U.S. DOLLAR ANALYSIS & TALKING POINTSISM services PMI increases Fed rate hike probability.Services prices increase pushes reflation narrative.EUR

U.S. DOLLAR ANALYSIS & TALKING POINTS

- ISM services PMI increases Fed rate hike probability.

- Services prices increase pushes reflation narrative.

- EUR/USD on the cusp of a downside breakout below 1.07.

Recommended by Warren Venketas

Get Your Free USD Forecast

DOLLAR FUNDAMENTAL BACKDROP

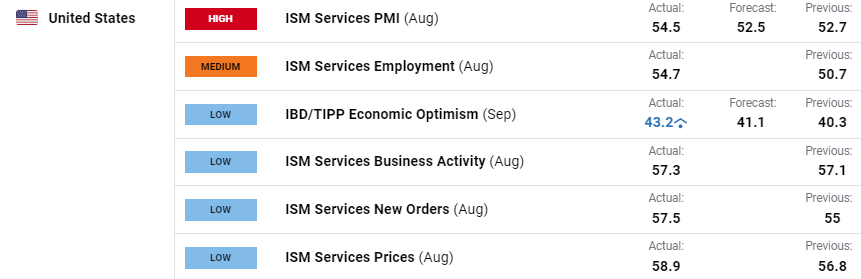

US ISM services PMI numbers (see economic calendar below) surpassed forecasts on all metrics reiterating the robust state of the US economy. The headline print reached levels last seen in February and with services prices also showing an increase, the consequence on inflation in conjunction with higher crude oil prices may keep the Federal Reserve on their toes in terms of being too accommodative too quickly.

US ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

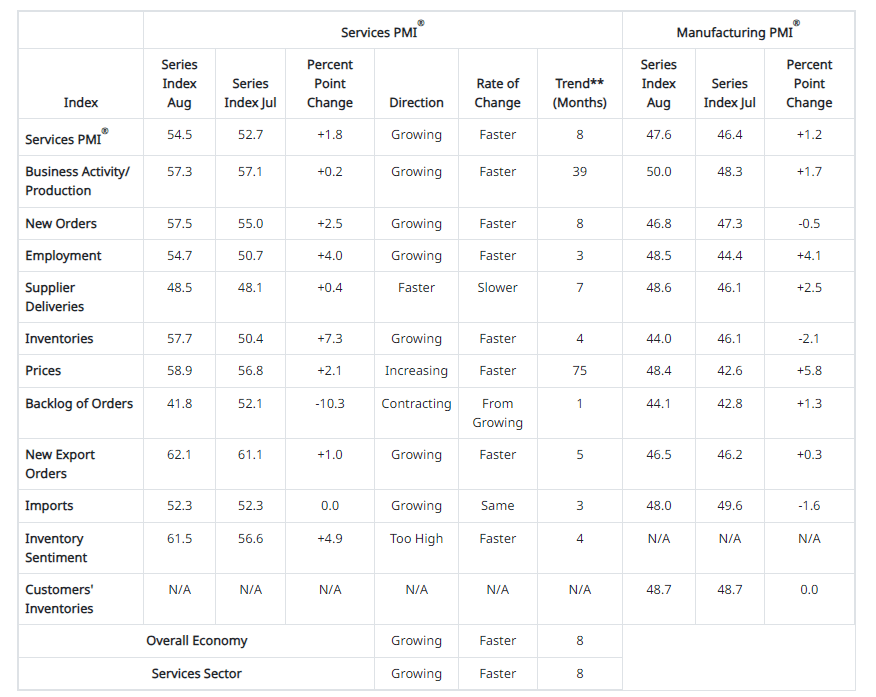

The breakdown below has reversed the angle markets viewed the US economy from the previous report as slowdown fears are being limited.

ISM SERVICES SURVEY RESULTS

Source: ISM

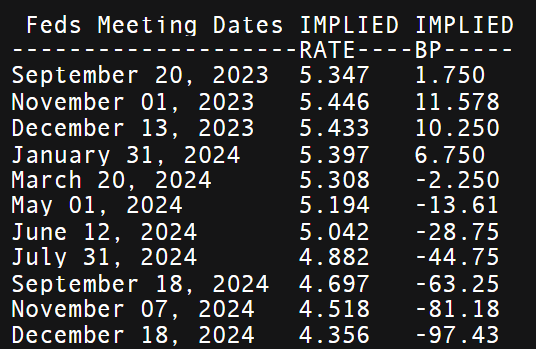

The odds for an interest rate hike in November (refer to table below) has now increased post-announcement along with pressure from the Fed’s Collins earlier today stating that the Fed has not sufficiently contained inflation.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

MARKET REACTION – TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

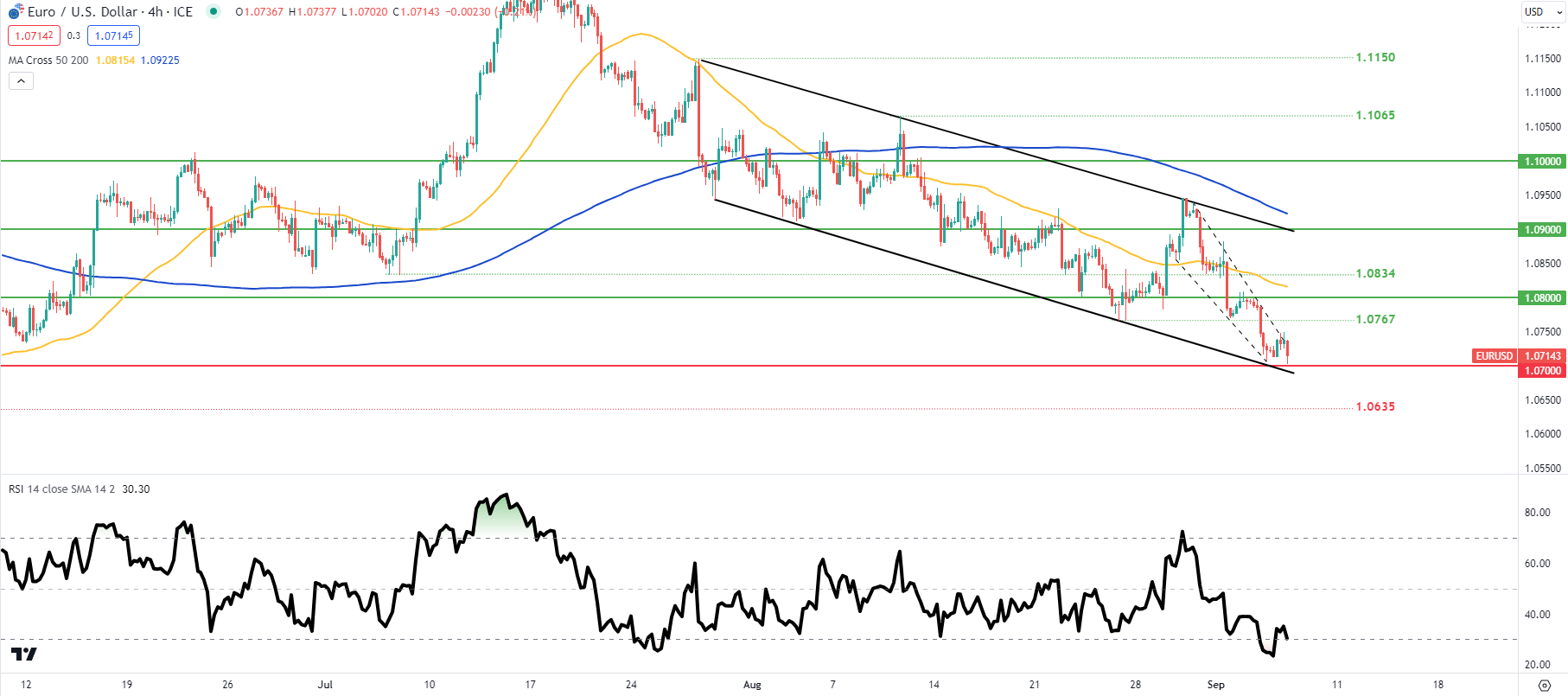

EUR/USD 4-HOUR CHART

Chart prepared by Warren Venketas, IG

The 4-hour EUR/USD chart above immediately slumped down towards the 1.0700 support handle but has since retracted somewhat. The pair remains within the short-term falling wedge pattern giving bulls hope for an upside breakout to come.

Resistance levels:

Support levels:

- 1.0700

- Channel support

- 1.0635

— Written byWarren Venketasfor DailyFX.com

Contact and followWarrenon Twitter:@WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS