Crude Oil, WTI, Brent, Saudi Arabia Russia, OPEC+, EIA, API, OVX – Talking PointsCrude oil leapt over hurdles overnight as production cuts are pushed

Crude Oil, WTI, Brent, Saudi Arabia Russia, OPEC+, EIA, API, OVX – Talking Points

- Crude oil leapt over hurdles overnight as production cuts are pushed further out

- Inventory data show US demand to be strong and solid ISM number supports a robust outlook

- If oil prices keep going up and the US economy is strong, will another Fed hike hit WTI?

Recommended by Daniel McCarthy

Understanding the Core Fundamentals of Oil Trading

The crude oil price scaled to new heights again today as traders and hedgers weigh production cuts and a continuing run down of stockpiles.

Earlier this week Saudi Arabia and Russia committed to maintain their production cuts through to the end of this year. The cuts of 1 million and 300k barrels per day respectively.

The squeeze on supply appears to be having the desired effect of pushing prices higher in the near term but could have unintended consequences in the long run if the price of energy ramps up significantly over an extended period.

Aside from potential demand destruction, the Federal Reserve has made it clear that they are resolute in its fight on inflation. If the cost of energy leads to consistently higher prices at the pump, it might contribute to keeping rates higher for longer than would otherwise be the case.

Overnight the US ISM services PMI for August printed at 54.5, notably above forecasts of 52.5 and 52.7 prior. This saw the interest rate market reassess the Fed’s hiking cycle and Treasury yields continued to climb in the aftermath.

With the anaemic outlook for China’s growth and Europe facing its own headwinds, perhaps OPEC+ see slower global economic activity as a reason for the production cuts.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Other data released overnight saw the American Petroleum Institute (API) report reveal another drop of -5.52 million barrels for the week ended September 1st. This was much lower than the -1.429 million anticipated and comes on top of the massive depletion of -11.486 million prior.

Later today the market will be watching out for the US Energy Information Agency’s (EIA) weekly petroleum status report. The market is forecasting for a decrease of around 2 million barrels.

The front-month Bloomberg Nymex WTI crack spread has collapsed over the last week, trading as low as US$ 29.11 a barrel overnight, after nudging US$ 44 in August.

The crack spread is the gauge of gasoline prices relative to crude oil prices and reflects the profit margin of refiners.

The latest Baker Hughes rig count revealed 1 less rig in the US over the week ended September 1st.

So, while stockpiles are being drawn, it is possible that refiners are hesitant to add to production while profit margins are shrinking.

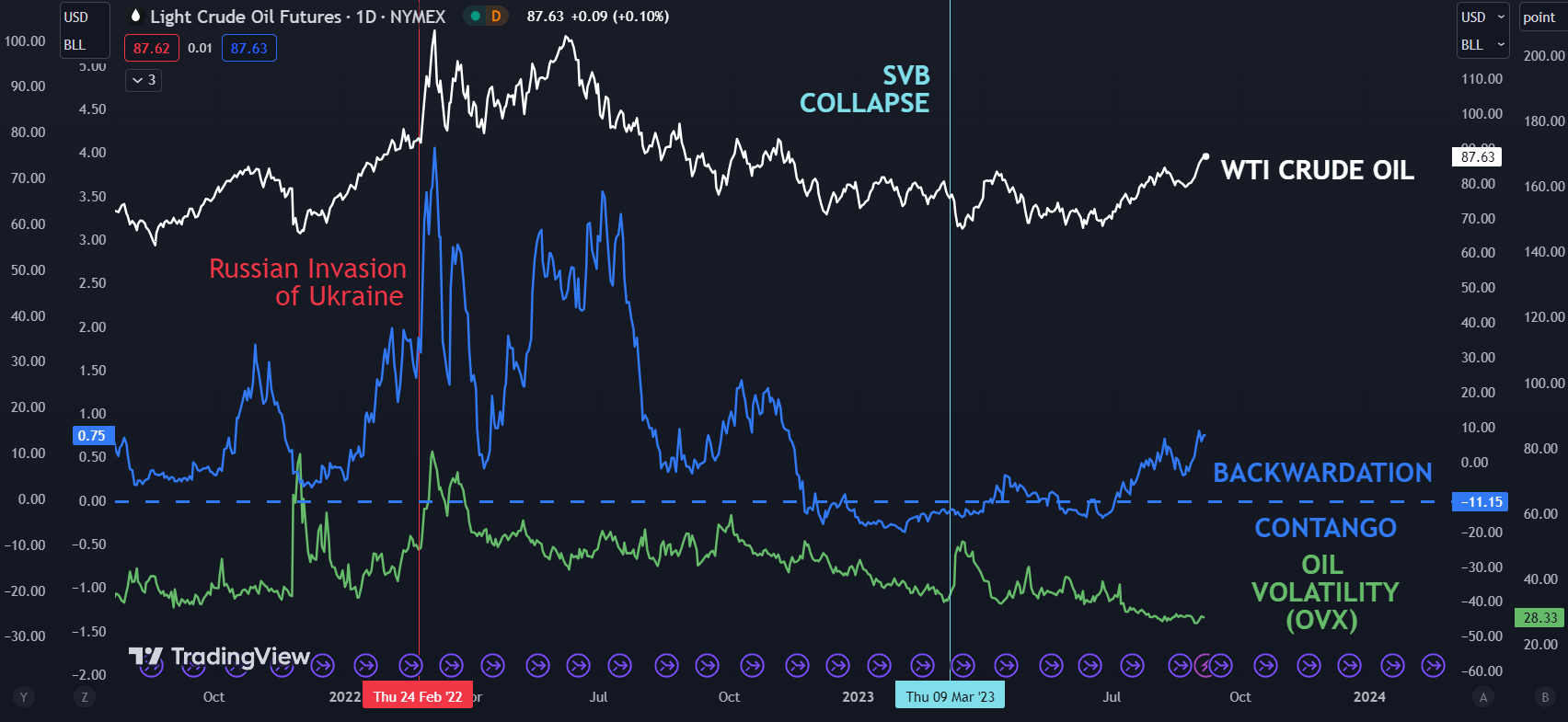

In addition, backwardation between the front 2 WTI futures contracts had been moving in a bullish direction for crude and might support the case that demand in the US is robust for now.

At the same time, the OVX index continues to languish at its lowest level since 2019 which may indicate that the market is not fussed about the surge in prices.

The OVX index measures volatility in the WTI oil price in a similar way that the VIX index gauges volatility on the S&P 500.

At the start of trading on Thursday, the WTI futures contract is a touch above US$ 87.50 bbl while the Brent contract is eyeing US$ 90 bbl at the time of going to print. Live prices can be found here.

For more information on how to trade oil, click on the banner below.

Recommended by Daniel McCarthy

How to Trade Oil

WTI CRUDE OIL, BACKWARDATION AND VOLATILITY (OVX)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS