EUR/GBP - Prices, Charts, and AnalysisECB’s Robert Holzmann calls for another 200 basis points of rate hikes.Bank of England may slow rate hikes in Q

EUR/GBP – Prices, Charts, and Analysis

- ECB’s Robert Holzmann calls for another 200 basis points of rate hikes.

- Bank of England may slow rate hikes in Q2.

Recommended by Nick Cawley

Traits of Successful Traders

Robert Holzmann, the governor of Austria’s central bank and ECB governing council member, today called for two full percentage points of interest rate hikes over the coming four policy meetings. Holzmann said that the ECB should hike rates by 50 basis points at each of the next four policy meetings. In an interview with the German Handelsblatt newspaper, Holzmann said that he expects inflation to take a ‘very long time’ to come down and that the central banks’ bond holdings should be reduced a bit more aggressively.

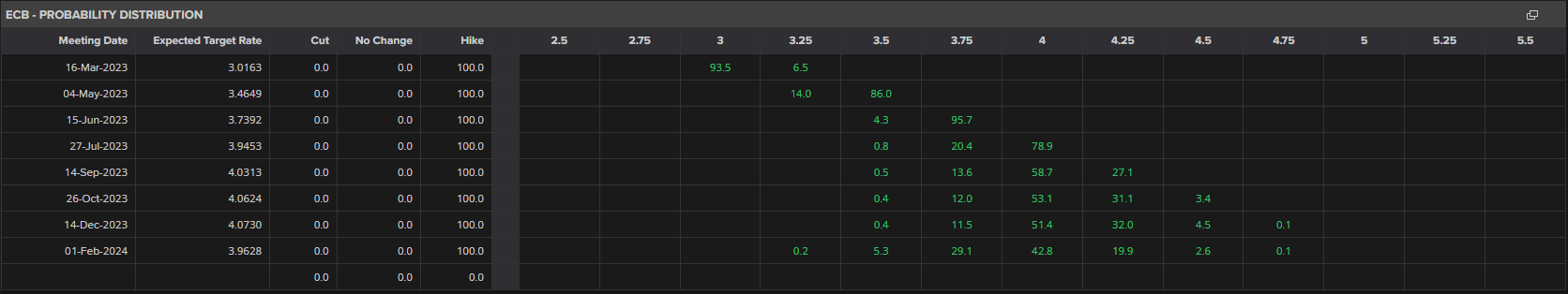

Euro rate hike probabilities rose on the back of Holzmann’s latest comments.

For all market-moving data releases and events, see the DailyFX Economic Calendar

The ECB’s increasingly hawkish outlook is at odds with the Bank of England’s (BoE) who may start to slow down, or put on hold, further rate hikes soon. The BoE is expected to hike interest rates by 25 basis points at this month’s meeting and, data-dependent may put further hikes on hold. The Bank of England is ahead of the ECB in the interest rate hiking cycle and it now looks increasingly likely that the ECB may be catching up. Narrowing this rate differential between the two currencies over the coming months, with the Euro tightening against the British Pound, will favor EUR/GBP bulls.

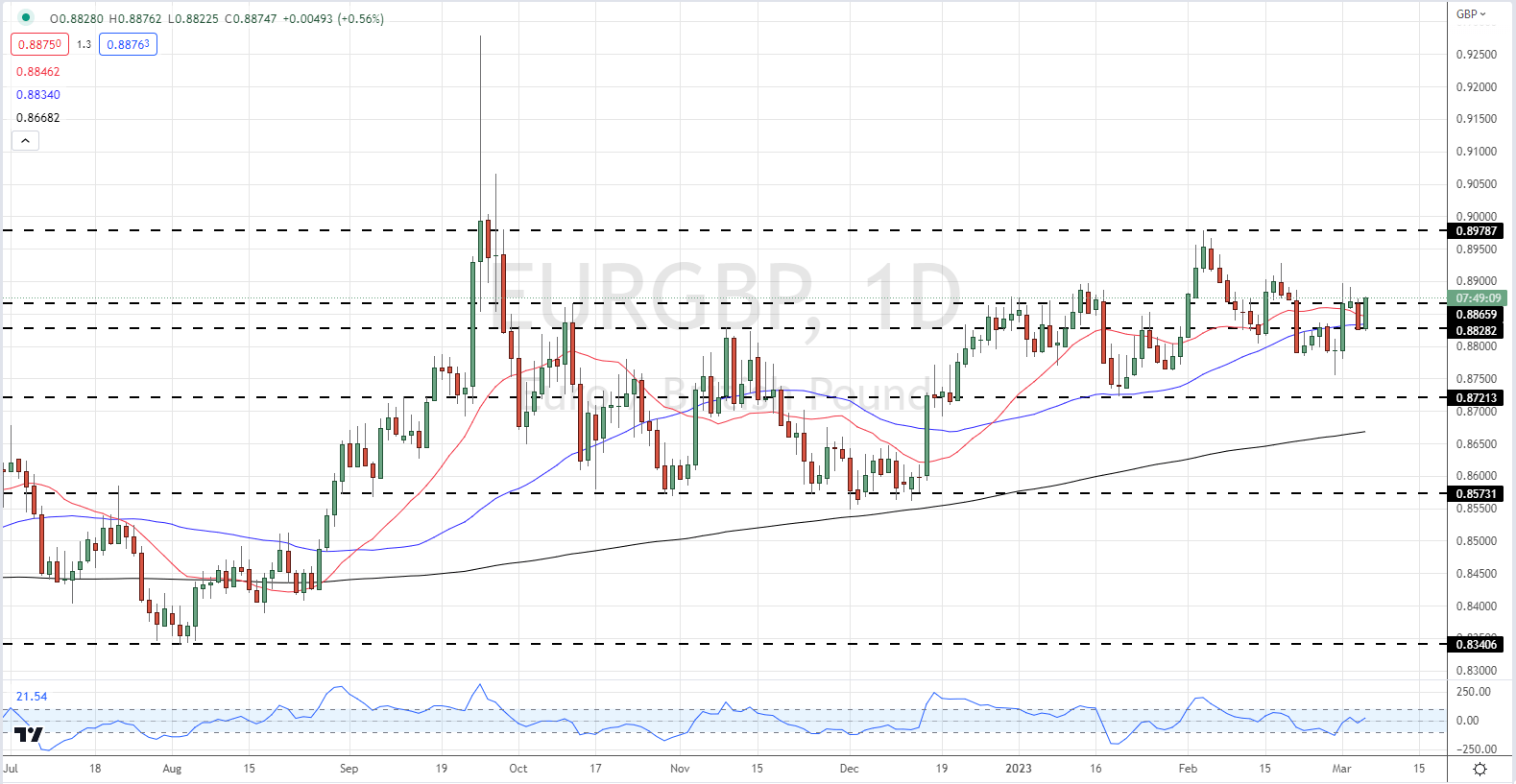

The daily EUR/GBP chart shows the pair starting to push higher again after a period of sideways, consolidation trade. Any move higher from here is likely to find only limited resistance before February 3 multi-month high at 0.8979 comes into play.

EUR/GBP Daily Price Chart – March 6, 2023

All Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 4% | 13% | 9% |

| Weekly | -2% | 7% | 3% |

Retail Trader Data Shows a Bullish Contrarian Bias

Retail trader data show 45.41% of traders are net-long with the ratio of traders short to long at 1.20 to 1.The number of traders net-long is 5.66% higher than yesterday and 1.82% higher from last week, while the number of traders net-short is 11.91% higher than yesterday and 8.89% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBPprices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bullish contrarian trading bias.

What is your view on the EUR/GBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com