Crude Oil, LNG, WTI, China, PBOC, Fed, Kashkari, US Dollar, RBNZ - Talking PointsCrude prices are under the pump after US Dollar resumed strengthening

Crude Oil, LNG, WTI, China, PBOC, Fed, Kashkari, US Dollar, RBNZ – Talking Points

- Crude prices are under the pump after US Dollar resumed strengthening

- The Fed reminded markets of their intention and markets appear a touch spooked

- If China is unable to reignite its economy, where will that leave WTI?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Crude oil slid lower again on Wednesday as it continues to retreat from the 10-month high seen last week.

A combination of China’s growth woes and a potentially hawkish-for-longer Fed supporting the US Dollar appears to have underpinned the energy commodity for now.

This is despite liquified natural gas (LNG) prices catching a bid yesterday on the prospect of industrial action in the gigantic gas fields in the northwest of Australia.

Woodside Petroleum (WDS.AU) and Chevron (CVX.US) are in negotiations with unions to avoid disruption to just over 10% of global LNG supply.

China’s new home prices were marginally softer in July but there is expanding concern that contagion emanating from property developers missing debt repayments could spread to other sectors.

Zhongrong International Trust Co., a major player in China’s trust sector, has missed several obligations to its clients over the past week.

The Peoples Bank of China set the Yuan at 7.1986 for the reference rate. A much stronger setting than had been anticipated by the market. It is being reported that State Banks have been directed to buy the Yuan.

Australian mining stocks are notably lower on the concerns that their exports could be impacted by a continual sluggish economic performance from their best customer.

Recommended by Daniel McCarthy

How to Trade FX with Your Stock Trading Strategy

Sentiment toward risk and growth-orientated assets had been already soured going into today’s APAC session following on from the North American session. Wall Street tumbled over 1% on all the major indices.

The negative perspective emanated from strong US retail sales leading to fears of a more hawkish Fed than previously thought.

These notions were reinforced by comments from Minneapolis Federal Reserve President Neel Kashkari. He questioned the prospect of whether or not the Fed had done enough to get inflation down to the target of 2%.

Treasury yields are slightly lower going into Wednesday’s trade after adding a few basis points across the curve yesterday. Spot gold is treading water above US$ 1,900.

The RBNZ left its cash rate on hold today at 5.50%, but the language in the accompanying statement was interpreted as hawkish by the market. The Kiwi rallied in the aftermath.

GBP/USD is steady near 1.2700 ahead of inflation data while EUR/USD traders will be eyeing Euro-wide GDP data.

The full economic calendar can be viewed here.

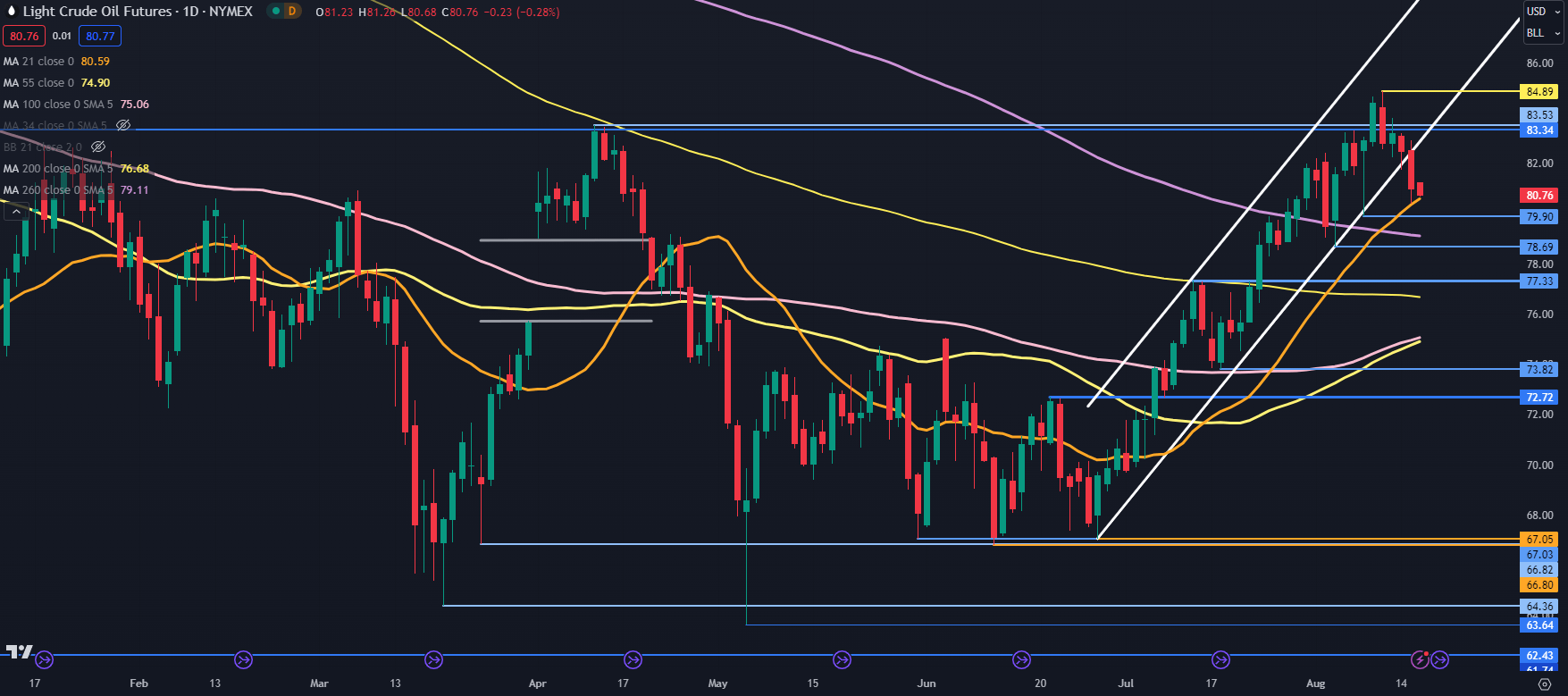

WTI CRUDE OIL TECHNICAL ANALYSIS SNAPSHOT

The WTI futures contract broke below the lower bound of an ascending trend channel yesterday. For more information on breakout trading, click on the banner below.

The selloff paused at the 21-day simple moving average (SMA) and it may provide support ahead of the 260-, 200-, 100- and 55-day SMAs at 79.11, 76.68, 75.06 and 74.90 respectively.

Support may also lie at the recent lows of 79.90 and 78.69. Further down, support could be at the breakpoint of 77.33 and the prior low at 73.82.

On the topside, resistance might be at the breakpoints near 83.40 ahead of the recent peak at 84.89.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS