DAX 30 Index, Coronavirus Restrictions, Vaccines, German Lockdown, IGCS – Speaking Factors:Fairness markets broadly gained throug

DAX 30 Index, Coronavirus Restrictions, Vaccines, German Lockdown, IGCS – Speaking Factors:

- Fairness markets broadly gained throughout APAC commerce as buyers cheered the prospect of further fiscal assist out of the US.

- The specter of prolonged lockdown measures in Germany could start to weigh on regional market sentiment.

- The DAX 30 index appears poised to increase current positive factors as value holds constructively above key assist.

Asia-Pacific Recap

Fairness markets broadly gained throughout Asia-Pacific commerce after President-elect Joe Biden introduced a larger-than-expected $2 trillion reduction package deal. Australia’s ASX 200 index rose 0.43% whereas Japan’s Nikkei 225 climbed 0.85%. China’s CSI 300 index plunged 1.93% after the outgoing Trump administration signed an order strengthening a November ban stopping US investments in corporations related to the Chinese language army.

In FX markets, the cyclically-sensitive Australian and New Zealand {Dollars} largely outperformed whereas the haven-associated Japanese Yen and US Greenback misplaced floor in opposition to their main counterparts. Gold costs slipped marginally decrease as yields on US 10-year Treasuries moved 2 foundation factors larger.

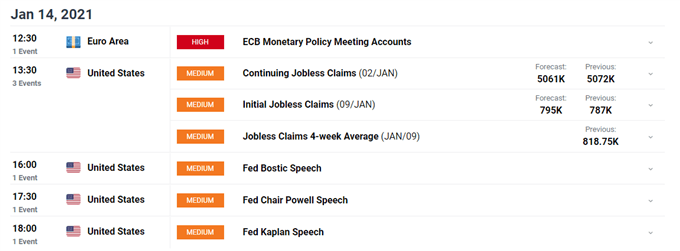

Wanting forward, the discharge of the European Central Financial institution’s assembly minutes for December headline the financial docket alongside jobless claims figures out of the US.

DailyFX Financial Calendar

Merkel Warns of Prolonged Restrictions

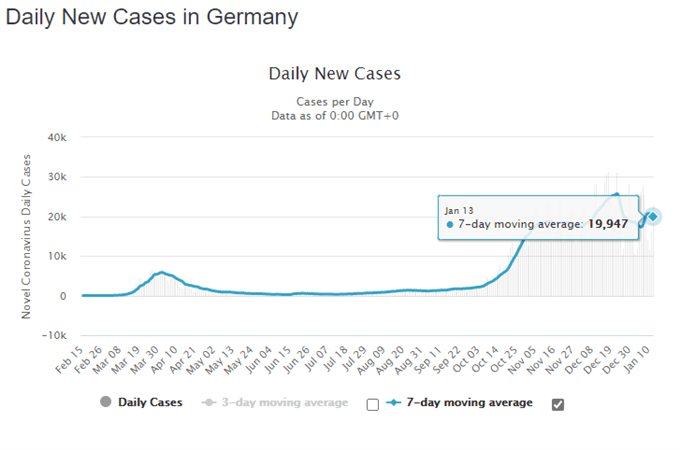

The potential extension of coronavirus restrictions in Germany could start to weigh on regional danger urge for food, as an infection numbers proceed to climb regardless of the imposition of a nation-wide lockdown on the finish of November.

Chancellor Angela Merkel has warned that harsh curbs could have to stay in place till Easter after the extremely transmissible mutation ,at the moment wreaking havoc within the UK, was detected in Germany. Certainly, Ralph Brinkhaus – the pinnacle of the ruling CDU/CSU group – careworn that “if this virus actually hits tougher, then the lockdown measures should be sharpened”.

Supply – Worldometer

On condition that the 7-day transferring common monitoring infections continues to hover simply shy of 20,000 regardless of the nation being positioned beneath strict lockdown measures, further tightening for a extra prolonged time period appears virtually inevitable.

That being mentioned, buyers could dismiss these worrying issues on hopes of a swift return to a degree of normalcy in gentle of the approval of the Covid-19 vaccines developed by Pfizer and BioNTech, and Moderna.

However, a level of warning needs to be maintained within the close to time period as the fact of a chronic interval of harsh curbs could start to gnaw in danger urge for food and in flip weigh on Germany’s benchmark DAX 30 index.

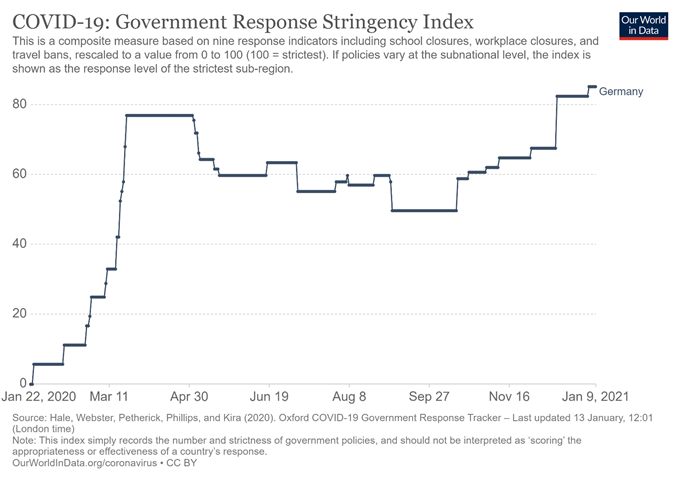

Supply – Our World in Knowledge

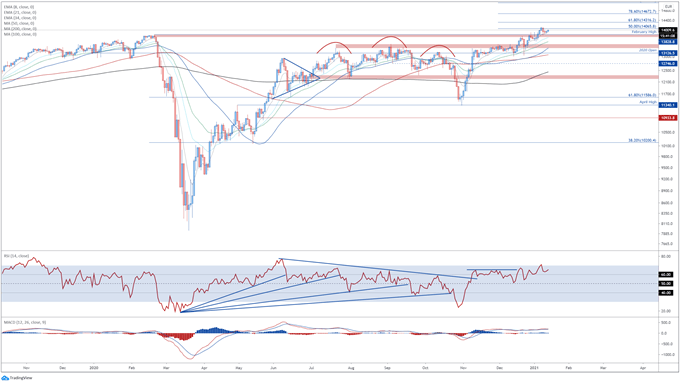

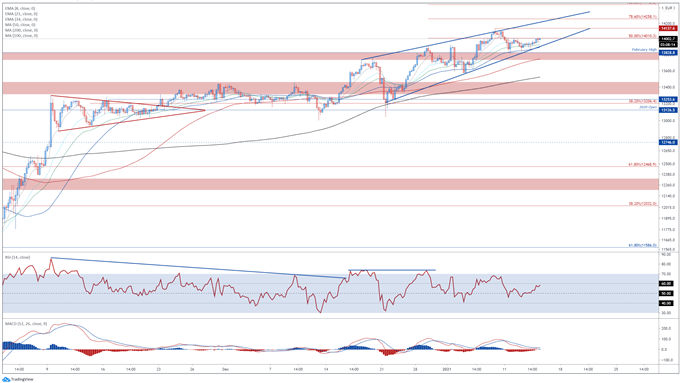

DAX 30 Index Futures Day by day Chart – RSI Eyeing Push into Overbought Territory

From a technical perspective, additional positive factors appear to be within the offing for the DAX 30 index, as costs stays constructively perched above key assist on the February 2020 excessive (13829).

Bullish transferring common stacking, in tandem with the RSI holding firmly above 60 and eyeing a push into overbought territory, hints at swelling shopping for strain.

A every day shut above the file excessive set on January 8 (14138) would most likely ignite an impulsive topside push in the direction of the 61.8% Fibonacci growth (14316) and psychological resistance at 14400. Breaching that possible carves a path for patrons to drive costs in the direction of the 78.6% Fibonacci (14673).

Alternatively, falling again under vary assist at 13750 – 13850 may ignite a short-term pullback to the 34-day exponential transferring common (13560).

DAX 30 index futures every day chart created utilizing Tradingview

DAX 30 Index Futures 4-Hour Chart – Rising Wedge in Play?

Zooming right into a four-hour chart reinforces the bullish outlook depicted on the every day timeframe, as costs storm away from the trend-defining 50-MA and the February excessive (13829).

With a bullish crossover happening on the MACD indicator, and the RSI climbing again above 50, the trail of least resistance appears to favour the upside.

Nonetheless, the index seems to be carving out a bearish Rising Wedge sample which may in the end set off a big draw back reversal.

However, if value stays constructively positioned above the 50-MA, and wedge assist stays intact, additional positive factors appear possible within the close to time period.

Clearing the 50% Fibonacci (14010) would most likely carve a path for value to probe the yearly excessive (14138), with a convincing push above bringing the 78.6% Fibonacci (14258) into the crosshairs.

Conversely, plunging again under wedge assist and the January 13 low (13870) may ignite a pullback in the direction of the sentiment-defining 200-MA (13525).

DAX 30 index futures 4-hour chart created utilizing Tradingview

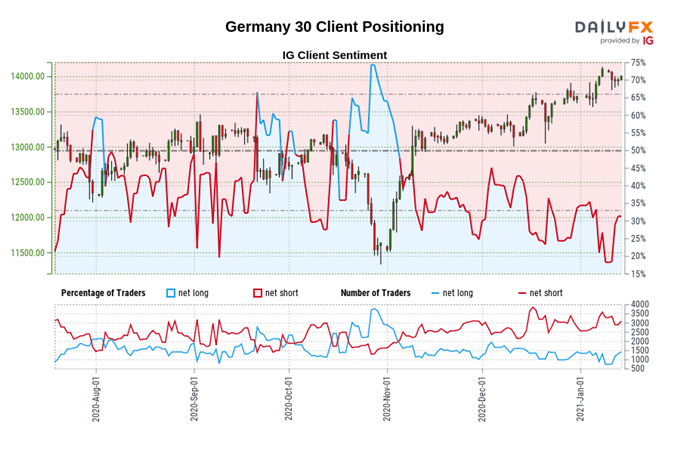

IG Shopper Sentiment Report

The IG Shopper Sentiment Report reveals 31.21% of merchants are net-long with the ratio of merchants quick to lengthy at 2.20 to 1. The variety of merchants net-long is 4.66% larger than yesterday and 66.67% larger from final week, whereas the variety of merchants net-short is 4.86% larger than yesterday and three.24% decrease from final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests DAX 30 costs could proceed to rise.

Positioning is extra net-short than yesterday however much less net-short from final week. The mix of present sentiment and up to date modifications offers us an additional combined DAX 30 buying and selling bias.

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Really helpful by Daniel Moss

Get Your Free Equities Forecast