EUR/USD, EUR/GBP AnalysisFed-ECB policy divergence on the cards, EUR/USD attempts to halt the recent declineEUR/GBP continues to trade within familiar

EUR/USD, EUR/GBP Analysis

- Fed-ECB policy divergence on the cards, EUR/USD attempts to halt the recent decline

- EUR/GBP continues to trade within familiar range

- Scheduled risk events overshadowed by geopolitical uncertainty

- Elevate your trading skills and gain a competitive edge. Get your hands on the euro Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free EUR Forecast

Fed-ECB Policy Divergence on the Cards

Recent developments have seen the Fed delay the start of its rate-cutting cycle due to hotter-than-expected inflation data and a resilient economy, including a robust labor market. This has led to a prolonged period of higher interest rates in the US, which has put pressure on the Euro.

In contrast, ECB officials have expressed a preference for a rate cut in June as the governing council gears up to move before the Fed. Traditionally major central banks look the Fed for that first move and subsequently follow shortly after. The growing calls for a rate cut in the eurozone are materializing at the right time as the continent grapples with stagnating growth and inflation that has headed lower than initially anticipated. Just this morning EU inflation for March was confirmed to be falling at an encouraging pace.

During the April meeting, the ECB refrained from pre-committing to any specific rate path, indicating a more data-dependent approach. This cautious stance has allowed the central bank to maintain flexibility in its decision-making process, taking into account the evolving economic landscape and geopolitical uncertainty.

Traders and investors will be closely monitoring upcoming economic data releases, particularly those related to inflation and growth in the US and the eurozone, as well as any further comments from ECB and Fed officials. If the data continues to support the case for a rate cut and the ECB follows through on these expectations, the Euro could be poised for gains in the near term.

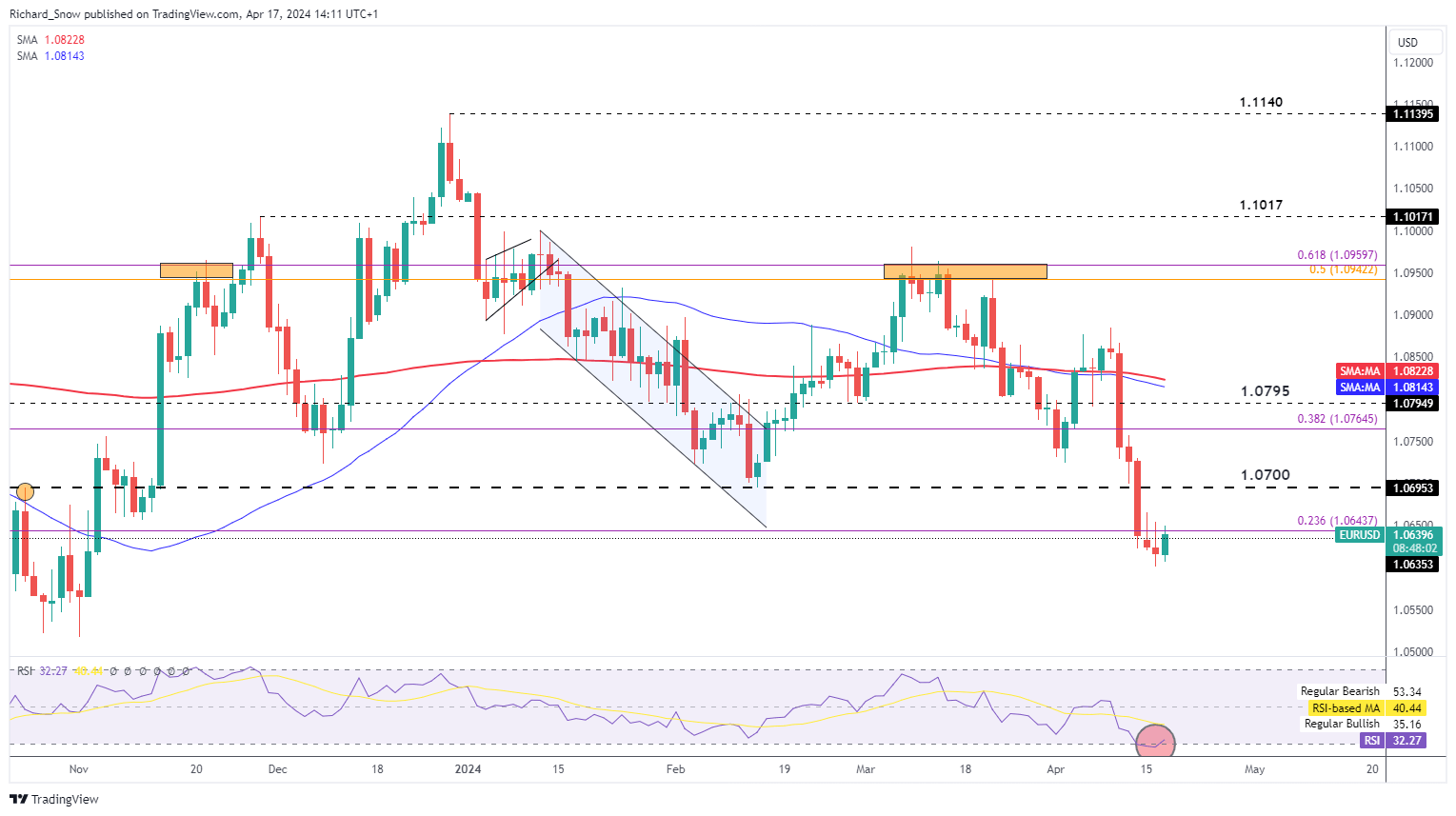

EUR/USD Attempts to Halt the Recent Decline

EUR/USD attempts to halt the recent US CPI-inspired sell-off. The pair has come under pressure after Fed officials signaled a reluctance to cut the Fed funds rate in the face of stubborn inflation.

Nevertheless, the pair attempts to arrest the recent decline, recovering from oversold territory. The shorter-term pullback at extreme levels is not uncommon but the longer-term outlook suggests a further decline is possible. EUR/USD bears will be watching the 23.6% Fibonacci retracement level (corresponding to the broad 2023 decline.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

EUR/USD is the most liquid FX pair in the world. It and other liquid pairs are seen as more desirable due to the lower spreads and vast interest they attract. Find out how to trade the most liquid FX pairs:

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade The Top Three Most Liquid Forex Pairs

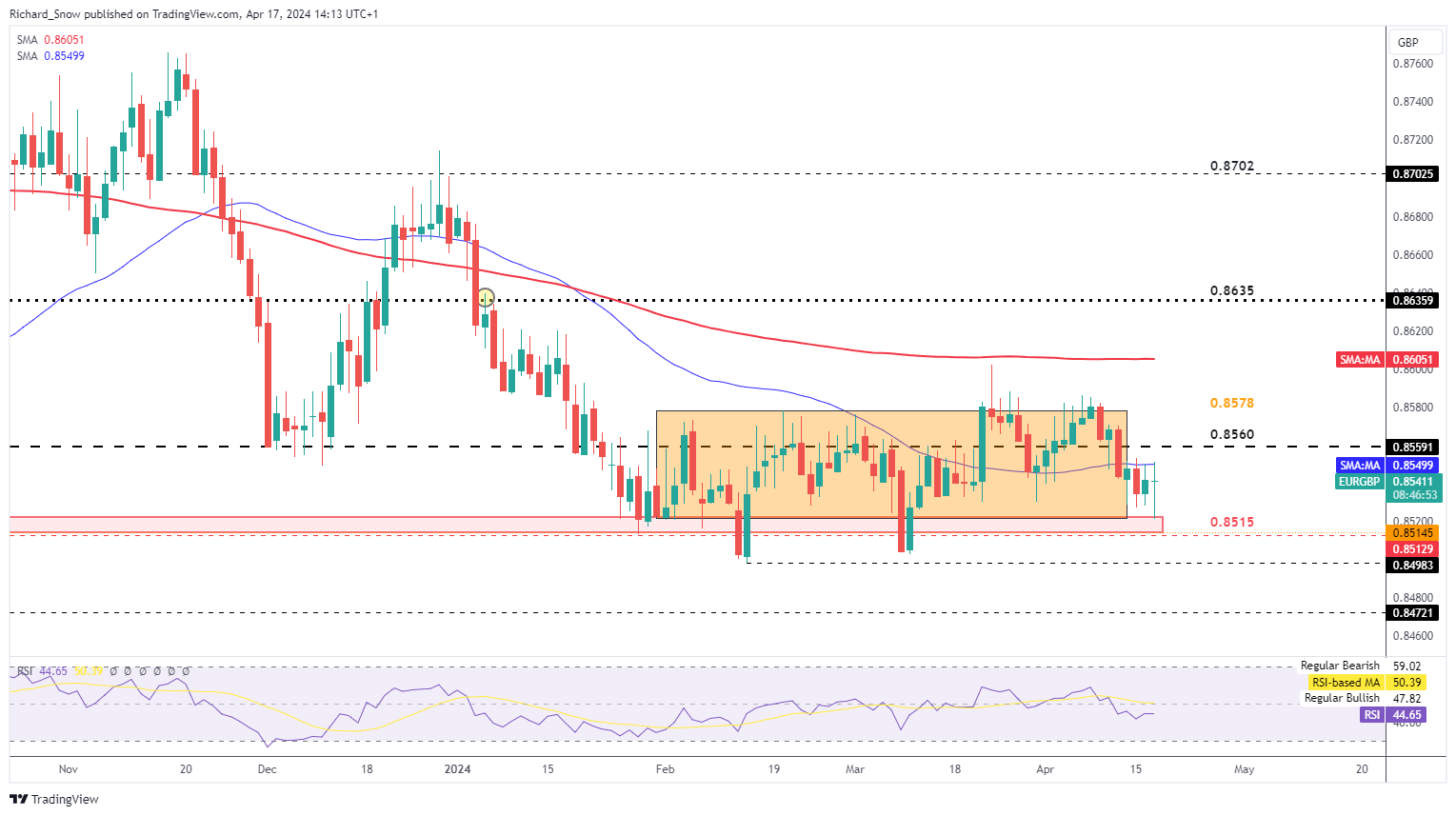

EUR/GBP Continues to Trade Within the Familiar Range

EUR/GBP bounces off the 0.8515 zone of resistance which underpins the familiar trading zone that has emerged since late January. It is a fairly narrow range, with the pair testing the 50-day simple moving average (SMA) currently. Sterling has a modest reaction to the UK CPI data earlier this morning as it rose against the euro.

Both currencies have struggled to forge a directional move as the two central banks consider rate cuts. Both regions have experienced lackluster growth but progress on UK inflation has lagged the EU, helping keep the pair rooted near the bottom of the range.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

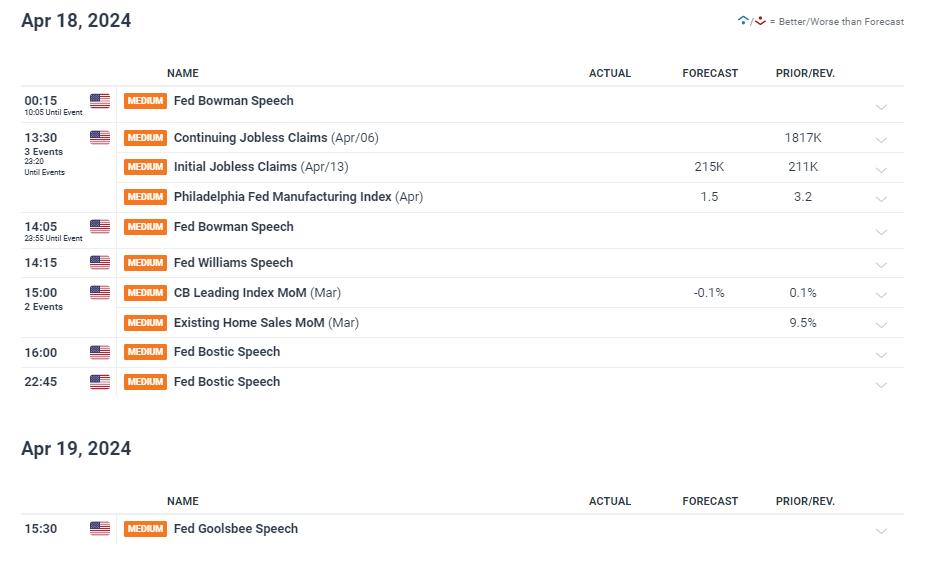

Scheduled Risk Events Overshadowed by Geopolitical Uncertainty

This week is rather quiet from the perspective of scheduled risk events, apart from a plethora of Fed speakers tomorrow who are expected to weigh in on the stubborn inflation data that has persisted in 2024. After today’s ECB final inflation data for March, euro-centered data continues to be in short supply. The major concern for markets in the coming days is focused around the events unfolding in the Middle East.

Israel has communicated their intention to respond to Iran’s drone strikes, which were in response to a targeted strike from Israel on Iranian targets in Syria. Representatives at this weekend’s United Nations meeting support de-escalation efforts in the region and have called for restraint from Israel, which appears to have been in vain.

Customize and filter live economic data via our DailyFX economic calendar

Stay up to date with breaking news and themes driving the market by signing up to the DailyFX weekly newsletter

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS