Crude Oil Prices, Analysis, and ChartA deadly attack on US service personnel has market focus firmly on Middle East conflictCrude price benchmarks hav

Crude Oil Prices, Analysis, and Chart

- A deadly attack on US service personnel has market focus firmly on Middle East conflict

- Crude price benchmarks have slipped after days of strong gains

- Near-term fundamentals remain supportive

- Demand backdrop remains clouded

Learn How to Trade Oil with our Complimentary Guide

Recommended by David Cottle

How to Trade Oil

Crude Oil prices retreated a little on Monday after a string of gains last week took them back to highs not seen for twelve weeks. The West Texas Intermediate benchmark has edged back above $78/barrel for the first time since November 30.

While a little pause for reflection is surely reasonable enough after a strong run, the near-term fundamentals continue to look very supportive. United States President Jo Biden has vowed a response to weekend attacks by reportedly Iranian-backed militia in Yemen which left three troops dead. Congressional hawks are already calling for a strike on Iran itself in retaliation and, whether this happens or not, it seems escalation in the Gaza/Red Sea conflict nexus is sadly assured.

Away from that region, the market is looking for more stimulus out of Beijing and, on Wednesday, confirmation that the US Federal Reserve is still on board with market hopes that interest rates will be heading significantly lower this year. While there’s scope for disappointment on both counts, oil prices have found support in both hopes. Throw in last week’s news that the US economy expanded ahead of expectations in the final three months of 2023 and it is clear enough why oil prices should be gaining.

The backdrop is, however, a little more clouded than the current upbeat assessment might suggest. Notwithstanding those stimulus efforts and others, the market faces plentiful oil supply and decidedly uncertain end-user demand. However, this reality seems unlikely to reassert itself while Middle Eastern geopolitics remains in charge of the headlines.

In terms of scheduled data, the Fed will be running the table for energy markets this week, as for all others. There are some other points of interest though, including Eurozone growth data and the Bank of England’s interest rate decision.

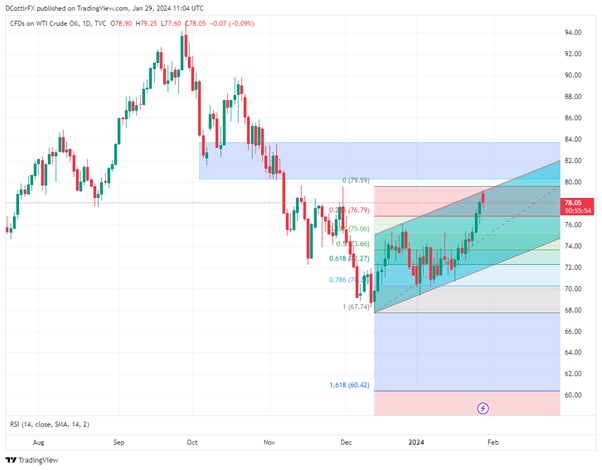

US Crude Oil Prices Technical Analysis

Chart Compiled Using TradingView

Recommended by David Cottle

Get Your Free Oil Forecast

Prices appear to have faltered at a point that confirms a broad uptrend channel in place since December 13. The rejection of that channel top at $79.07 isn’t quite conclusive at this point but still bears watching. Support is likely at $76.79, the first, Fibonacci retracement of the rise from those mid-December lows.

Bulls will need to recapture a trading band bounded by November 1’s intraday low of $80.23 and November 3’s high of $83.55 and consolidate their position there if they are going to make progress back to last year’s high of $94.98. Retaking that would be a massive ask even given current fundamental support. In any case a period of consolidation looks likely now, albeit within the broader uptrend, which remains in place down to $73.

Crude’s Relative Strength Index is getting close to overbought territory having risen steadily into 2024.

–By David Cottle for DailyFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS