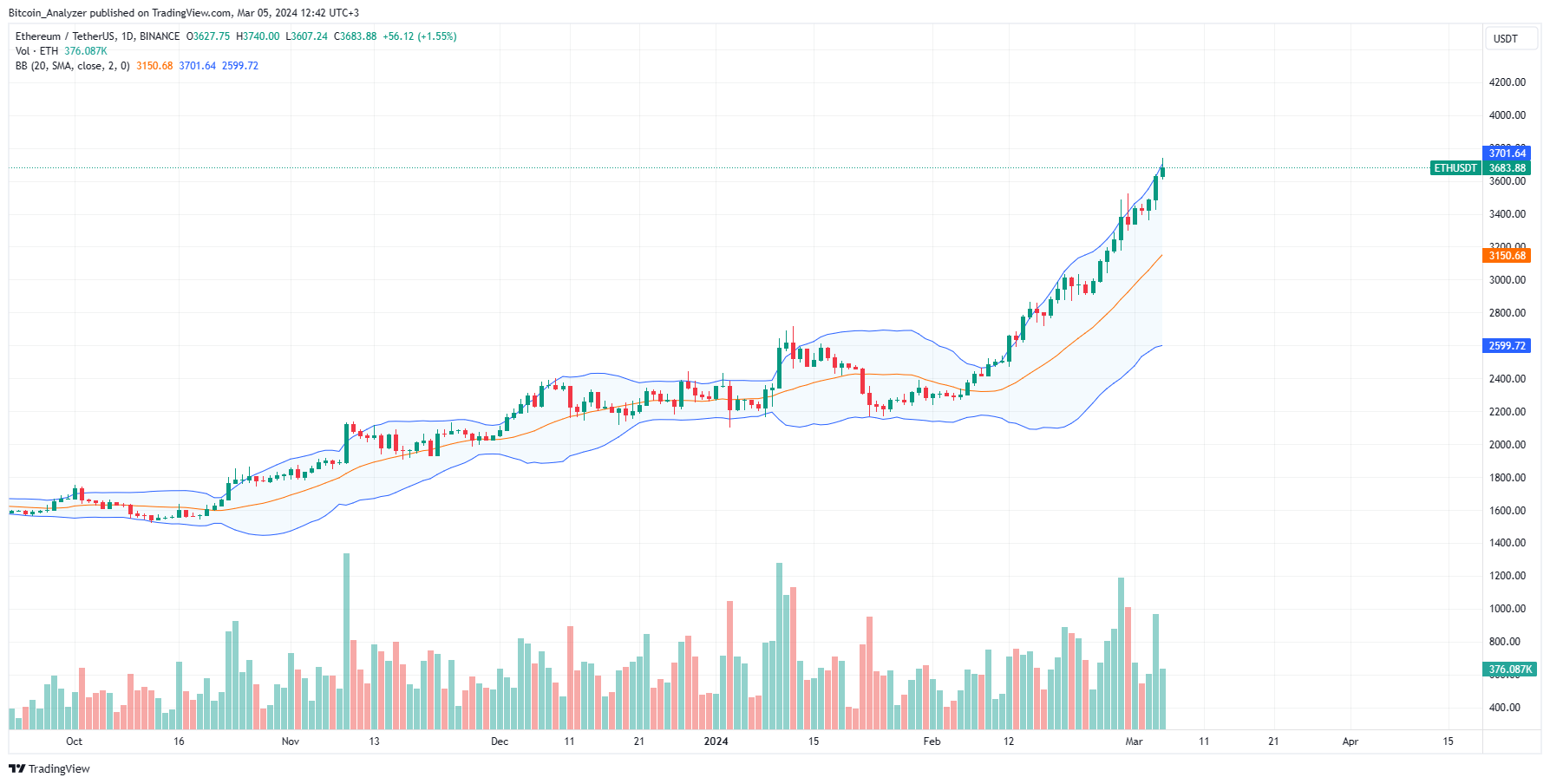

Ethereum continues to accelerate, looking at events in the daily chart. With buyers determined, the coin can easily retest $4,000 in the coming tradin

Ethereum continues to accelerate, looking at events in the daily chart. With buyers determined, the coin can easily retest $4,000 in the coming trading sessions. So far, the uptrend is defined, and bulls will continue ramping up momentum

At spot rates, ETH is already outperforming Bitcoin, looking at price action in the past 24 hours. A notable formation is that buyers drove prices strongly, decisively breaking above the February 29 high. The marked expansion in trading volume pointed to determination and resolve. As such, the odds of this trend continuing remains elevated.

| Broker | Review | Regulators | Min Deposit | Website | |

| 🥇 |  |

Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  |

Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 🥉 |  |

Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  |

Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  |

Read Review | IFSC, FCA, CySEC, ASIC, CMA | USD 5 | Visit Broker >> |

| 6 |  |

Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  |

Read Review | IFSC | USD 10 | Visit Broker >> |

| 8 |  |

Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  |

Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  |

Read Review | SVGFSA | USD 5 | Visit Broker >> |

Coin trackers show that ETH/USD is up 14% in the last week of trading, adding approximately 5% in the last day. However, while attention is on ETH, it is trailing Dogecoin and Shiba Inu in the top 10. The two meme coins are up 95% and 282%, respectively, when writing on March 5.

In the next few trading sessions, ETH prices will likely be impacted by several developments:

Spot Ethereum exchange-traded fund (ETF) ruling postponement: The United States Securities and Exchange Commission (SEC) has postponed their ruling on several spot Ethereum ETF applications. The filings, submitted by Fidelity and BlackRock—two of the world’s largest asset managers, initially triggered a wave of FOMO to Ethereum. In their statement, the SEC also requested more comments from the public. The agency seemed concerned about the proof-of-stake consensus algorithm, citing chances of manipulation.

The state of decentralized finance (DeFi) and rising total value locked (TVL): For the better part of 2022, TVL slumped to as low as $38 billion but sharply recovered throughout late 2023 and early 2024. This metric is an indicator of interest. If TVL continues to rise, it is highly likely that ETH prices will expand higher.

Ethereum Price Analysis

Ethereum is in an uptrend, looking at the formation in the daily chart.

Adding 5% in the last day, buyers can search for entries in the short term since the coin is in a bullish breakout formation.

The support lies at around $3,500. Accordingly, every potential dip above this level might offer entries for buyers targeting $4,000—a round number.

In the short term, a decisive break above $3,750—at the back of high trading volume—might see ETH soar to $3,800.

Conversely, losses below $3,650 might see ETH drop to $3,600.

www.fxleaders.com

COMMENTS