Crude Oil, WTI, Brent, API, EIA, Fed, FOMC, US Dollar, US CPI - Talking PointsCrude oil is struggling going into Thursday as the market awaits invento

Crude Oil, WTI, Brent, API, EIA, Fed, FOMC, US Dollar, US CPI – Talking Points

- Crude oil is struggling going into Thursday as the market awaits inventory data

- The Fed has been consistent in its messaging on a less aggressive stance

- If the US Dollar languishes, will that serve to underpin WTI??

Recommended by Daniel McCarthy

Get Your Free Oil Forecast

Crude oil steadied in Asian trade today after tumbling overnight in the wake of a surge in stockpiles. The move lower unfolded despite favourable conditions for equities after more hawkish comments from Fed speakers.

Data released overnight saw the American Petroleum Institute (API) report reveal an accumulation of 12.94 million barrels for the week ended October 6th. This was much higher than the 1.3 million increase anticipated and comes after a depletion of 4.21 million prior.

The market’s focus now turns toward the official Energy Information Agency (EIA) stockpile figures that are due later today. The WTI futures contract is near US$ 83 bbl while the Brent contract is a touch above US$ 85.50 bbl.

US CPI will also be released and will come into sharper focus after US PPI beats estimates to the upside, coming in at 2.2% year-on-year to the end of September against 1.6% anticipated.

A Bloomberg survey of economists is estimating that year-on-year headline CPI will be 3.7% to the end of September. To learn more about trading the news, click on the banner below.

Federal Reserve Governor Christopher Waller and Boston Federal Reserve President Susan Collins joined the conga line of Fed board members spruiking a less hawkish mantra this week.

Federal Open Market Committee (FOMC) meeting minutes released overnight support the thesis with the bank specifically saying, “Participants generally judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee’s goals had become more two-sided.”

To learn more about trading markets around news event, click on the banner below.

Recommended by Daniel McCarthy

Introduction to Forex News Trading

Equity markets appeared to cheer the news with the Dow Jones, S&P 500 and Nasdaq all finishing higher by 0.19%, 0.43% and 0.71% respectively.

APAC equities took the lead with a sea of green across the board today. Chinese stocks sailed with an extra tailwind when it was announced that the national wealth fund had been buying stocks in the four largest Chinese banks.

Futures are pointing toward a steady start for the European and North American cash session.

Currency markets have been fairly quiet so far in the Thursday session after the US Dollar slipped against the major pairs yesterday but gained against commodity-linked currencies. Gold remains firm, trading near US$ 1,880 an ounce.

After the vital UK data this morning, there will be a plethora of ECB speakers ahead of the US CPI figures.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade Oil

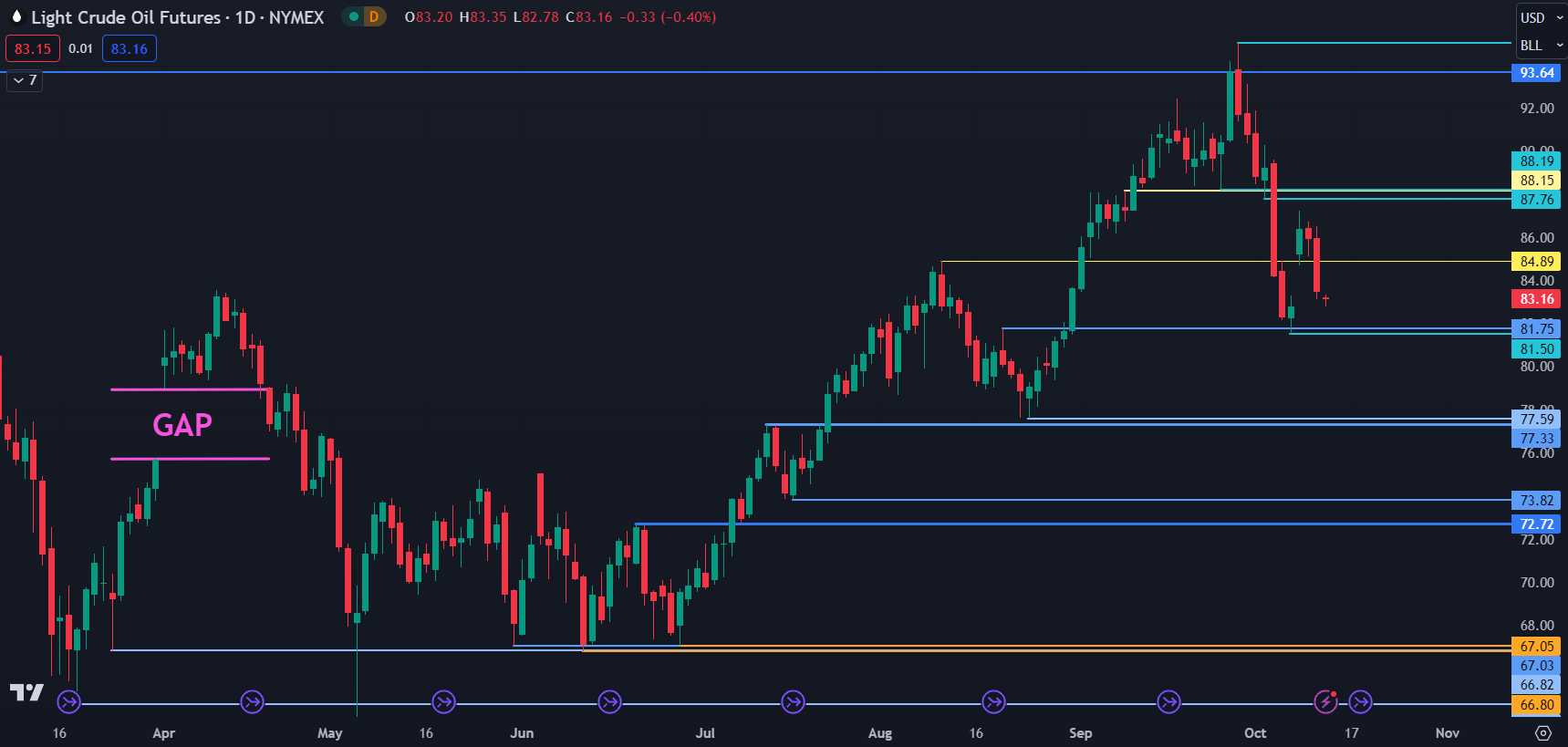

WTI CRUDE OIL TECHNICAL SNAPSHOT

The WTI futures contract filled in the gap created at the start of this week today.

Although this technical feature is not as pronounced as it was back in April, it may have some bearish implications.

It should be noted though that past performance is not indicative of future results.

Support may lie near the breakpoints of 83.53,83.34 or the prior low at 81.50.

Nearby resistance could be at the breakpoints of 84.89, 87.76, 88.15 and 88.19. On the downside.

WTI CHART

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS