The eternal and seemingly everlasting talks between Britain and the European Union face one other deadline to conclude a remaining settlem

The eternal and seemingly everlasting talks between Britain and the European Union face one other deadline to conclude a remaining settlement.

U.Ok. Prime Minister’s Boris Johnson journey to Brussels has ended and has not produced an settlement with the European Union. The U.Ok. and E.U. have introduced on the night of 9th December that December the 13th is now the deadline for reaching a remaining settlement.

The U.Ok. modified its Inner Market Invoice as a way to show good religion to the European Union as talks between Boris Johnson and the E.U. management acquired underway this week. Nevertheless, an deadlock continues to be demonstrated earlier than the top of the month deadline. Failure to succeed in an settlement might lead to tariffs and quotas from either side which might produce troubling financial implications.

EUR/GBP Charges Observe Negotiation Outlook

The present talks, which had been specializing in inside measures between the U.Ok. and Eire, future commerce between the E.U. and Britain, and fishing rights, seem to face continued obstacles. The U.Ok. and E.U. have created a number of deadline extensions up to now, however the present deadline appears to have precipitated an actual focus. Buyers are nervous as either side grumble in regards to the potential for a ‘arduous’ Brexit which might trigger monetary ache and unknown financial implications.

The present talks might be conceivably prolonged by way of the month and into subsequent yr. Nevertheless, nobody needs to see that happen, as stalled negotiations will produce sad companies and traders as they attempt to gauge their financial futures.

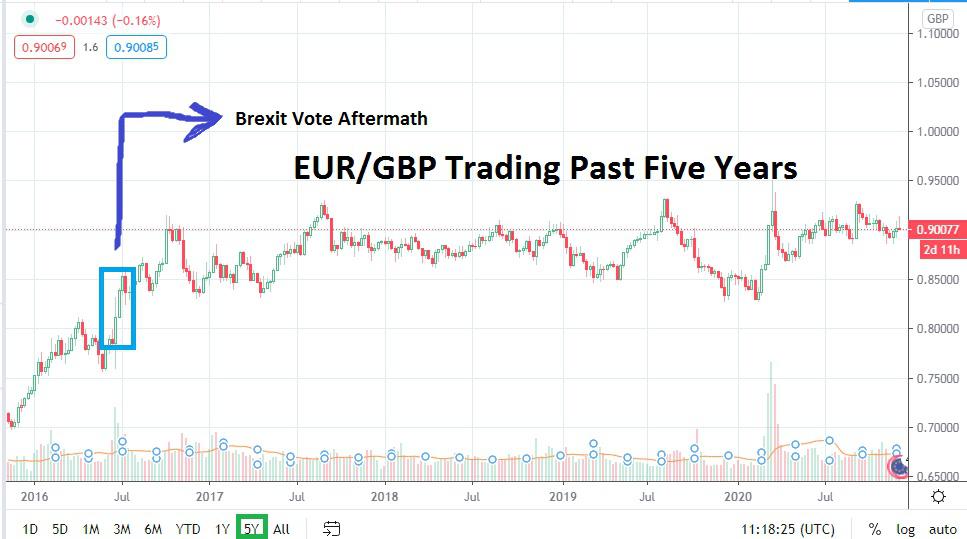

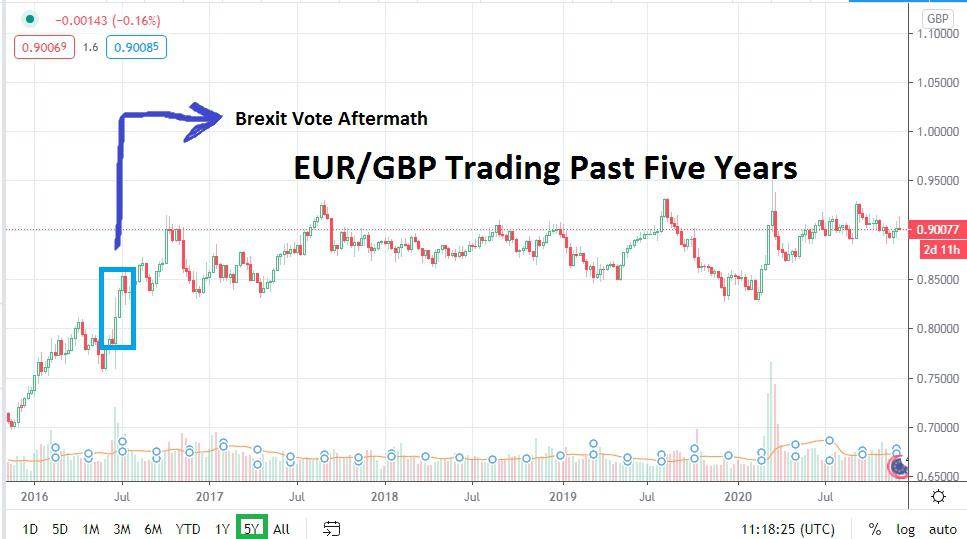

Within the midst of an unclear consequence, the EUR/GBP and even the GBP/USD are affected. The EUR/GBP is presently buying and selling inside what has grow to be a snug vary of roughly 0.8900 to 0.9200. The query is what’s going to occur if a deal shouldn’t be reached, which might conceivably injury the GBP due to the psychological results by way of monetary issues. A failure to agree a deal might trigger the EUR/GBP to surge increased, giving a GBP to euro forecast ultimately difficult values within the 0.9300 to 0.9500 vary.

The U.Ok. by no means grew to become a financial accomplice of the E.U. by becoming a member of the EUR, however the worth of the EUR/GBP because of the commerce agreements and joint financial insurance policies actually helped create a transparent and optimistic outlook for the 2 main currencies. If an settlement might be made within the close to time period between the U.Ok. and E.U., the EUR/GBP might produce a strong downturn and commerce within the 0.8700 to 0.8500 worth vary once more, giving a downwards pound to euro forecast over the following 6 months into 2021.

Because the UK voted to go away the E.U. in June 2016, the GBP has suffered in worth towards the EUR and towards the USD as effectively. The U.Ok. and E.U. have been languishing in negotiated chatter relating to their future ‘residing’ preparations for just a few years and traders have grown cautious and fatigued by the dearth of a optimistic consequence. Remaining necessary buying and selling companions and determining how finest to handle the welfare of their residents by way of assorted rights like work and journey visas and commerce inside the two entities in a productive method is essential.

The GBP/USD has been buying and selling inside a variety of 1.2800 to 1.3400 with relative consolation mid-term. A failure to succeed in an settlement between the UK and EU might see the GBP/USD once more problem lows close to 1.2400 to 1.2100 ranges over the long run. If a deal is made, the GBP/USD might rise ultimately to the value space between 1.3700 and 1.4000.

Key Obstacles to Brexit Deal

Curiously, one of many key issues the U.Ok. and E.U. are going through is what outsiders could take into account a easy activity: the rewriting of fishing rights. Whereas actually not an important business and best menace to general worth of complete commerce commerce for the U.Ok. and E.U., the fishing business within the E.U. has made a populist and political stand because it fights for its proper to retain ‘catch’ rights in U.Ok. waters.

On common, European fishing corporations take shut to six million tons of product from the ocean and, on common, these similar corporations take about 700,000 tons of that complete from U.Ok. waters. European corporations don’t wish to lose the power to fish in U.Ok. waters. If an settlement on fishing rights might be agreed upon it should spotlight that different aspects relating to commerce will be capable of be labored out too.

Britain is aware of the fishing rights for the EU are necessary, and after the UK agreed to vary the Inner Market Invoice earlier this week, the continuing talks between the UK and EU possible have given Prime Minister Boris Johnson some extra firepower as he negotiates.

Backside Line

Ultimately, it appears affordable to consider the U.Ok. and E.U. will discover a technique to transfer ahead and agree on a correct technique to proceed a affluent working relationship. Regardless of how acrimonious the present talks generally appear to be, it does appear rational {that a} deal will ultimately be made. The large query is when an settlement will probably be achieved.