It has been a tough week for cryptocurrencies, headlined by a 13% decline in Bitcoin (BTC). Sentiment has steadily soured as requires crypto regul

It has been a tough week for cryptocurrencies, headlined by a 13% decline in Bitcoin (BTC). Sentiment has steadily soured as requires crypto regulation have gained steam. The newest within the dialogue was from ECB head Christine Lagarde.

Citing considerations over Bitcoin market manipulation and performance, Lagarde issued a number of feedback worthy of word directed at cryptos in latest days. Listed below are few of the important thing quotes:

- “Bitcoin is a extremely speculative asset, which has performed some humorous enterprise and a few attention-grabbing and completely reprehensible cash laundering exercise.”

- “There needs to be regulation. This needs to be utilized and agreed upon at a worldwide stage.”

The tone from Lagarde dealing with BTC was ominous. Nonetheless, the ECB president cited no particular situations of BTC cash laundering or market manipulation. For the reason that feedback, the main cryptocurrencies have struggled to carry onto marketshare. Over the previous 24 hours, BTC (-8.43%), Ethereum ETH (-5.44%), XRP (-6.10%), Litecoin LTC (-8.57%) and Bitcoin Money BCH (-9.41%) are all deep into the crimson.

Cryptocurrencies Lag, Stay In Bullish Territory

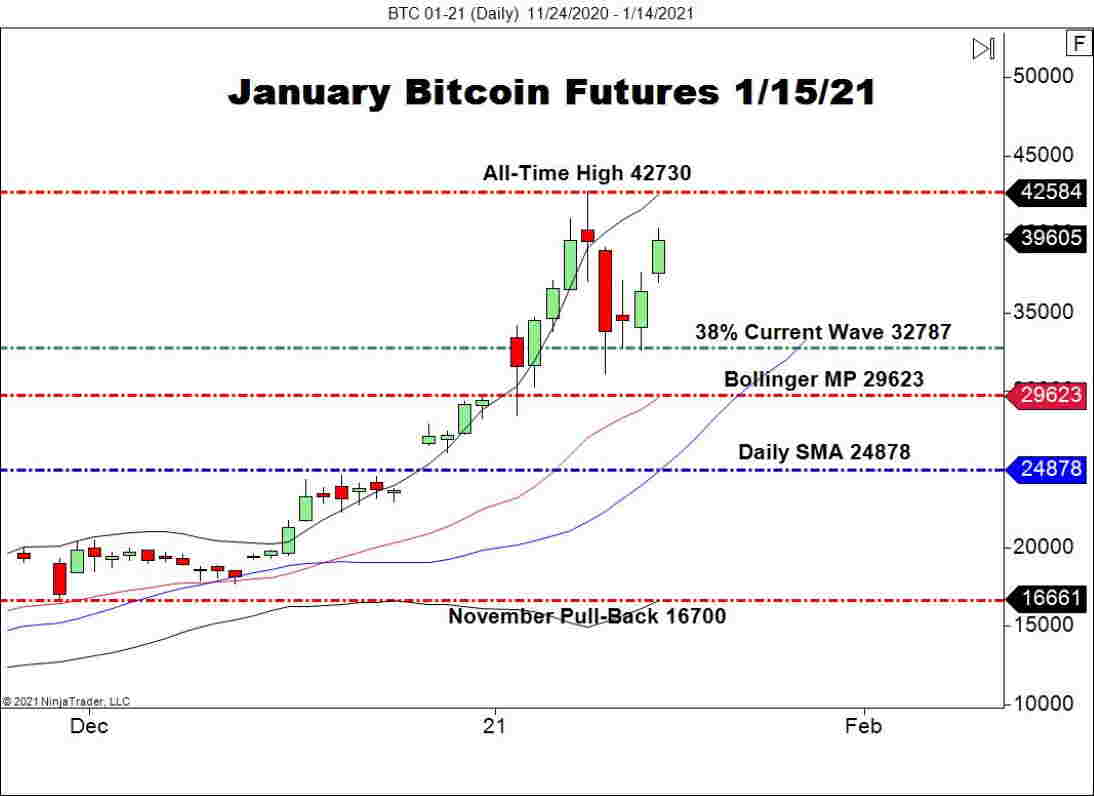

Beneath is a have a look at January Bitcoin futures as of yesterday’s shut. The story has been a lot totally different in the present day ― costs are down huge and in rotation simply above the 35,000 stage.

++11_24_2020+-+1_14_2021.jpg)

For early subsequent week, there are two ranges on my radar:

- Resistance(1): All-Time Excessive, 42730

- Help(1): 38% Present Wave, 32787

Backside Line: As you’ll be able to see from the chart above, the bullish development for January BTC futures may be very a lot intact. Value is firmly above the 38% Retracement stage, confirming the each day uptrend. If in the present day’s pullback extends, a shopping for alternative might come into play.

Till new all-time highs are made, I’ll be seeking to purchase BTC from $33,025 on the money markets. With an preliminary cease loss at $29,450, this commerce produces $3000 on a barely sub-1:1 threat vs reward administration plan.