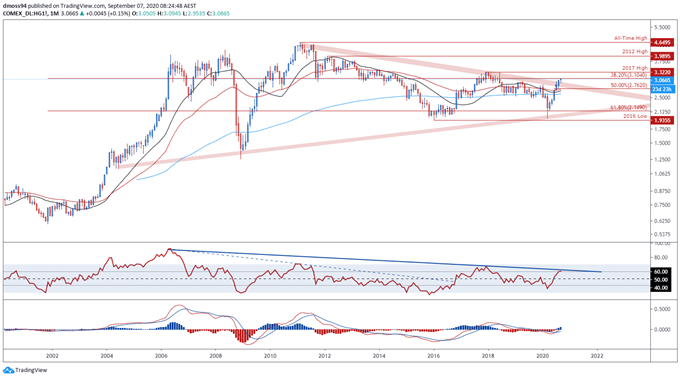

Copper Futures (HG) Month-to-month Chart – Symmetrical Triangle Break Ominous for Bears

Copper Futures (HG) month-to-month chart created utilizing TradingView

From a technical perspective, copper costs seem poised to climb larger after breaking above Symmetrical Triangle resistance.

Nevertheless, the event of RSI hints at fading bullish momentum, because the oscillator struggles to interrupt above 60 and the downtrend extending from the 2006 extremes.

Lack of ability to shut above key resistance on the 38.2% Fibonacci (3.1040) might generate a pull again in the direction of the January 2020 excessive (2.8860), with an in depth beneath in all probability invalidating the topside break of Symmetrical Triangle consolidation.

However, value continues to trace above the 21-, 50- and 200-month transferring averages, which means that the trail of least resistance stays to the topside.

Due to this fact, if assist on the psychologically pivotal 3.00 degree stays intact additional good points look greater than probably.

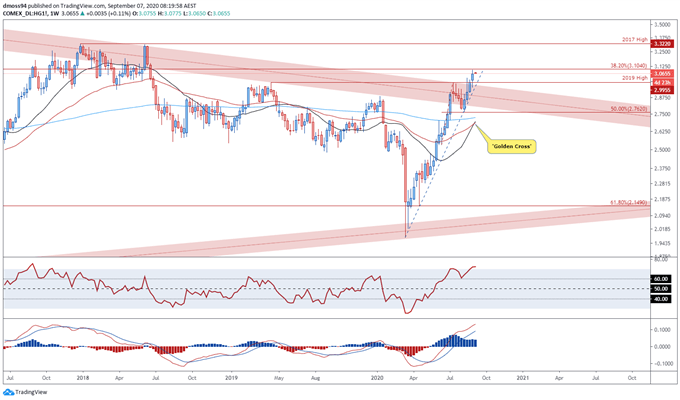

Copper Futures (HG) Weekly Chart – ‘Golden Cross’ Implies Swelling Bullish Momentum

Copper Futures (HG) weekly chart created utilizing TradingView

Zooming right into a weekly chart reinforces the bullish tilt seen on the month-to-month timeframe, because the RSI and MACD indicators soar to their highest ranges since August 2017.

A bullish ‘golden cross’ formation – the ‘quicker’ 21-WMA crossing above the ‘slower’ 50-WMA – is indicative of swelling bullish momentum which will in the end generate a sustained push above resistance on the 38.2% Fibonacci (3.1040).

A weekly shut above key Fibonacci resistance would in all probability sign a resumption of the first uptrend and will carry the 2017 excessive (3.3320) into play.

Conversely, if value breaks beneath confluent assist on the 2019 excessive (2.9955) and yearly uptrend prolonged declines could also be within the offing, with a break again beneath the psychologically imposing 3.00 degree probably inspiring a correction again to the sentiment-defining 200-WMA (2.7270).

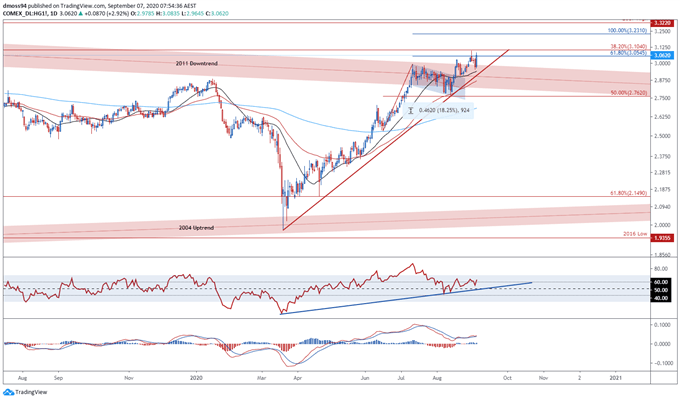

Copper Futures (HG) Each day Chart – Lengthy-Time period Pattern Break Hints at Additional Positive factors

Copper Futures (HG) every day chart created utilizing TradingView

That being mentioned, scrolling right into a decrease timeframe signifies that copper costs could proceed to trace larger after surging away from the 21-day transferring common (2.9515) on September 4.

The topside break of the Bull Flag continuation sample in mid-August means that the ductile metallic might push to its highest ranges in seven years, with the implied measured transfer indicating value might climb above the 2017 excessive (3.32) within the coming weeks.

Furthermore, the RSI and MACD indicators seem like trending larger and will encourage additional shopping for within the coming days if value clambers above the yearly excessive (3.0945).

A every day shut above the 38.2% Fibonacci (3.1040) is required to validate bullish potential and carve a path for copper to check the 100% Fibonacci (3.2310), with a every day shut above the three.25 degree opening the door to fulfil the bullish continuation sample’s implied measured transfer (3.3655).

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Really helpful by Daniel Moss

Constructing Confidence in Buying and selling