U.S. DOLLAR ANALYSIS & TALKING POINTSIncreasingly aggressive Fed guidance has bolstered the DXY, rangebound movement expected throughout today.Fe

U.S. DOLLAR ANALYSIS & TALKING POINTS

- Increasingly aggressive Fed guidance has bolstered the DXY, rangebound movement expected throughout today.

- Fed’s Cook and S&P PMI data under the spotlight later today.

- DXY awaits triangle breakout.

Recommended by Warren Venketas

Get Your Free USD Forecast

USD FUNDAMENTAL BACKDROP

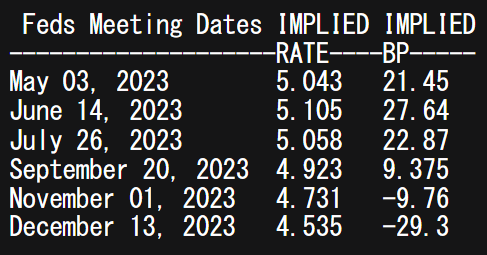

The Dollar Index (DXY) has managed to trade marginally higher this Friday morning as we enter the European session. In what has been a muted Asian session, the greenback has found support from hawkish Fed speak last night. The Fed’s Mester (known hawk) and Harker both echoed similar sentiments around maintaining a restrictive monetary policy environment preferring rates above the 5% mark to quell elevated inflation in the US. Money markets tend to agree with these comments with the Fed funds futures below indicating a peak rate of 5.105% at present.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

Looking ahead, the economic calendar is relatively muted barring S&P PMI figures for the US which carries less weight than the ISM report but still heightened in it’s release today with no other market moving events scheduled. To close out the trading session, the Fed’s Cook will come into focus by way of consistency in narrative from prior speakers throughout the week.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

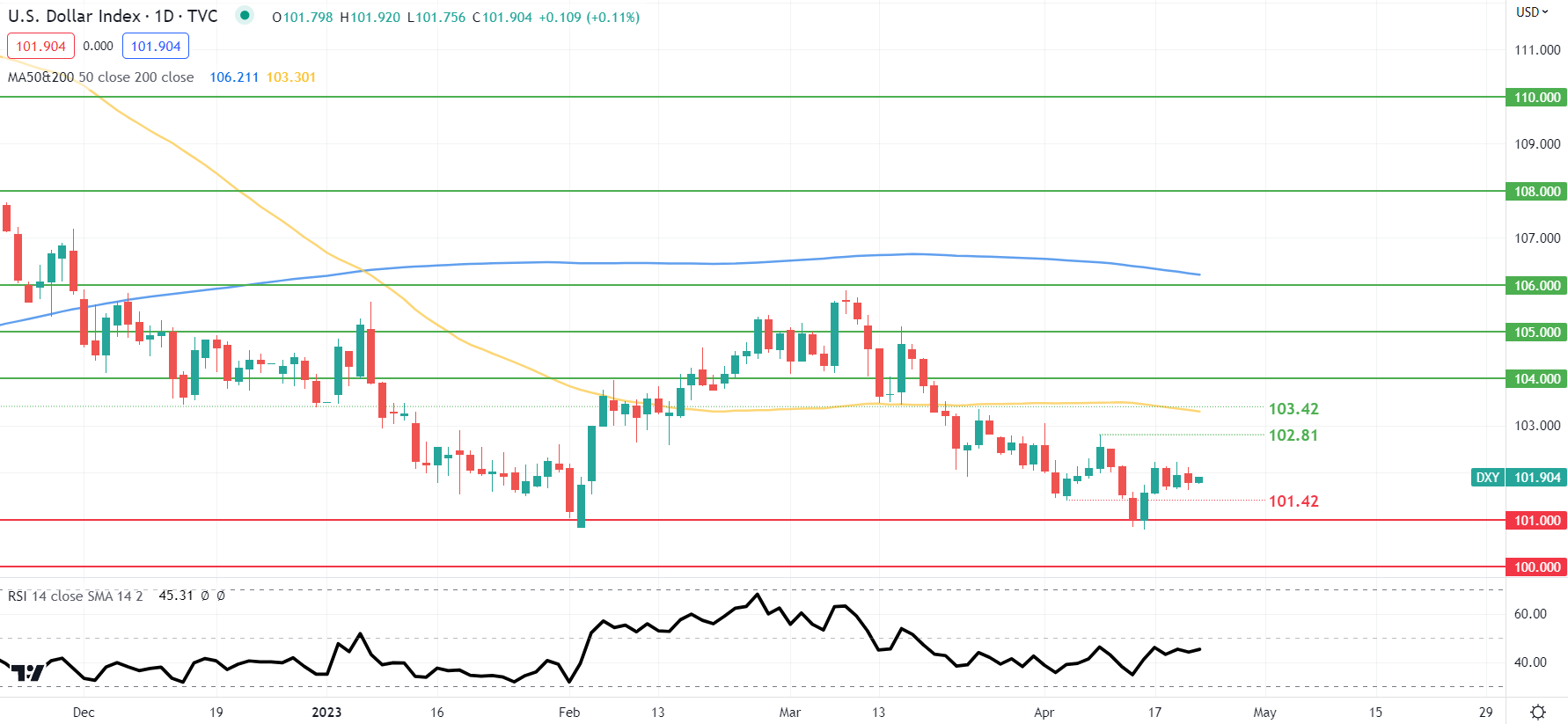

U.S. DOLLAR INDEX DAILY CHART

Chart prepared by Warren Venketas, IG

Daily DXY price action shows a consolidating sideways movement resembling a symmetrical triangle type formation. This typically, can break in either direction but often favors the prevailing trend. The Relative Strength Index (RSI) is not providing much in the way of a directional bias but could find its footing next week amidst a slew of US economic data.

Resistance levels:

- 103.42/50-day MA (yellow)

- 102.81

Support levels:

Contact and followWarrenon Twitter:@WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com