CRUDE OIL PRICE OUTLOOK:Crude oil costs fell barely throughout Monday’s APAC session amid rising viral considerations Japan declared new state of

CRUDE OIL PRICE OUTLOOK:

- Crude oil costs fell barely throughout Monday’s APAC session amid rising viral considerations

- Japan declared new state of emergency in Tokyo, Osaka and two different areas. India’s every day Covid-19 infections hit a report excessive

- Wednesday’s OPEC+ assembly is beneath the highlight as merchants await clues in regards to the provide outlook

Really helpful by Margaret Yang, CFA

Get Your Free Oil Forecast

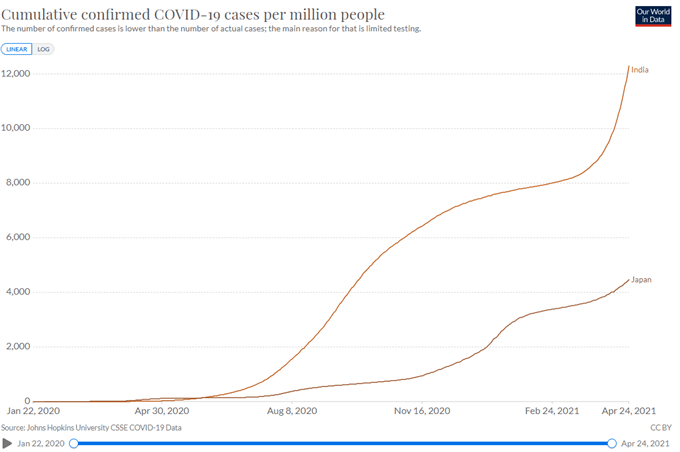

WTI traded barely decrease through the APAC mid-day session as viral resurgence in Japan and India set a bitter tone for oil buying and selling. Japan declared a 3rd state of emergency in Tokyo, Osaka and two different prefectures to curb a surge in coronavirus instances. These areas account for ¼ of Japan’s inhabitants and 1/three of its financial output. The measures began on Sunday and will probably be in place till at the very least Could 11th, casting a shadow on the upcoming Tokyo Olympics.

Japan is the world’s fourth largest oil importing nation, consuming round 7% of world oil exports throughout 2019. Due to this fact, decreased home journey and a halt of non-essential companies might deliver a substantial impression to vitality consumption through the restricted interval.

India reported a report improve in its every day Covid-19 infections, with 349,691 instances added over the previous 24 hours. India is the world’s third largest oil importer and accounted for round 10% of world imports in 2019. A speedy surge in coronavirus infections could result in tightened journey restrictions and will deliver the nation nearer to a nation-wide lockdown.

In the meantime, oil merchants will keep watch over Wednesday’s OPEC and non-OPEC ministerial assembly for clues in regards to the provide outlook. The oil cartel and its allies have determined so as to add 2.25 million bpd from Could to July at a gathering held on April 1st. Since then, the vitality demand outlook was brightened by sturdy financial information from the US and China. Wanting forward, deteriorating viral conditions in elements of Asia could hinder OPEC+ from contemplating elevating output additional.

Iranian oil manufacturing could possibly be one other wildcard within the oil market. Lately, the nation tried to renew talks on the 2015 nuclear deal with a view to free itself from financial sanctions imposed by the US. Though the continued negotiations have but to yield any fruit, the potential return of Iranian provide sooner or later posts a risk to the delicate provide and demand steadiness.

Cumulative confirmed Covid-19 Instances – India and Japan

Supply: ourworldininformation

Technically, WTI fashioned a “Double High” sample earlier than getting into right into a consolidative part on the 4-hour chart. An instantaneous resistance degree could be discovered at US$ 63.83 – the 61.8% Fibonacci retracement. An instantaneous assist degree could be discovered at round US$ 61.15 – the 100-period SMA line.

The MACD indicator has fashioned a bullish crossover beneath the impartial midpoint, suggesting that bullish momentum could also be accumulating.

WTI Crude Oil Worth – 4-Hour Chart

Really helpful by Margaret Yang, CFA

Constructing Confidence in Buying and selling

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part under or @margaretyjy on Twitter

ingredient contained in the

ingredient. That is in all probability not what you meant to do!nn Load your utility’s JavaScript bundle contained in the ingredient as a substitute.www.dailyfx.com