EUR/USD Forecast - Prices, Charts, and AnalysisECB’s Isabel Schnabel – ‘inflation developments have been encouraging’.The single currency remains unde

EUR/USD Forecast – Prices, Charts, and Analysis

- ECB’s Isabel Schnabel – ‘inflation developments have been encouraging’.

- The single currency remains under pressure as rate-cut expectations grow.

Learn How to Trade EUR/USD with our Complimentary Guide

Recommended by Nick Cawley

How to Trade EUR/USD

Most Read: Euro (EUR) Forecast: EUR/USD, EUR/GBP Crumble as Rate Cut Talk Gets Louder

In a recent interview with Reuters, Isabel Schnabel, a member of the executive board of the ECB, said that the central bank’s monetary policy is working and that they remain on track to get inflation back to target (2%). What is notable is that before today’s dovish interview, Ms. Schnabel has been a known hawk, giving her strong backing when the ECB was hiking interest rates. The interview started on a telling note. When Ms. Schnabel was asked if she was surprised by the recent benign inflation reading, she quoted Keynes saying’

‘When the facts change, I change my mind, what do you do sir?’

During the interview, Ms. Schnabel added that ‘inflation developments have been encouraging’, the recent inflation number has made a ‘further rate increase rather unlikely’, and that underlying inflation is now ‘falling more quickly than we had expected’.

Euro Zone annual inflation fell to 2.4% in November, below market forecasts and sharply lower than October’s reading of 2.9%

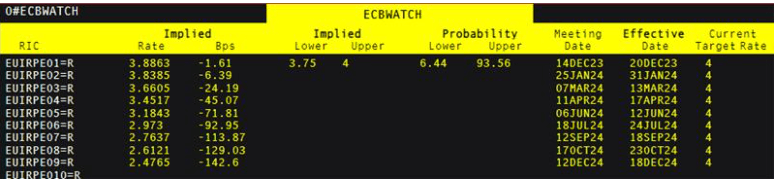

Financial markets took note of Ms. Schnabel’s comments and priced in deeper rate cuts in 2024. The latest market forecast is for over 140 basis points of rate cuts next year with the first 25bp cut seen at the March ECB meeting.

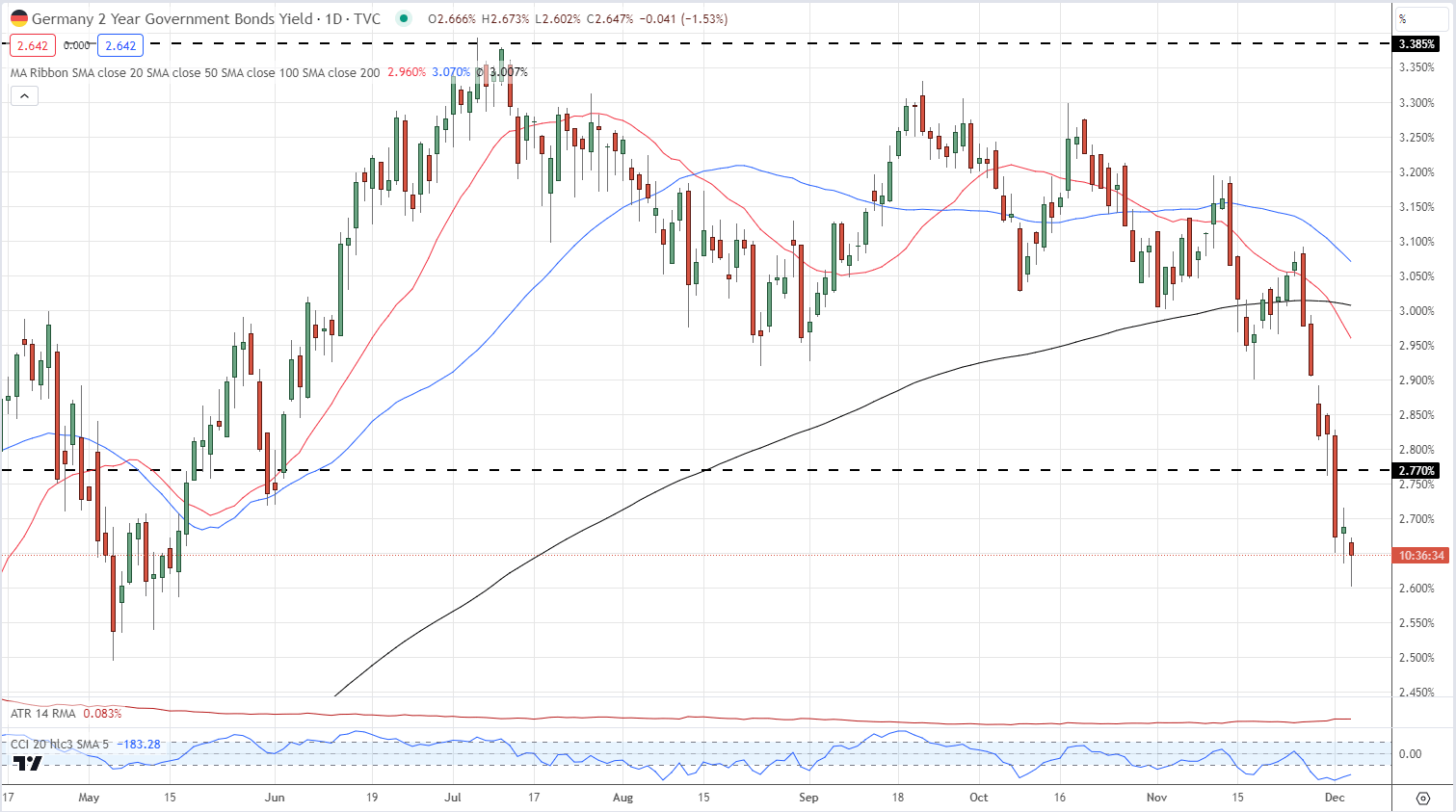

German government bond yields – the ECB proxy – continue their recent sell-off this morning, making a fresh multi-month low. The yield on the rate-sensitive 2-year touched 2.60%, a level last seen in mid-May and around 80 basis points lower than the early July high.

German 2-Year Schatz Yield

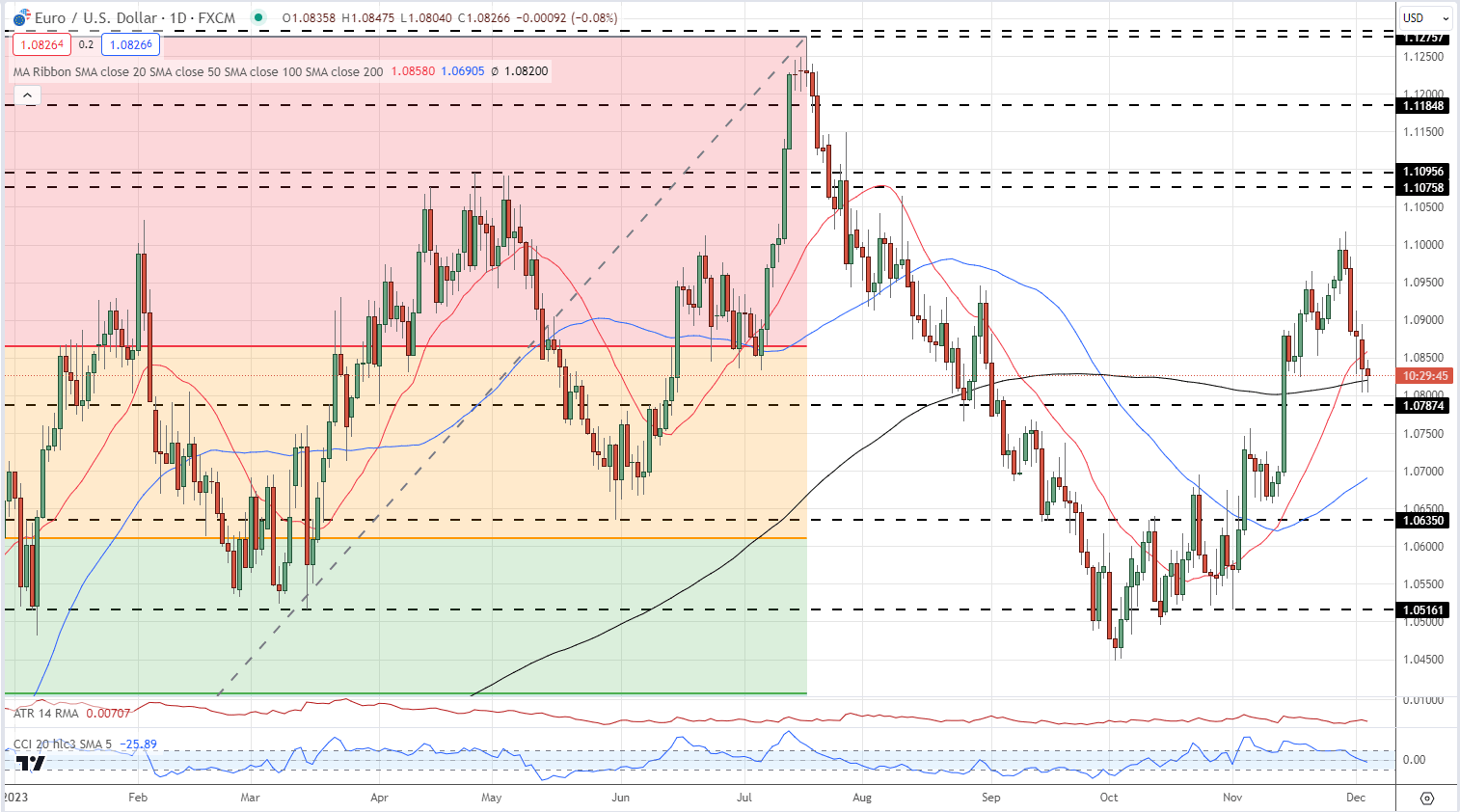

An increasingly dovish outlook and lower government bond yields have left the Euro struggling against a range of currencies. The Euro has fallen for seven days in a row against the Japanese Yen, another currency with a dovish background, while EUR/GBP has fallen by around two big figures in the last two weeks.

EUR/USD is also moving lower, despite growing rate cut expectations in the US. The pair currently trade a fraction above the 200-day simple moving average and a break below would see EUR/USD trading with a 1.07 handle. Support is seen at 1.0787 before 1.0750 comes into view.

EUR/USD Daily Chart

All Charts via TradingView

IG Retail trader data 50.01% of traders are net-long with the ratio of traders long to short at 1.00 to 1.The number of traders net-long is 5.19% higher than yesterday and 24.92% higher than last week, while the number of traders net-short is 1.77% higher than yesterday and 25.16% lower than last week.

You can Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | 1% | 2% | 1% |

| Weekly | 21% | -25% | -8% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS