ECB to carry fireplace as Eurozone outlook brightens, however divisions might jolt euro – Foreign exchange Information Preview

ECB to carry fireplace as Eurozone outlook brightens, however divisions might jolt euro – Foreign exchange Information Preview

Posted on July 15, 2020 at 9:39 am GMTRaffi Boyadjian, XM Funding Analysis Desk

The European Central Financial institution is predicted to take a pause in its pandemic response and preserve coverage unchanged when it declares its newest resolution on Thursday at 11:45 GMT. Having been the epicentre of the Covid-19 pandemic at one level, Europe is now one of many few areas on this planet that has to this point managed to keep away from a resurgence. Therefore, traders are rising extra assured in regards to the restoration of the euro space and President Christine Lagarde will in all probability echo this optimism in her post-meeting press convention at 12:30 GMT. The query is, will the enhancing outlook be sufficient to prop up the euro, because it’s turning into more and more unlikely that EU leaders will be capable to attain a deal on a fiscal stimulus bundle at this week’s summit.

Trigger for optimism?

There could be little doubt that the pandemic has hammered Eurozone economies, significantly these of nations hit hardest by the virus, reminiscent of Italy and Spain. However as circumstances of the coronavirus proceed to spiral uncontrolled in lots of elements of the world, Europe can at the very least take consolation that its insurance policies have been profitable in decreasing the infections to manageable ranges. A strict lockdown that brings financial exercise to a halt, adopted by a phased easing of the restrictions is the mannequin adopted by most European nations, and it appears to have labored.

Companies that had been shuttered for weeks at the moment are in a position to reopen and the chance of a significant re-escalation is subsiding as most individuals look like abiding by powerful social distancing guidelines. Though the percentages of a second wave through the winter months stay uncomfortably excessive, Europe is a lot better ready than earlier than to cope with one other outbreak.

ECB probably accomplished for now

Policymakers are additionally feeling extra optimistic in regards to the Eurozone’s prospects, particularly when in comparison with the US the place an incoherent method to combating the pandemic has seen infections flare up in a number of states, threatening the restoration. Within the euro space, the restoration appears to be on a way more steadier footing, even whether it is missing in dynamism.

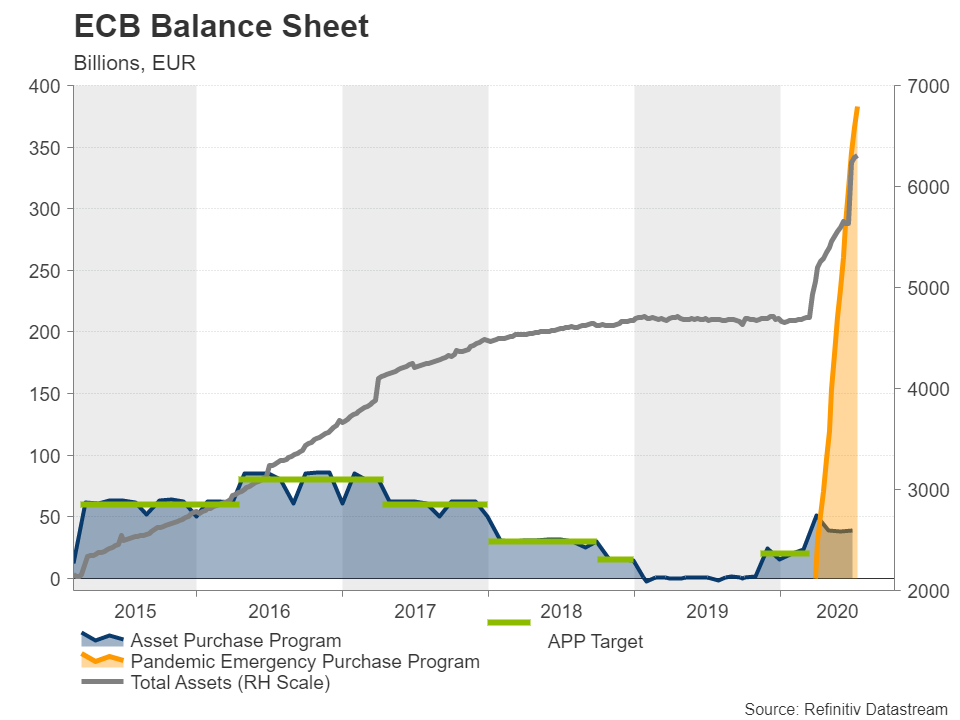

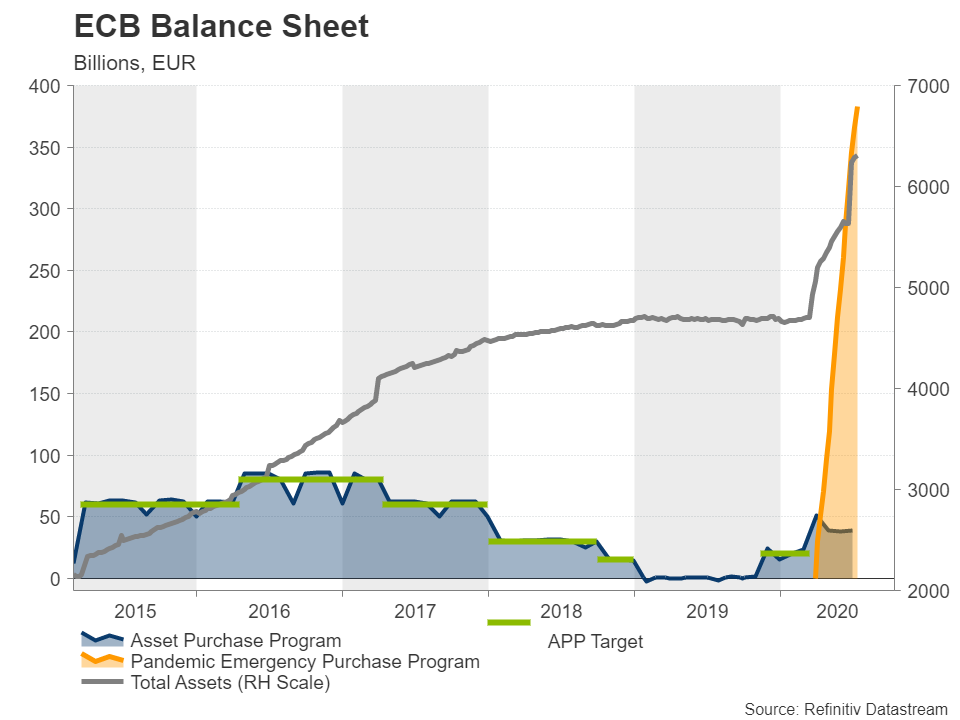

In a latest interview with the Monetary Instances, Lagarde hinted that the ECB was probably accomplished for now, saying “we’ve got accomplished a lot that we’ve got fairly a little bit of time to evaluate that rigorously”. Therefore the Financial institution is sort of sure to take no new motion on the July assembly, which suggests the main focus on the press briefing will as a substitute be on different issues troubling traders. Particularly, simply how versatile is the Pandemic Emergency Buy Programme (PEPP)?

Query marks about flexibility of PEPP

Rumours that the Governing Council is cut up about how a lot flexibility must be given to the PEPP have been circulating the markets for a while. Though the ECB has made fairly numerous exceptions to its rule guide in its emergency programmes, there are nonetheless worries that ought to periphery yield spreads shoot up within the occasion of one other virus turmoil, its present toolbox gained’t be sufficient to calm markets down.

Nonetheless, as a lot as traders would admire gaining extra readability on how far the ECB is keen to go to maintain yield spreads low, a extra speedy precedence for them and for policymakers is how quickly will the European Union comply with a fiscal stimulus bundle. EU leaders are set to fulfill on July 17-18 to debate the proposed €750 billion virus aid fund designed to help closely indebted Eurozone members get well from the pandemic. However all of the indications are {that a} compromise deal isn’t on the playing cards this week, with a call prone to be pushed again but once more to a later date.

EU fiscal bundle would increase the euro

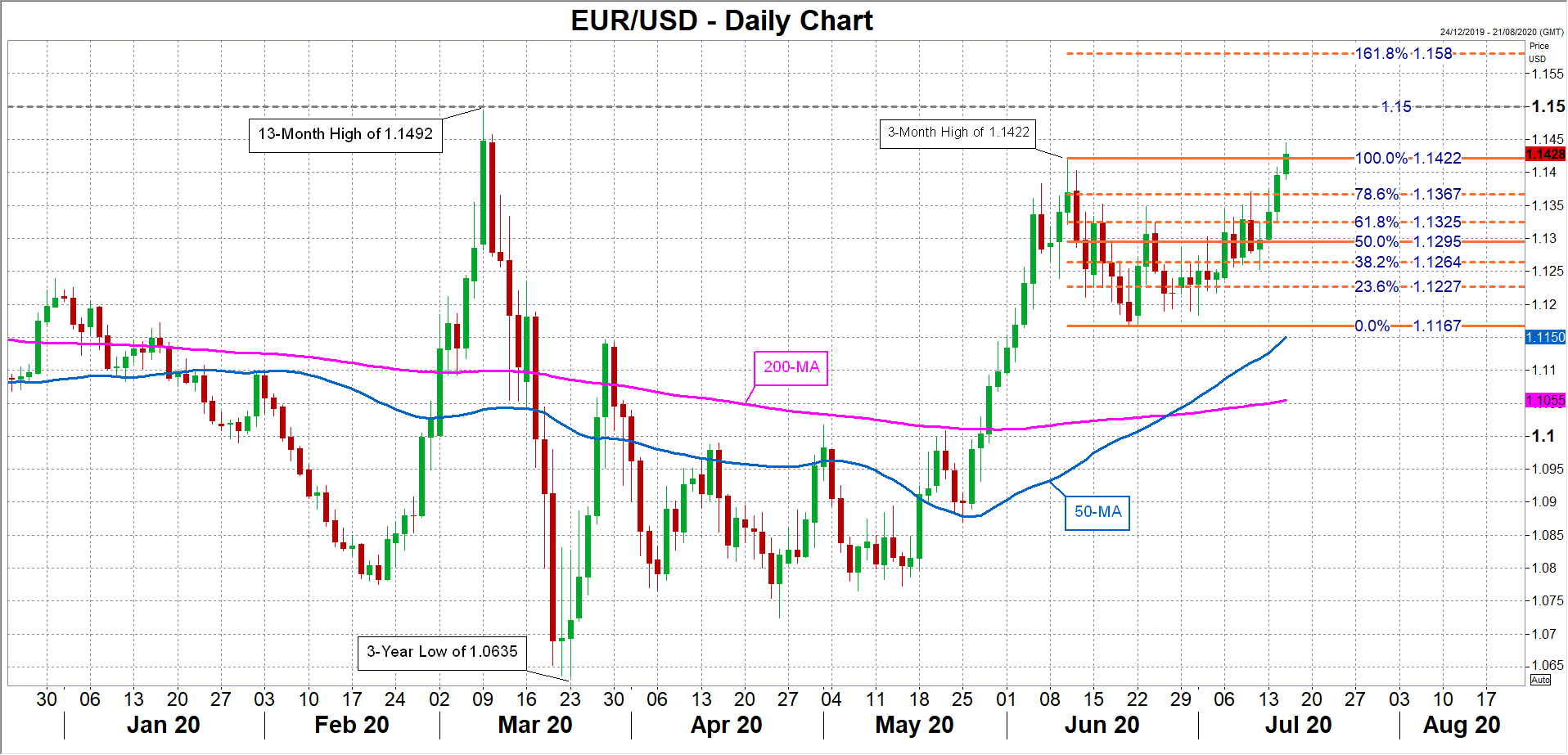

A delay to the rescue bundle might disrupt the euro’s present bull cost. The one foreign money has simply damaged above its June peak of $1.1422, clearing the way in which for the $1.15 deal with. Increased up, the 161.8% Fibonacci retracement of the June down leg at $1.1580 would turn into the following goal.

Robust good points in direction of the $1.15 stage and past are greater than doable if a big fiscal bundle is signed off at this week’s EU summit. Nevertheless, within the absence of an settlement, the euro could be vulnerable to shedding steam and doubtlessly easing in direction of the 61.8% Fibonacci of $1.1325. A sharper pullback might be triggered if EU disunity is on full show on the weekend, making a drop in direction of the closely congested space across the 23.6% Fibonacci of $1.1227 extra probably.

One other hazard for the euro is the chance of the ECB sounding too optimistic on Thursday as this may ship the mistaken indicators to the markets about policymakers’ readiness to do no matter it takes to get the Eurozone financial system again on its toes.

EURUSD