The early U.S. session has been a superb one for many large-cap equities. Experiences over the pending E.U. bailout bundle are at present fueling

The early U.S. session has been a superb one for many large-cap equities. Experiences over the pending E.U. bailout bundle are at present fueling constructive sentiment. Wall Avenue is generally upbeat over the information, with the DJIA DOW (+305), S&P 500 SPX (+18), and NASDAQ (-45) buying and selling blended. Additionally, safe-havens are on the rally, with gold up greater than 1.25% and the Swiss franc trending.

As soon as once more, it appears to be like like authorities stimulus is driving international markets increased. Throughout the U.S. in a single day, E.U. management introduced grandiose plans for a sweeping US$858 billion in loans to struggling members. About half of the US$858 billion is to be distributed in grants, which means there is no such thing as a obligation to pay again the funds. Just like the U.S. stimulus packages from earlier this 12 months, the markets are leaping on the bandwagon. At this level, buyers understand extra liquidity as being a powerful bullish sign for danger property.

On the standard financial information entrance, it appears to be like just like the U.S. retail sector is starting to lag. The Redbook Index (July 17) fell on each a month-to-month and yearly foundation. Whereas not a main market driver, the month-over-month plunge suggests that buyers are tightening up the purse strings forward of 1 August.

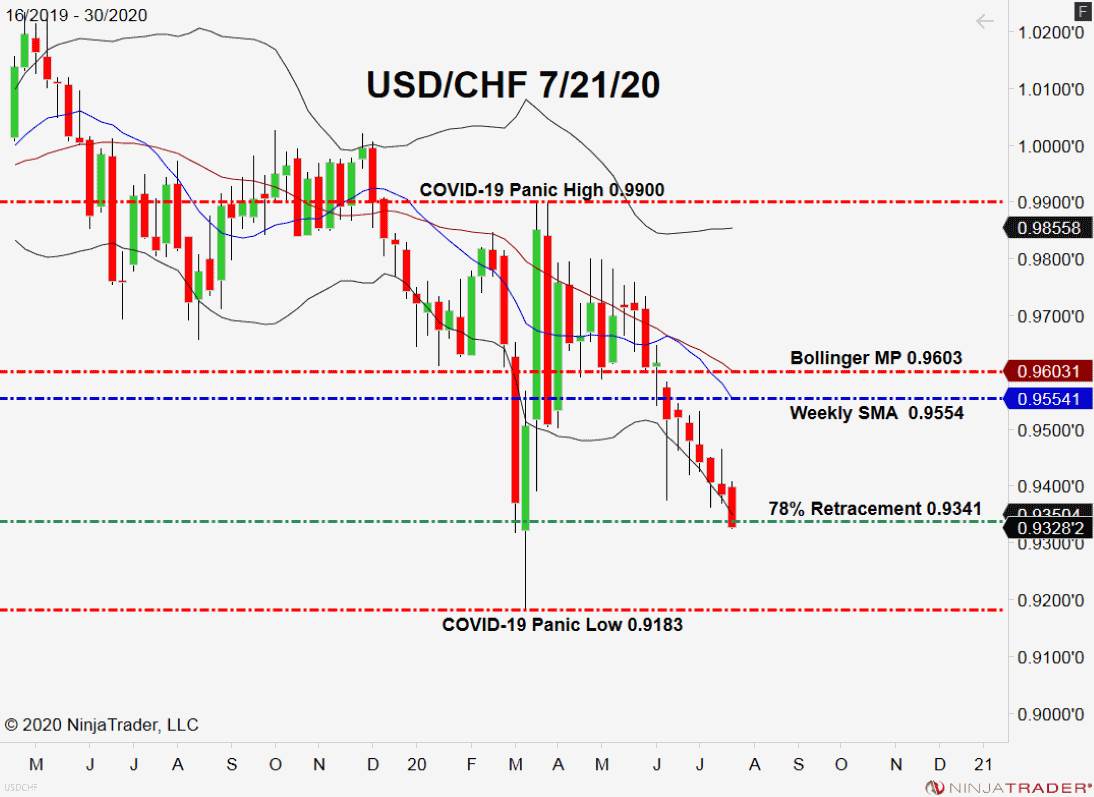

Though equities are largely within the inexperienced, safe-havens aren’t faring too badly both. In truth, the USD/CHF is testing a key macro assist stage.

Giant Cap Equities Rally, Protected-Havens Comply with Swimsuit

In a Dwell Market Replace from final week, I outlined a shopping for alternative within the USD/CHF. As of now, the commerce is below hearth and at risk of being swept off the board.

+2020_30+(11_04_16+AM).png)

Overview: In the intervening time, we’re witnessing a mass exodus from the USD. The Buck continues to fade as buyers aggressively worth in forex devaluation.

Given this 12 months’s stimulus and FED QE, it’s little surprise that the Buck is below strain. Whereas weakening the greenback has been the United State’s response to COVID-19, it will likely be fascinating to see simply how lengthy that coverage lasts. If inflation ticks increased within the short-term, be looking out for a extra hawkish FED by September’s FOMC assembly.